In our e-letters to clients, we’ve been talking about the importance of diligence a great deal. Well, this report shows how diligence pays off in the short term and long term.

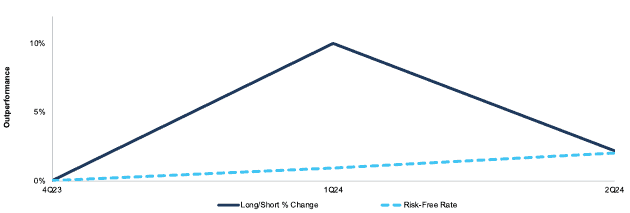

Our Focus List Stocks: Long Model Portfolio, the best of our Long Ideas, and our Focus List Stocks: Short Model Portfolio, the best of our Danger Zone picks, beat the Risk-Free Rate[1] as a long/short portfolio by 0.2% in the first half of 2024. The long portfolio was up 5.6% while the short portfolio was down -3.4% for a net return of 2.2% compared to the Risk-Free Rate at 2.0% in 1H24. See Figure 1.

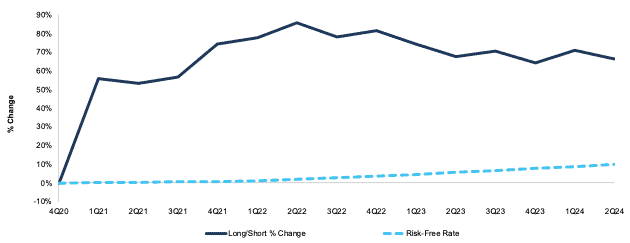

From 2021 through 2Q24, our Focus List Stocks have beaten the Risk-Free Rate by 56%. See Figure 2.

This outperformance underscores just how important reliable fundamental research is in turbulent markets.

Figure 1: Focus List Stocks: Long/Short Performance vs. Risk-Free Rate: 1H24

Sources: New Constructs, LLC

Note: Gain/Decline performance analysis excludes transaction costs, dividends and rebates. The Risk-Free Rate is based on the 3-month T-bill.

Figure 2: Focus List Stocks: Long/Short Performance vs. Risk-Free Rate: 2021 Through 1H24

Sources: New Constructs, LLC

Note: Gain/Decline performance analysis excludes transaction costs, dividends and rebates. The Risk-Free Rate is based on the 3-month T-bill.

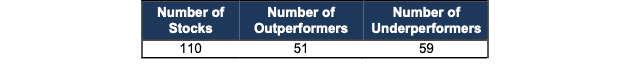

Figure 3 details the Model Portfolios’ performance, which includes all stocks present in the Model Portfolios at any point in 1H24.

Figure 2: 1H24 Long/Short Performance of Stocks in the Focus List Model Portfolios

Sources: New Constructs, LLC

Professional and Institutional members get real-time updates and can track all Model Portfolios on our site. The Focus List Stocks: Short and Focus List Stocks: Long Model Portfolios leverage superior fundamental data, which provide a new source of alpha.

We’re here to help you navigate these turbulent times. Our uniquely rigorous fundamental research consistently earns #1 rankings in several categories on SumZero.

This article was originally published on August 8, 2024.

Disclosure: David Trainer, Kyle Guske II, and Hakan Salt, receive no compensation to write about any specific stock, sector, style, or theme.

Questions on this report or others? Join our online community and connect with us directly.

[1] The Risk-Free Rate is based on the 3-month T-bill.