Superior Data & Powerful Tools for Expert Investors

Our Institutional Membership provides you with an edge that empowers you to outperform. It helps you manage risk and pick better stocks so you can make more $. We do the grunt work for you and analyze 10-Ks and 10-Qs with unrivaled diligence. We deliver proven-superior fundamental research.

Exclusively Available to Institutional Members:

Superior Fundamental Data

Get an edge with proven-superior fundamental data. The market is missing footnotes, but not our clients. We use AI and machine learning to scour filings and footnotes for 3,400+ companies.

Here are case studies showing how to monetize the idiosyncratic alpha in our data.

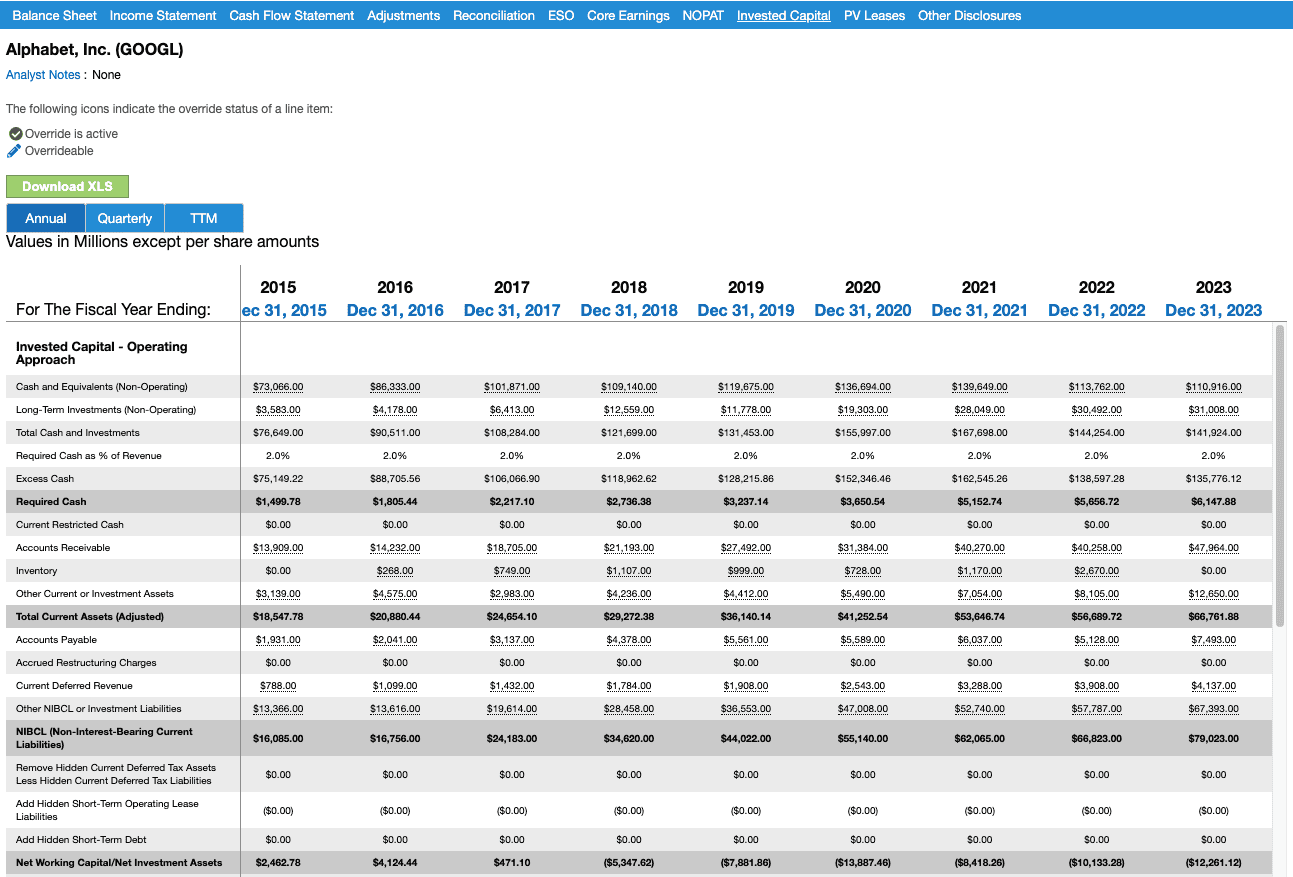

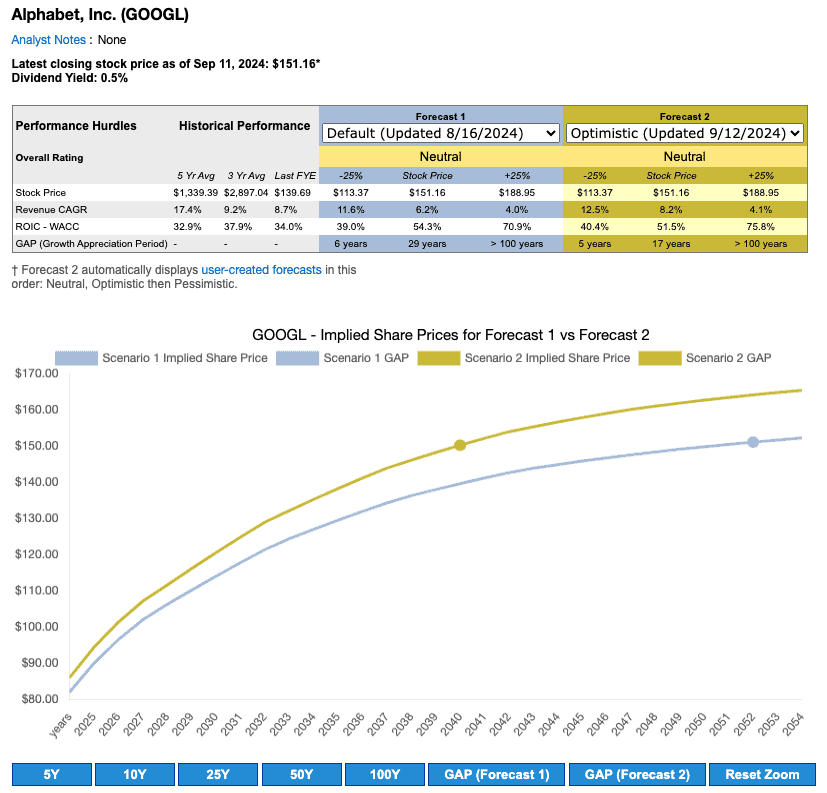

Dynamic Reverse DCF Models

Use our powerful discounted cash flow modeling tools to quickly and easily quantify the future cash flows required to justify the current stock price. It's expectations investing applied at scale and powered by the best data in the business.

In this case study, we apply our reverse DCF model to Nvidia (NVDA) at $120/share. See more Reverse DCF case studies in our private online community (use this form to sign up for free).

