I am not only going to show you how companies try to hide the truth from investors, but I am also going to show you how to turn the tables on them.

I believe pursuit of the truth is its own best reward because it enables you to (1) live life with a clear conscience and (2) make great discoveries that give you an edge. True to form, we just made an astounding discovery and have a new #1 stock pick based on brand new research. I share the discovery and how to get my new #1 stock pick in my latest training session here.

Read on for more on how we make the Truth make money for you.

Truths We Don’t Need to Know

Should you handle the truth? I’ll never forget Colonel Jessup, played by Jack Nicholson, telling Lt. Daniel Kaffee (Tom Cruise) “you can’t handle the truth” in the movie A Few Good Men. Honestly, it made me wonder if I could handle the truth. It opened my eyes to the fact that there are many truths that many people prefer not to handle.

Sometimes, for good reason…sometimes not.

Figure 1: Colonel Jessup and Uncomfortable Truth

Sources: Snapshot from a scene in the movie A Few Good Men

Some truths are, legitimately, too scary to face, especially if there’s nothing we can do to change them. For example, I think Colonel Jessup is right when he questions the ability of civilians to handle the truth. To be honest, I’d rather not think about how dangerously close we might be to being attacked by enemy forces. There’s nothing I can do about it; so worrying about it is futile. No reason to waste energy on things I cannot control.

Truths We Need to Know

There are truths, however, that we need to know. In particular, we need to know whether we can trust the people closest to us: our parents, our family, our business partners. We need to know because they affect our survival.

Next to loved ones, money is one of the most important drivers of our survival. So, we also need to know that we can trust the people that help us manage our money.

A Sucker Is Born Every Minute

“A sucker is born every minute” speaks to the ingrained human tendency to want to believe they can make lots of money without work.

The people pitching you stocks purposefully exploit this tendency. They are not in the business of selling truth. The truth does not make them money. Selling stocks or “research” makes them money. So, they employ whatever tactics are required to make money.

Have you noticed how much money the people selling “get rich quick” schemes make? Have you noticed how much money Wall Street Makes?

There are so many people who readily take what is easily available and pleasant over the truth. For example, does anyone truly believe meme stocks are good investments? No, but if they offer easy access to good performance, then, as we’ve seen, lots of people are all in. And, guess who makes lots of money on meme stocks: company managements and Wall Street. By the way, we’ve warned and continue to warn against buying meme stocks, especially AMC Entertainment (AMC) and Gamestop (GME).

The Truth About Stocks Is Hard To Get

Sometimes people avoid the truth because it’s too much work. Get rich quick schemes are easy, by design, easy…easy to believe and to execute.

On the other hand, when it comes to things with enduring value, the truth is not always readily available or pleasant. Sometimes, the truth is hard to find, too hard to find. As I detail in Fake News Is Cheap For A Reason, we’re awash in so much misleading information, that it’s hard to discern fact from fiction.

Let’s start with how companies try to scare you away from the truth. It starts with the companies burying the data you need to get to the truth in complicated jargon, accounting reports, and 1000+ page filings. Who has time to read all the 10-Ks and 10-Qs that companies publish? These filings are, on average, 200 pages long. And, we’re not talking comic book material.

Figure 2: Who Has the Time To Read 200+ Page Filings

Sources: New Constructs

You Have the Right to Ask for the Truth!

If you take anything from this letter, I want it to be that you should verify whether or not the people selling you stocks or research have actually analyzed all the 10-Ks and 10-Qs on the stocks they are selling you. Anyone who tells you they are reading all the filings for a given company should be more than willing to show you their work. It’s not hard to share the model they built based on the data or to show you the earnings adjustments they made based on the footnotes they analyzed.

Trust me: if they’ve done the work, then they should be proud to share it.

How do I know? I know because I’ve done the work, and I’ve never been anything but proud to share my models with friends, family, clients, colleagues, etc.

So, let me show you how we share our work.

