We updated the SHAK Danger Zone pick on November 18, 2024. A copy of the associated Position Close report is here.

We updated the SNAP Danger Zone pick on September 22, 2025. A copy of the associated Position Close report is here.

We started our Zombie Stock list in June 2022 and have added a total of 33 stocks to the list. After this report, 15 stocks remain on the list. Companies are removed because:

- they have extended their cash runway before running out of cash,

- their stock prices are near $0, or

- they have turned their businesses around and look like they will avoid bankruptcy.

In this report, we’re taking six stocks off our Zombie Stocks list and closing one Danger Zone pick. Prior reports where we removed stocks from the Zombie Stock List are here, here, here, here, here, here, and here.

As a reminder, to make the Zombie Stock list, companies must:

- have less than 24 months of cash to sustain their high cash burn, and

- have a negative interest coverage ratio (EBIT/Interest expense).

See the end of this report for performance details on all the Zombie Stocks.

Zombie Stock Picks to Close

See Figure 1 for the Zombie Stocks we are removing from the list and their performance vs. the S&P 500 while on the Zombie Stock List.

Figure 1: Zombie Stocks Removed: Performance as of Closing Prices on 10/4/24

| Company | Ticker | Date Added to Zombie Stock List | Return as Short vs. S&P 500 Since Named Zombie | Return as Short vs. S&P 500 as a Danger Zone Pick |

| Snap Inc. | SNAP | 7/22/22 | 37% | 125% |

| Opendoor Technologies | OPEN | 1/30/23 | 47% | 47% |

| Shake Shack | SHAK | 8/10/22 | -109% | 31% |

| Uber Technologies | UBER | 8/17/22 | -112% | 17% |

| Twilio Inc. | TWLO | 11/23/22 | 3% | 3% |

| Okta Inc. | OKTA | 11/16/22 | 2% | 2% |

Sources: New Constructs, LLC and company filings

Below, we provide details on why we’re removing each stock from the Zombie Stock list and whether we’re closing the Danger Zone pick entirely.

Snap Inc. (SNAP)

We put Snap Inc. (SNAP: $11/share) back in the Danger Zone on September 14, 2020 and named it a Zombie Stock on July 22, 2022. Our thesis highlighted the firm’s lack of competitive advantages vs. deep pocketed competitors, unprofitable growth, unsustainable cash burn, and overvalued stock price.

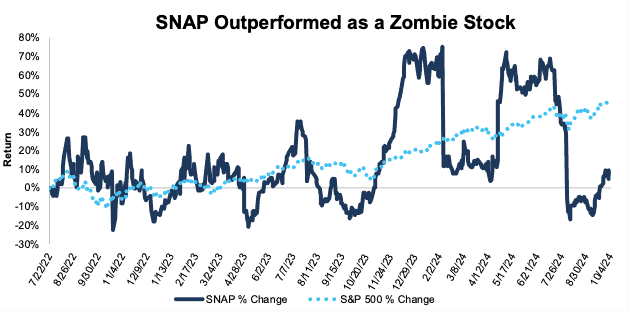

Since our original Danger Zone report in September 14, 2020, SNAP has outperformed as a short by 125%, falling 57% compared to a 68% gain for the S&P 500. Since we added Snap to our Zombie Stock list, the stock has outperformed as a short by 37%, rising 8% compared to a 45% gain in the S&P 500.

When we named Snap a Zombie Stock, its free cash flow (FCF) burn was rising, and it had only enough cash to sustain the burn for 15 months.

Today, Snap has 48 months before it runs out of cash at its current TTM cash burn rate. While the company’s cash on hand has fallen from $4.2 billion in 2022 to $3.1 billion in the TTM ended 2Q24, its cash burn has also decreased. Snap’s FCF excluding acquisitions was -$2.2 billion in 2021, -$1.4 billion in 2023, and -$720 million in the TTM ended 2Q24.

Snap no longer qualifies as a Zombie Stock as it was able to extend its runway before running out of cash, but that doesn’t mean it’s now a good stock. The company still has not generated positive FCF in any year of our model and currently generates a -16% return on invested capital (ROIC). The economic book value, or no growth value, of the business is -$8/share. With such poor fundamentals and an overvalued stock, we are taking Snap out of the Zombie Stock list, but it remains in the Danger Zone.

Figure 2: SNAP vs. S&P 500 – Price Return as a Zombie Stock – Successful Short Call

Sources: New Constructs, LLC and company filings

Note: Gain/Decline performance analysis excludes transaction costs and dividends.

Opendoor Technologies Inc. (OPEN)

We put Opendoor (OPEN: $2/share) in the Danger Zone and named it a Zombie Stock on January 30, 2023. Our thesis highlighted Opendoor’s consistently poor and deteriorating fundamentals, high expenses relative to sales, significant headwinds to the business due to the housing market at the time, large FCF burn, and overvalued stock price.

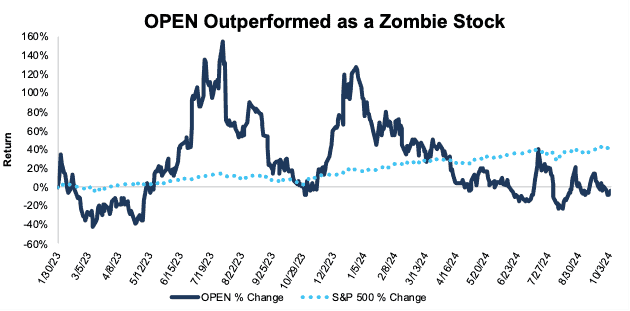

Since we added OPEN to our Zombie Stock list the stock has outperformed as a short by 47%, falling 4% compared to a 43% gain in the S&P 500.