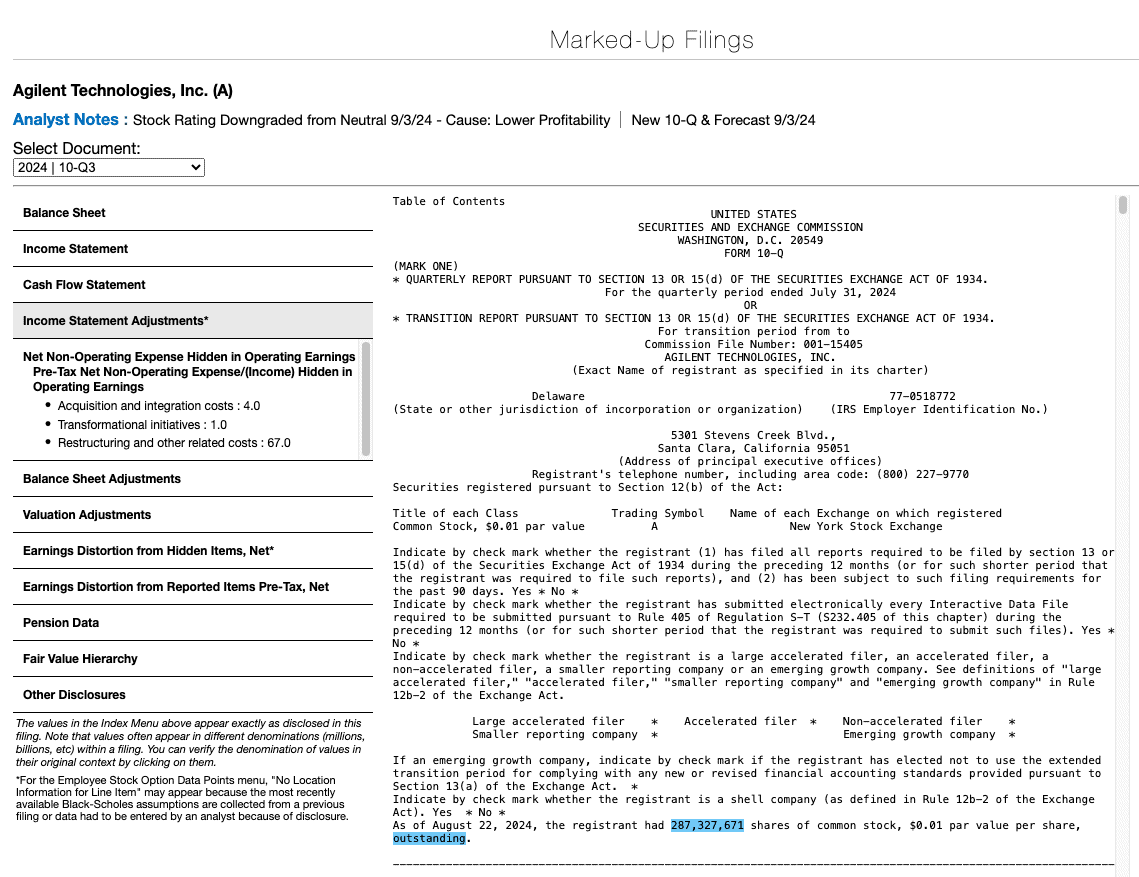

Marked-Up Filings

Easy, instant access to the exact location within financial filings where we get our data.

Audit the source data that drives our valuation models and get easy, direct access to the source filings for additional research. We are 100% transparent with our data and models because we want you to