Endurance Specialty Holdings (ENH) made a $3.2 billion takeover bid for Aspen Insurance Holdings (AHL) on Monday. The bid was unsolicited. And, reportedly, it was made public after months of fruitless negotiations led ENH to attempt to bypass AHL’s management and reach out to shareholders directly.

We think ENH’s offer undervalues the stock. AHL’s Chairman Glen Jones sent a similar message:

“Endurance’s ill-conceived proposal undervalues our company, represents a strategic mismatch, carries significant execution risk, and would result in substantial dis-synergies. Furthermore, most of the consideration to Aspen shareholders would be in a stock that would reflect these problems.”

AHL’s board has rejected the offer, a decision that shareholders should support.

AHL Stock is Too Cheap and So Is ENH’s Offer

Subscribers will know that we are bullish on AHL as it is one of our Most Attractive Stocks for April. In particular, we like AHL due to its remarkably cheap valuation. Before ENH’s bid was made public, AHL had a valuation of ~$39/share. At this price, AHL had a price to economic book value (PEBV) ratio of just 0.7, which implies that the market expected AHL’s after-tax profit (NOPAT) to permanently decline by 30%.

ENH’s offer values AHL at $47.50/share, a 22% premium to $39/share. This premium may sound like a great offer, but it still represents a 20% discount to the company’s economic book value (EBV) or no-growth value. In other words, $47.50 is too cheap because it implies that AHL’s cash flows will permanently decline by 20%. In this context, Mr. Jones’s comments ring quite true, and it appears that ENH is simply trying to pick up AHL on the cheap.

If AHL can grow NOPAT by just 5% compounded annually for 15 years, the stock has a fair value of ~$64/share, a 35% premium to ENH’s offer. If, indeed, there are synergies to come from a merger with ENH (note: there is no reason to merge if there are no synergies), then ENH should offer AHL shareholders a price that reflects the value the companies can create together let alone the value AHL can create on its own.

AHL Deserves Better

ENH’s offer only makes sense if AHL is a fundamentally weak company that’s about to undergo significant profit decline. Nothing we see supports that view.

As I wrote last week, the insurance sector is one of our favorite sectors in the market right now, and we see great opportunity for these companies going forward. The combination of the financial crisis and the fallout from Superstorm Sandy hit these insurance companies hard, but they’ve been on the right track in the past year. Premiums are up, loss expenses are down, and balance sheets are improving across the industry.

In AHL’s case, revenues have increased by 12% in the past two years while losses and loss adjustment expenses have declined by 21%. As a result, AHL’s NOPAT margins have increased from -5% to 11%, and its return on invested capital has increased from -4% to 9%.

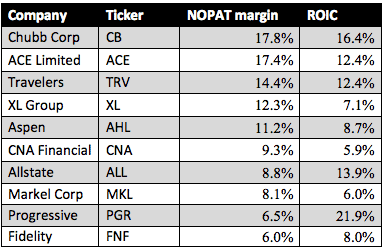

Fundamentally, AHL is not the strongest company in the property and casualty insurance industry, but neither is it the weakest. Figure 1 compares AHL to nine of its largest competitors on the basis of NOPAT margin and ROIC. It shows that AHL, while not at the top of the pack, is competitive with some of the largest companies in its industry and not in danger of being left in the dust.

Figure 1: Property and Casualty Insurers Comparison

AHL stacks up well with the largest and most successful companies in the industry.

Long Term Outlook

AHL operates in a volatile industry where costs can fluctuate rapidly. It is certainly possible that costs will come back up in the next year or two and decrease profits. However, that potential is already generously factored into the stock price while any long-term potential growth is ignored.

AHL is a solid, cheap stock in a good industry. It is worth more than what ENH is offering to pay. Existing shareholders should be glad that the board turned down ENH’s lowball offer as the stock still has significant upside from here.

Only one ETF, the PowerShares KBW Property & Casualty Insurance Portfolio (KBWP) allocates more than 3% to AHL and earns an Attractive-or-better rating. However, KBWP also has only $17 million in assets, leaving it with low levels of liquidity. KBWP has good holdings, including AHL, but low liquidity makes it a risky investment. It’s safer, and easier, to just buy a basket of individual stocks instead.

Sam McBride contributed to this report.

Disclosure: David Trainer owns ALL and CB. David Trainer and Sam McBride receive no compensation to write about any specific stock, sector, or theme.

Feature Photo Credit: James MacIndoe (Flickr)