Where You CANNOT Get Truth Consistently

Before we go into details about how to get the truth about stocks, we should take a second to be clear about where you CANNOT get the truth.

If you’ve read any of my prior letters, you know that I am very open about how much misinformation exists on Wall Street. Per the specific examples below, you cannot get truth from companies or Wall Street. These examples of how companies and Wall Street mislead investors speak for themselves.

- CFOs “Fudge the numbers” (details)

- Conflicts between research analysts and their bosses (details)

- Bad data causing bad research (details)

- Fake “Credit” Ratings (details)

- Fake “Buy” Ratings (details)

So, who to trust to give you the truth when it comes to managing your money?

How We Show You The Truth

There’s only one real way to prove you have the truth about stocks – and that is to show your work. Anyone can claim to have the truth. But, if they can’t back it up with hard data, hard numbers, examples of their models, then you have no reason to trust them.

Accordingly, we take pride in showing you our data, numbers, our models, and even the filings from which we parse all the data, including markups showing where we get our proprietary footnotes data. In fact, all of our models are 100% auditable. We provide the formulas for all of our metrics and methodologies, and we provide access to the original, marked-up filings to show where we get all the data used for the metrics.

Enough talk about what we show you, let’s get into details. Read on.

Part I: Showing the Work: Parsing Filings

New Constructs is doing the work every day. Our Robo-Analyst is downloading, analyzing, and building models based on all the 10-K and 10-Q filings submitted to the SEC for the most actively-traded U.S. stocks.

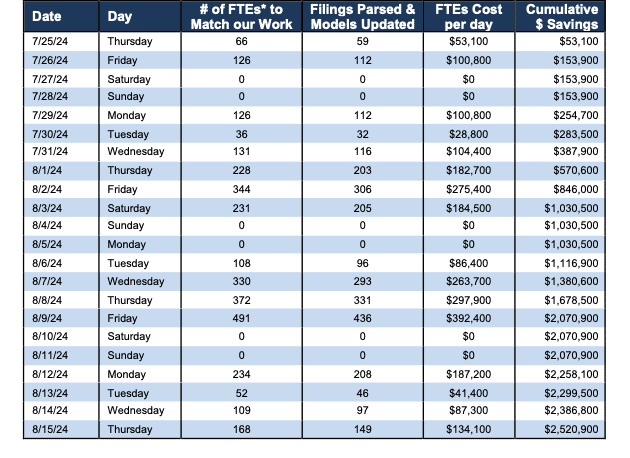

We share how much work we do every quarter in Filing Season Finds reports. Figure 3 shows how many filings we analyzed every day in the first half of August. “Filing season” refers to the four times during the year when most companies (those with December 31 fiscal year ends) file their 10-Ks and 10-Qs with the SEC.

We’re happy to show this work. I think other firms would be happy to show it, too, if they did it.

Figure 3: 2Q24 Filing Season: Created $2.5 Million in Value

Sources: New Constructs

As you can see, the filings come in big bunches, and it is impossible to analyze them all the day they come out without our Robo-Analyst technology.

Part II: Showing the Work: Detailed Reports

Next, check out this video tutorial (also in Figure 4) going through one of our standard company reports on Amazon (AMZN). We update and produce these reports every day with the latest stock price and 10-K and 10-Q data for every company we cover. These reports, as the tutorial demonstrates, show you all the work we do to build the model, make footnote adjustments, etc.

This is what I mean about showing you our work.

For all of our Long Idea and Danger Zone reports, you will get unrivaled transparency into our thesis as well as the financial model we use to support that thesis. To prove my point, I am sharing this strongly out-performing Long Idea that remains one of our top picks. You can email me to get a copy if you’re not a member. Trust, once you read the report, you’ll understand why our picks earn us the #1 ranking on SumZero. And, you will understand why clients have so much confidence in our research.

Figure 4: How to Read our Robo-Analyst Stock Reports

Part III: Showing the Work: Marked-up Filings

As far as I know, no other research firm in the world can show you exactly where or how they get data from the footnotes, but we can. This tutorial demonstrates our Marked-Up Filings feature, available to our Institutional clients, which allows clients to audit every single data point in our models and reports.