know how much work we do. Investors deserve 100% transparency if they are to trust any research.

See exactly how this feature works in this video.

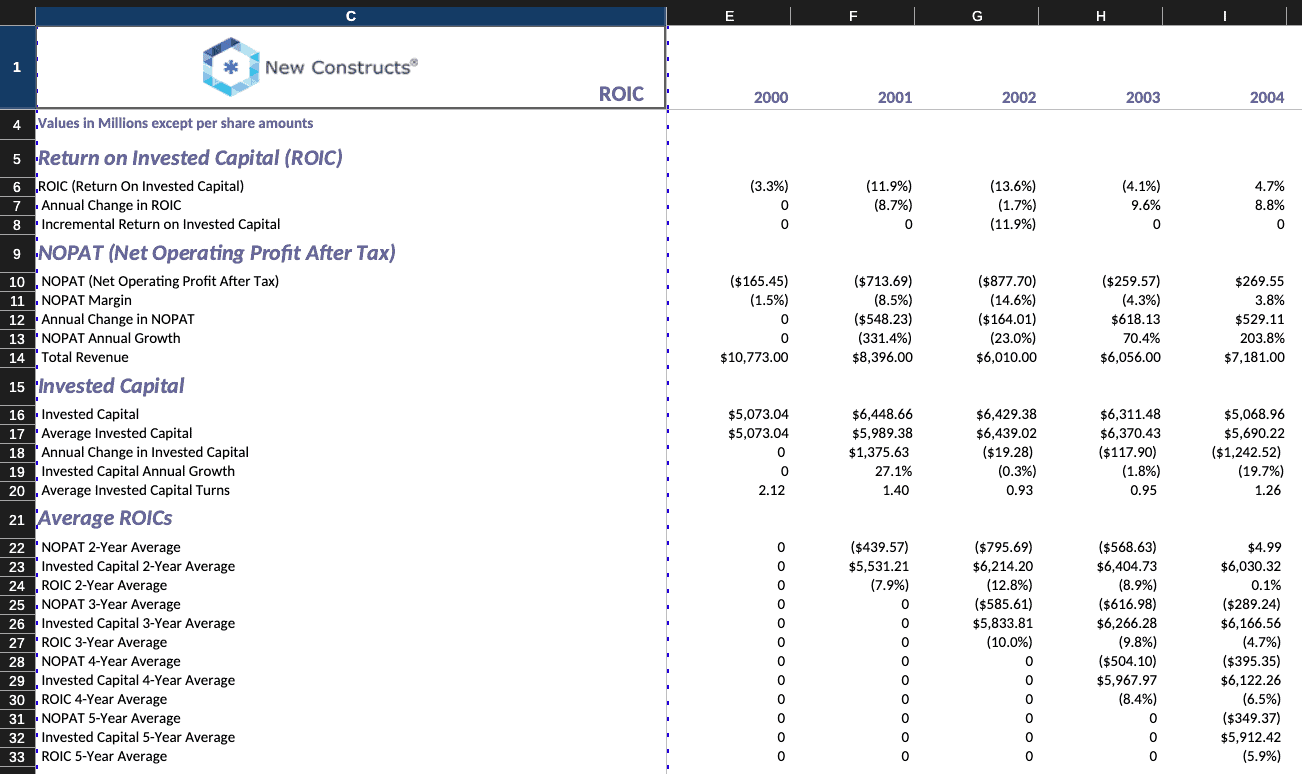

Excel Models & Add-In

Download our entire model in Excel, including all source data and calculations. Audit how our model works and make any adjustments you desire.

