Wall Street analysts are too bullish on second quarter earnings expectations for most S&P 500 companies. The percentage of S&P 500 companies whose Street EPS exceeds our Core EPS[1] equals 74% through 2Q24. For the stocks most likely to beat, see 3Q24 Earnings: Where Street Estimates Are Too Low & Who Should Beat.

Picking out the one stock most likely to miss the Street’s estimates for next quarter’s earnings is something one can only do with a superior earnings measure of the entire market. Only we provide such a measure. Without our proprietary footnotes data, other analysts are flying blind. They are forced to estimate earnings without the full picture of a company’s financials, including the material information hidden in footnotes.

Every quarter, we comb through thousands of footnotes to find the one stock we think is most likely to miss the Street. We think this stock will miss because Street Earnings are artificially increased by non-operating income that we remove when we calculate our proven-superior Core Earnings.

You probably won’t be surprised to learn that Street Earnings overstate profits for the majority of S&P 500 companies. In this report, the second of our two earnings season preview reports, we show:

- the frequency and magnitude of overstated Street Earnings[2] in the S&P 500 and

- the S&P 500 company most likely to miss 3Q24 earnings.

Our Robo-Analyst technology allows us to compare Core Earnings to Street Earnings across the entire market.

Street EPS Are Higher Than Core EPS for 369 S&P 500 Companies

For 369 companies in the S&P 500, or 74%, Street Earnings are higher than Core Earnings in the trailing twelve months (TTM) ended 2Q24. In the TTM ended 1Q24, Street Earnings were overstated for 373 companies.

The more interesting trend, however, is in the percentage of the S&P 500 where Street Earnings overstate Core Earnings by more than 10%. That number equals 42% (210 companies), which is slightly lower the 212 companies in the TTM ended 1Q24.

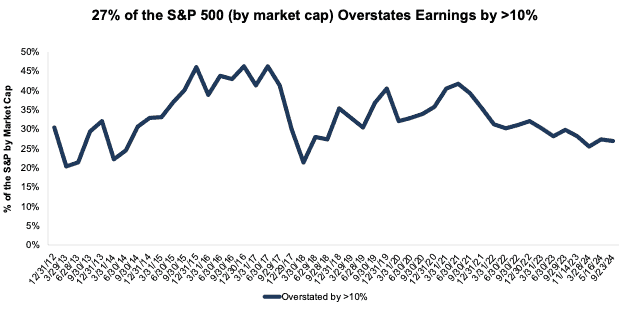

Those 210 companies make up 26.9% of the market cap of the S&P 500 as of 9/23/24, which is down from 27.4% of the market cap in 1Q24, measured with TTM data in each quarter. See Figure 1.

Figure 1: Overstated Street Earnings by >10% as % of Market Cap: 2012 through 9/23/24

Sources: New Constructs, LLC and company filings.

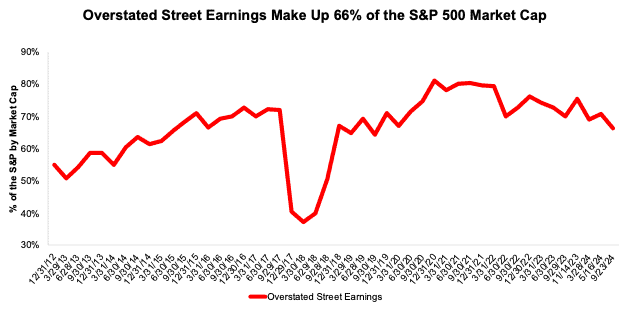

The 369 companies with overstated (by any amount) Street Earnings make up 66% of the market cap of the S&P 500 as of 9/23/24, which is down from 71% in 1Q24, measured with TTM data in each quarter.

Figure 2: Overstated Street Earnings as % of Market Cap: 2012 through 9/23/24

Sources: New Constructs, LLC and company filings.

Note that this analysis is based on our team analyzing the financial statements and footnotes for ~3,000 10-Ks and 10-Qs filed with the SEC after earnings season. We estimate that the cost of this work for most firms would be over $2 million each quarter. To say the least, there is tremendous value in our rigorous analysis of these filings across so many companies so that our clients can discern the best and worst stocks with unrivaled diligence.

When Street Earnings are higher than Core Earnings, they are overstated by an average of 19%, per Figure 3.

Figure 3: Street Earnings Overstated by 19% on Average in TTM Through 2Q24

Sources: New Constructs, LLC and company filings.

S&P 500 Company Likely to Miss 3Q24 Earnings

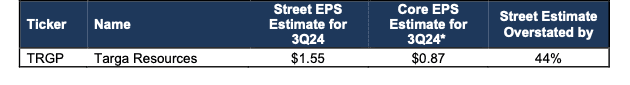

Figure 4 shows S&P 500 company likely to miss calendar 3Q24 earnings because their Street EPS estimates are overstated. Because investors and analysts tend to anchor their earnings projections to historical results, errors in historical Street EPS lead to errors in Street EPS estimates.

Figure 4: S&P 500 Company Likely to Miss 3Q24 EPS Estimates

Sources: New Constructs, LLC, company filings, and Zacks

*Assumes Street Distortion as a percent of Core EPS is the same for 3Q24 EPS as for TTM ended 2Q24.

This article was originally published on September 27, 2024.

Disclosure: David Trainer, Kyle Guske II, and Hakan Salt receive no compensation to write about any specific stock, style, or theme.

Questions on this report or others? Join our online community and connect with us directly.

[1] The Journal of Financial Economics features the superiority of our Core Earnings in Core Earnings: New Data & Evidence.

[2] Street Earnings refer to Zacks Earnings, which are reported to remove non-recurring items using standardized assumptions from the sell-side.