All eyes are on The Fed this week, but we want to bring your attention to a dangerous spot in the market. As expectations for a rate cut have increased, so too has this stock. In fact, shares are up over 90% in the past six months.

Why are we brining this to your attention now? Because the company continues to struggle as much now as when we first put it in the Danger Zone in September 2022. Since then, the stock has outperformed as a short by 90%, falling 38% while the S&P 500 is up 52%.

The recent 90% stock run-up is untethered from the fundamentals of the business, and the stock looks exceedingly expensive, again. In fact, the no growth value of the business is less than $0/share, yet the stock trades ~$19/share.

Below is a free excerpt from our latest Danger Zone report, published today to Pro and Institutional members. We hope you enjoy it. Feel free to share with friends and family, and we hope your portfolio stays safe from stocks like this one.

This stock is risky because of:

- rising cash burn resulting in short cash runway,

- high expenses relative to revenue,

- increasing debt balance,

- a stock valuation that implies the company will grow 2x faster than projected industry growth.

What’s Working

The company grew its customer base 13% year-over-year (YoY) in 2Q24 and increased storage attachment rates on installations to 54% in 2Q24, which is up from 18% in 2Q23. Meanwhile, megawatts hours of storage capacity installed increased 152% YoY over the same time.

What’s Not Working

The company’s growth has come to a halt. Revenue was down 11% YoY in 2Q24, which represents the fourth straight quarter of YoY decline. Customer additions were also down 33% YoY in 2Q24. Beyond the topline, the company’s fundamentals are deteriorating too, as we’ll detail below.

Profits Trending Lower

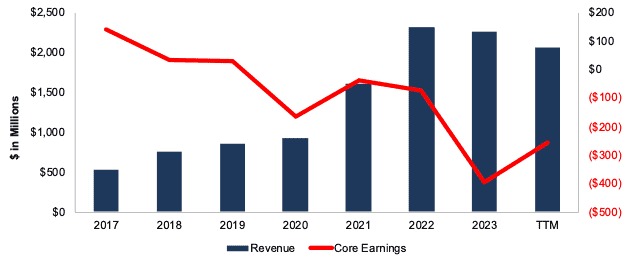

The company’s Core Earnings declined from $139 million in 2017 to -$256 million in the trailing-twelve-months (TTM). Note that the company’s revenue increased from $533 million to $2.1 billion over the same time.

In the TTM period, the company generated a -33% NOPAT margin and a -3% return on invested capital (ROIC).

Consistently negative Core Earnings and ROIC highlight the business’ inefficient revenue growth and operations.

Figure 2: Revenue and NOPAT: 2017 – TTM

Sources: New Constructs, LLC and company filings

Zombie Stocks Are Inherently Risky

Unprofitable companies with fast-depleting cash reserves are risky investments in any market. These risks are higher when the cost of raising capital is higher. When we first named this company a Zombie Stock, we noted it had just two months until running out of cash (or needing to raise additional capital). The company has been able to prolong this runway by taking on more debt. However, taking on additional leverage has not fixed cash-burning operations.

One Month of Cash Left

Given the company’s current cash balance, it can only support its TTM free cash flow (FCF) burn for one month from the end of August 2024. More details in Figure 3 in the full report. The fact remains that, without a significant improvement in operations, the company will need to take on additional debt and raise capital, else it run out of cash.

Unabated Cash Burn

The company’s FCF has been negative on both an annual and quarterly basis throughout the history of our model. In fact the company’s cash burn has been increasing each year since 2018. Since then, this company has burned through a cumulative $13.9 billion (78% of enterprise value) in FCF excluding acquisitions. In the TTM, the company’s cash burn sits at -$2,959 million.

….there’s much more in the full report. You can buy the report a la carte here.

Or, become a Professional or Institutional member – they get all Danger Zone reports.

Interested in starting your membership to get access all our Danger Zone picks? Get more details here.