Easily incorporate our data into your existing models with our API or Excel Add-in.

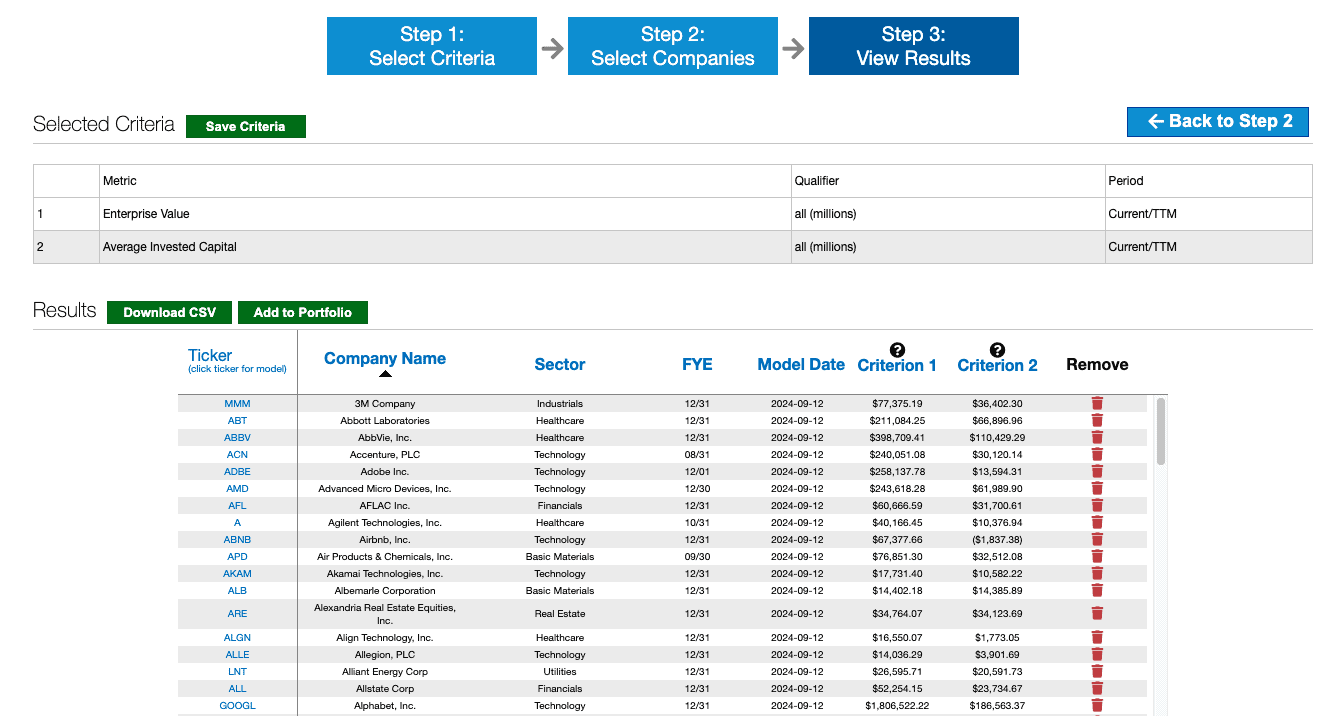

Screening & Data Download

Directly screen our database for almost every data point we collect or calculate, from reported total revenue to ROIC.

Data points offered include everything from our models, including valuation and operational metrics along with adjustments such as off-balance sheet debt and hidden non-operating income/gains.

Here's a tutorial showing how this feature works.

Macro Fundamental Research

Each quarter, we analyze the fundamental trends for the S&P 500 & NC2000 All Cap by aggregating our superior models for the holdings for each index. Get insights into the profitability and valuation of the market as a whole and segmented by sector.

We calculate Core Earnings, reported earnings, ROIC, economic earnings, NOPAT margin, invested capital turns, WACC, free cash flow, enterprise value, free cash flow yield, economic book value, & price-to-economic book value for each index and sector.