Not sure if you can trust our numbers? No problem. We give you the ability to audit every single number. If that does not show confidence in our data and models, I do not know what does. Also, the fact that we can offer auditability means that other firms can do the same. If we can do it, why can’t they do it?

Figure 5: Marked-Up Filings: Unrivaled Auditability of Valuation Models

Proof That We Can Handle The Truth

I think it is important to note that our Marked-Up Filings feature played a major role in gaining the trust of the respected institutions that published papers proving the superiority of our data, models and stock ratings.

Question:

How many research or Wall Street firms have papers from Harvard Business School, MIT Sloan School of Business, The Journal of Financial Economics and Ernst & Young that prove the superiority of their data, financial models and stock ratings?

Answer:

None, but New Constructs

Does our Work Matter?

Now that we’ve shown you how we show our work, you may ask, why do I care? Does New Constructs’ work matter? Does it produce superior results?

Yes, the truth pays. Loyal readers know that we’ve been ranked #1 in multiple stock-picking categories, including “All-Time” by SumZero nearly every month over the last three years. SumZero is a community of ~16,000 buy-side only investors; so, we’re going against real competition. “Buy-side only” means professional stock pickers at hedge funds, not Wall Street (i.e. sell-side) analysts.

If you’d like multiple real-world examples of how we’ve found some of the best stocks over the last 15 years, like picking Nvidia (NVDA) at $0.57/share in September of 2015 (see the report), then watch my latest training session. It’s happened this week, Wednesday September 18th at 5pmET – right after we discovered a new metric to boost our already-successful stock ratings. This training is my favorite of all time. We are really excited to share these brand new stock picks and the never-before-seen research that generates them. The replay will be in our online community here. You can join our private community for free by completing this form.

In that training, I’m not only going to share some of our research and proof that it works, but I will also reveal a secret metric we recently discovered that we use to super-charge our ratings. It’s a metric that only we can use because only we have the footnotes data required to produce the metric with integrity.

Proof the Truth Matters?

If you’re looking for 3rd-party, independent proof that our work delivers a new, never-before-seen edge, then see:

- Core Earnings: New Data & Evidence, a paper by professors from Harvard Business School & MIT Sloan and in The Journal of Financial Economics, which proves we our footnotes data delivers “novel alpha”.

- Human versus Machine: A Comparison of Robo-Analyst and Traditional Research Analyst Investment Recommendations, a paper from Harvard Business School that proves our stock ratings beat Wall Street analysts. Bloomberg features the paper here.

The Bottomline

There is no other research firm like New Constructs. No one does as much diligence, and no one can show the work and prove their diligence as we can. We might not have the market for truth cornered, but we do have the market for the truth about profitability and valuation of U.S. stocks, ETFs and mutual funds cornered.

So the question now to you is: can you handle the truth?

If your answer is yes, then you should be a client.

Want more details on New Constructs?

We regularly review our work and research on Long Ideas and Danger Zone Ideas with clients. We want you to know how much work we do! Here’s some ways to keep in touch with us:

- Free live Podcast every month. The next one is on Friday, October 18th, register here. The last one was September 13th. Get free replays in our online community.

- Join our online community (use this form to sign up for free). Ask questions and make friends! Lots of humble investors talking to each other is a good thing.

- Monthly Let’s Talk Long Ideas webinars where we do deep dives into our research, analytics, reverse DCF models and ideas for our Professional and Institutional clients. Our next one is on August 14th at 5:00pmET. Replays are here for our Professional and Institutional clients.

If this message resonated with you and you want to start your investing future with us – schedule a meeting with us here.

Diligence matters,

David

This article was originally published on September 19, 2024.

Disclosure: David Trainer, Kyle Guske II, and Hakan Salt, receive no compensation to write about any specific stock, sector, style, or theme.

Questions on this report or others? Join our online community and connect with us directly.