Institutional Membership Also Includes:

Everything from our other memberships

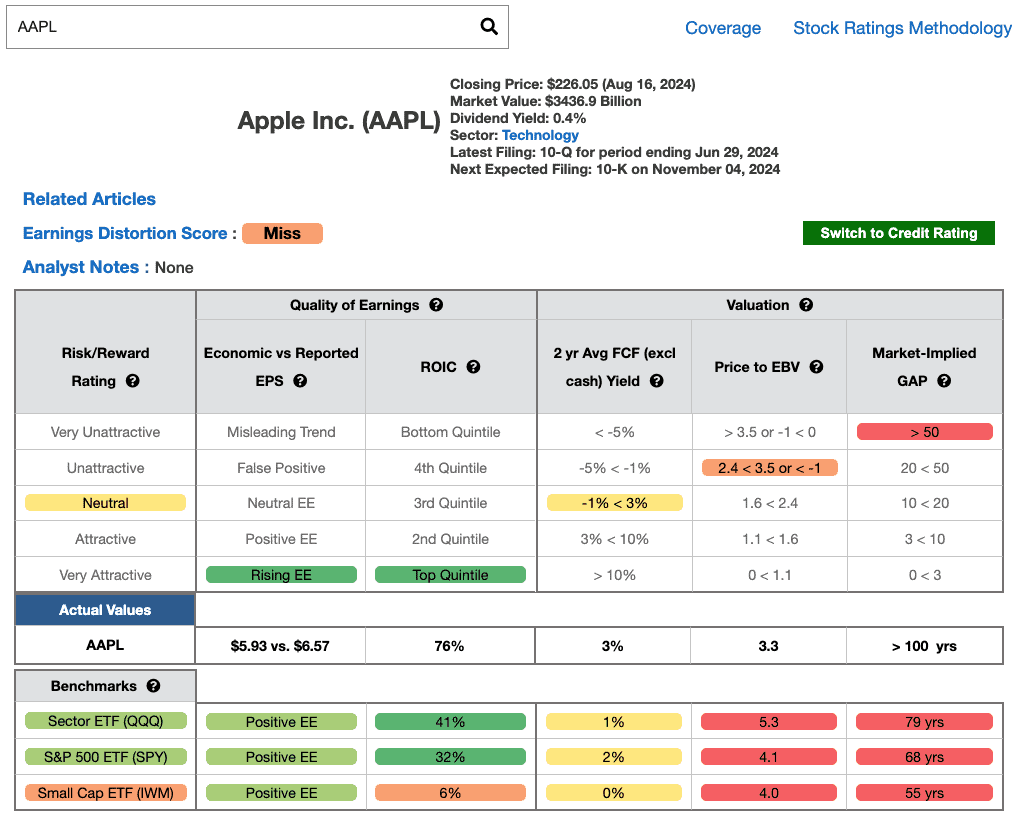

Ratings on 10,000+ Securities

Enter a ticker and instantly get an answer: green is good, red is bad. Ratings are updated daily based on the latest closing stock prices and 10K and 10Q filings.

Harvard Business School proves our stock ratings are superior to Wall Street analyst' ratings.

Our ratings get their edge from:

- superior fundamental data,

- superior financial modeling and ration and

- our more disciplined approach to investing.

Our experts leverage proprietary Robo-Analyst technology, a cutting-edge AI-driven machine learning application that scours the footnotes to the financial statements and the management discussion & analysis to produce more complete and proven-superior fundamental data and financial models.

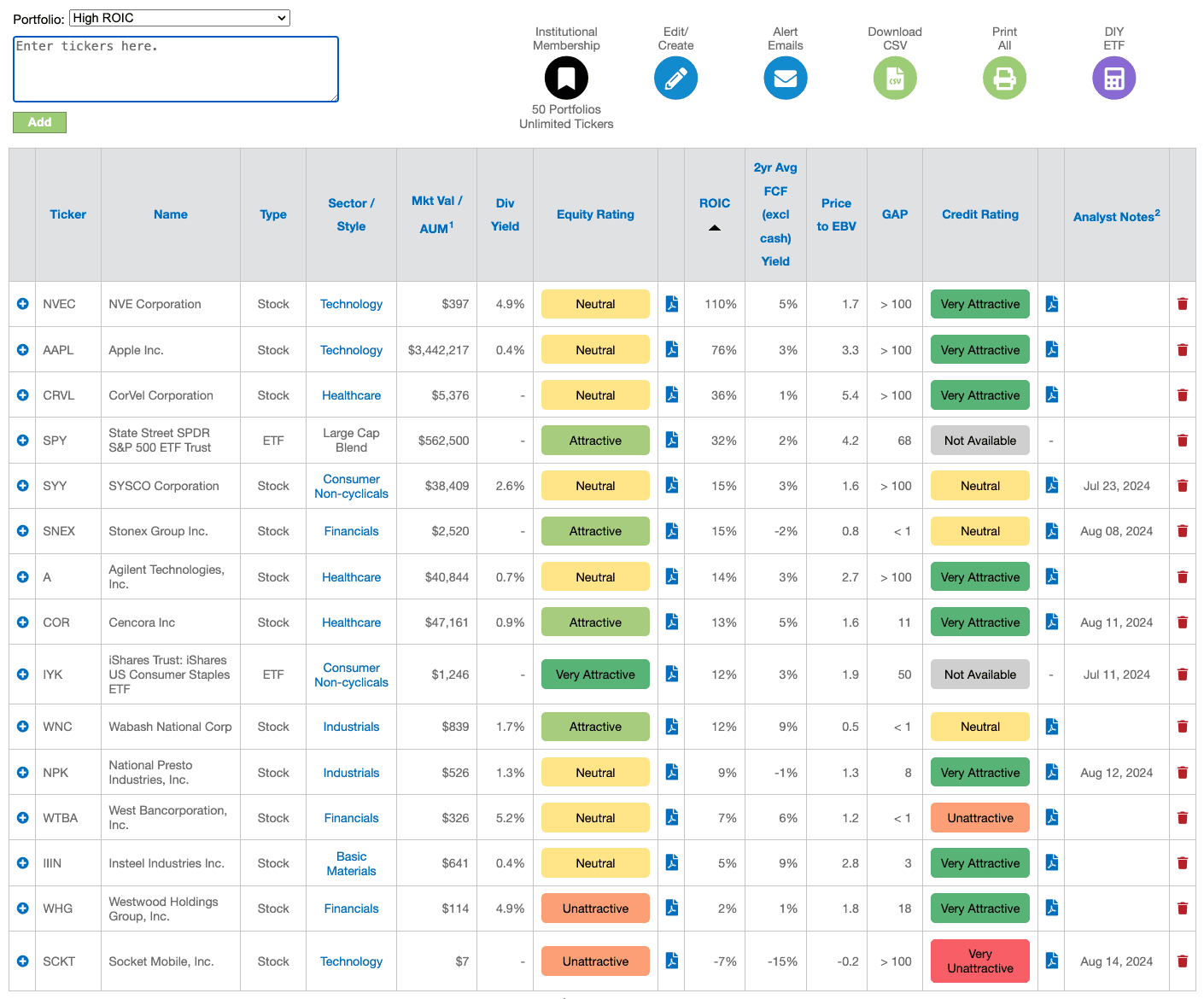

Portfolio Tracking

Easily upload your portfolios into the system in just a few seconds.

Get an immediate read on the strengths and weaknesses in your portfolios.

Create lists of all your favorite stocks and see how they stack up.

There's no better way to analyze the fundamental quality of your or your colleagues' portfolios.

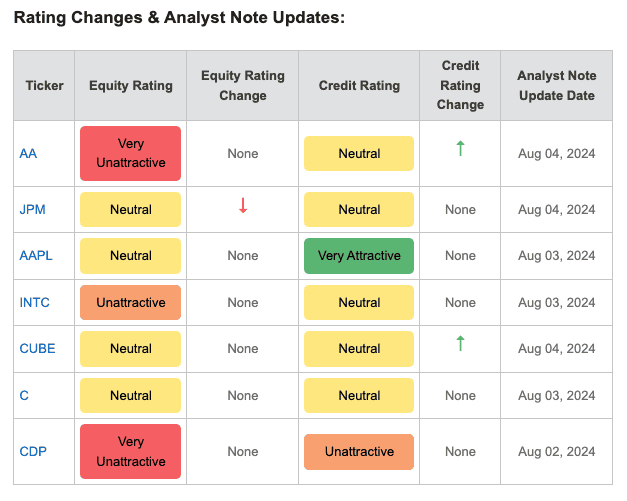

Portfolio Email Alerts

Get email alerts on all or any of the stocks, ETFs and mutual funds in your portfolio – and be notified any time there’s a major move in the financials, a change in our ratings or a major corporate event.

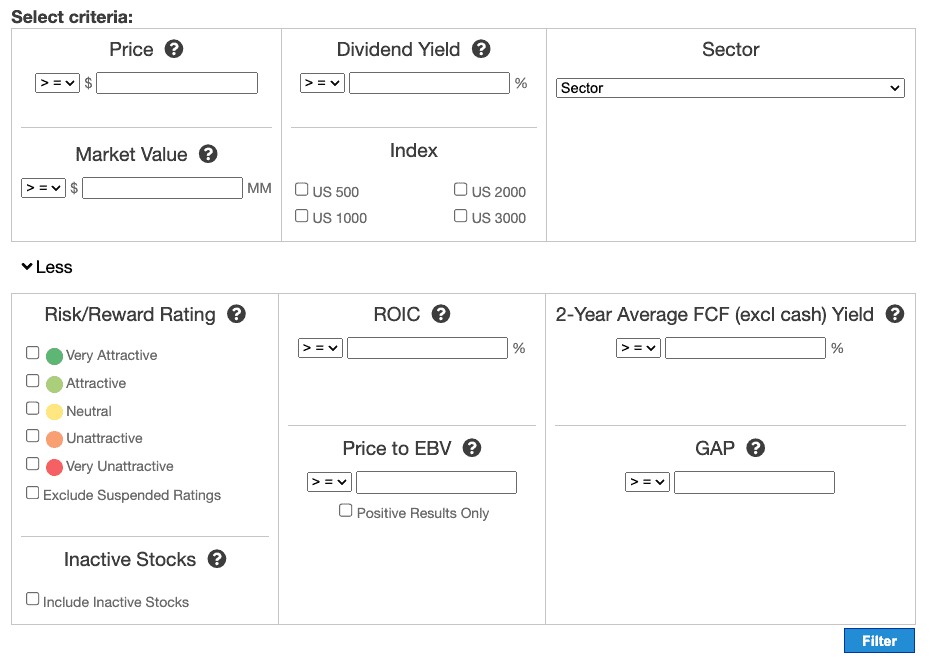

Stock Screening with Precision

Take your stock-picking to a higher level by screening the entire market with the most sophisticated metrics powered by proven-superior data. Never before have investors been able to screen over 10,000 stocks, ETFs & mutual funds based on the most advanced metrics powered by proven-superior data. Take advantage of our proven-superior analytics to find winners and avoid losers.

Detailed Research Reports

Get access to Long Idea and Danger Zone (avoid/short) research reports from our analyst team. We help you find companies with profitable operations, defensible moats, competitive advantages, and an undervalued stock price while protecting your portfolio from Zombie Stocks and potential land mines.

Membership Bonus #1

Access to Every Model Portfolio

Our model portfolios provide you with a curated list of our best ideas.

These model portfolios normally cost more than $32,000/year. We're including them as a BONUS with your Professional Membership!

- Focus List Stocks: Long ($10,989/year)

- Focus List Stocks: Short ($10,989/year)

- Most Attractive Stocks ($2,995/year)

- Most Dangerous Stocks ($539/year)

- Dividend Growth Stocks ($539/year)

- Safest Dividend Yields ($539/year)

- Exec Comp Aligned with ROIC ($6,000/year)

- Best & Worst ETFs and Mutual Funds by sector and style. ($399.92/year)

Membership Bonus #2

Members-only Access to Experts

Get members-only access to advanced training sessions, stock discussions and live Q&A with David Trainer & the New Constructs team. A $10,000 per month value included in your Professional Membership as a BONUS. Think of this offering as like getting your MBA in finance for free.

Membership Bonus #3

Education

Get access to our advanced educational materials. Enjoy explanations on how to model all the most sophisticated metrics like ROIC, EBV, FCF, NOPAT, WACC and Invested Capital. Get examples and full transparency for every calculation. See how the best models in the world work. It's hard to put a value on educational materials like these...but we'd say they are better than what you will find at any business school in the world - based on David Trainer's experience guest lecturing at these school. An $invaluable service included in your Professional Membership as a BONUS.

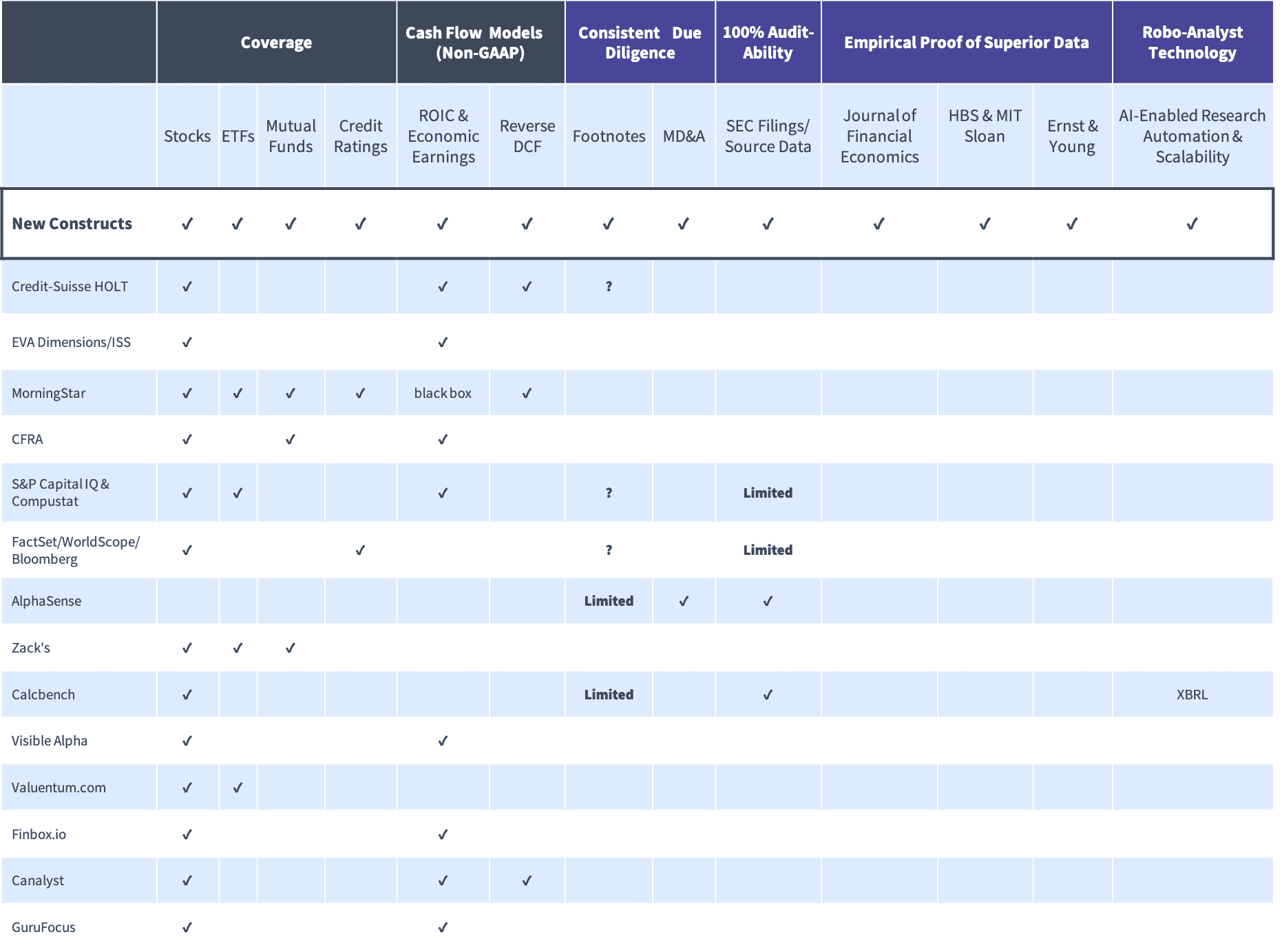

Compare New Constructs to the Competition

See how we stack up.

Machine learning makes the best stock investing software better, smarter, and faster than the competition. New Constructs offers more coverage with a focus on rigorous cash flow analysis than the competition. Our models are built on a data set that includes critical information from the footnotes and MD&A that other firms miss. We are totally transparent in our calculations and link all data back to the original SEC filings. We’re truly independent and don’t get paid by the companies or funds we cover.

Value Investing 2.0

The value investing process is the DNA that runs through our reports and tools. Your investment in a best stock investing software helps you eliminate the need to spend hours doing research in 200+ page annual reports. Let our forensic accounting experts and cutting-edge technology do the hard thinking for you.

Your Institutional Membership does the stock market research for you, which means we place the companies you select into an easy to use My Portfolio tracking tool that gives you access to our detailed reports and clear ratings.

We make it easy for you to make confident decisions. In the long-run, the stocks you place and keep in your portfolio are a direct reflection of your commitment to grow and protect your money. Your future is closer than you think and every decision matters. You need to know if there is critical information buried in an obscure disclosure in an annual report. With New Constructs’ best stock investing software, you can rest assured that you can find it.

You will clearly understand why a report recommends to buy or sell based on our deep forensic research. The tools are comprehensive but easy to follow so your decisions are made with conviction.