When we first named Opendoor a Zombie Stock, it could only sustain its FCF burn for another eight months.

Since then, the company achieved positive FCF in both 2022 and 2023, as well as in the TTM period. The company still generates a bottom quintile ROIC of 5%, and trades well above its economic book value of -$0.09/share. However, with the positive FCF and the stock continuing to trade below $2/share, we’re taking it off the Zombie Stock List. We’re taking the 47% outperformance as a short as a win. Additionally, while the stock remains expensive, valuation alone isn’t enough to land a stock in the Danger Zone. As a result, we believe it’s time to close this successful Danger Zone pick as well.

Figure 3: OPEN vs. S&P 500 – Price Return as Zombie Stock – Successful Short Call

Sources: New Constructs, LLC and company filings

Note: Gain/Decline performance analysis excludes transaction costs and dividends.

Shake Shack Inc. (SHAK)

We first put Shake Shack (SHAK: $110/share) in the Danger Zone on June 10, 2019 and declared it a Zombie Stock on August 10, 2022. Our thesis highlighted the firm’s misleading reported results, declining margins and ROIC, rising costs, reliance on price increases to grow, and overvalued stock price. At the time we added it to the Zombie Stock list, Shake Shack could only sustain its cash burn for 23 months.

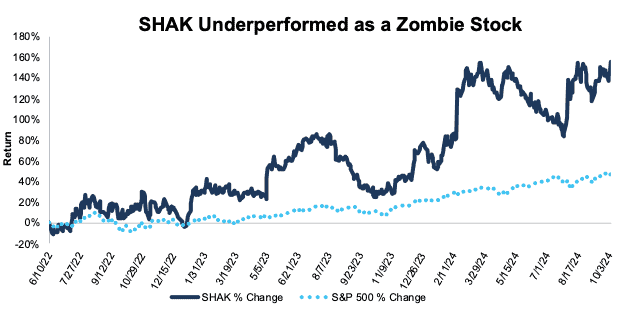

Since our original Danger Zone report, SHAK has outperformed as a short by 31%, rising 67% compared to a 98% gain for the S&P 500. However, since we added Shake Shak to the Zombie Stock list, the stock has underperformed as a short by 109%, rising 156% compared to a 47% gain in the S&P 500.

Shake Shak’s ROIC, NOPAT margin, and invested capital turns have improved slightly over the past two years, and the company’s FCF followed suit. FCF excluding acquisitions has improved from -$189 in fiscal 2022 to -$78 in the TTM. As a result, SHAK now has a runway of 44 months before it runs out of cash.

Shake Shack still ranks near the bottom, in terms of profitability, when compared to competitors in the fast casual industry, and its stock receives our Unattractive rating. SHAK no longer qualifies as a Zombie Stock due to its extended runway of cash, but it remains in the Danger Zone.

Figure 4: SHAK vs. S&P 500 – Price Return as a Zombie Stock – Unsuccessful Short as Zombie

Sources: New Constructs, LLC and company filings

Note: Gain/Decline performance analysis excludes transaction costs and dividends.

Uber Technologies Inc. (UBER)

We first put Uber (UBER: $74/share) in the Danger Zone on April 22, 2019, prior to its IPO, and named it a Zombie Stock on August 17, 2022. Our short thesis highlighted Uber’s negative profitability, declining take rate (revenue collected per ride on the platform), lack of competitive advantages, low switching costs, and overvalued stock price. We named Uber a Zombie Stock because it could only sustain its (at that time) cash burn for 21 months.

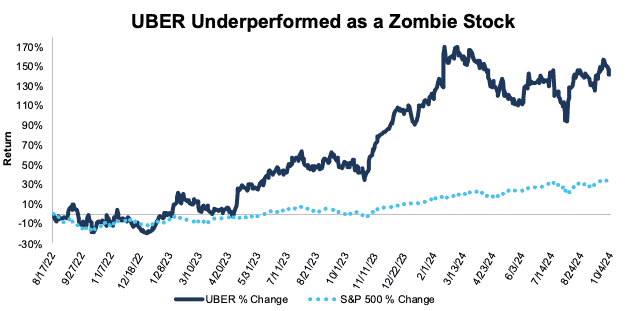

Since our original Danger Zone report, UBER has outperformed as a short by 17%, rising 78% compared to a 95% gain for the S&P 500. Since we added Uber to the Zombie Stock list though, the stock has underperformed as a short by 112%, rising 146% compared to a 34% gain in the S&P 500.

Uber’s fundamentals have improved significantly, as it has grown revenue 1.6x faster (on a compound annual basis) than expenses since the COVID-19 included sales drop in 2020. The company’s NOPAT has increased from -$3.1 billion in 2020 to $2.2 billion in the TTM ended 2Q24, and its NOPAT margin improved from -28% to 6% over the same time. Additionally, Uber’s ROIC improved from -11% in 2020 to 9% in the TTM.

The company burned -$2.2 billion in FCF excluding acquisitions in the TTM after generating positive FCF in 2022 and 2023. However, given its large cash balance and profitability, Uber now has a positive interest coverage ratio and a 67-month runway before running out of cash at its TTM burn rate.

Though Uber has improved its fundamentals significantly and has managed to take market share in the process, the stock remains vastly overvalued. It remains in the Danger Zone.

Figure 5: UBER vs. S&P 500 – Price Return as a Zombie Stock – Unsuccessful Short as Zombie

Sources: New Constructs, LLC and company filings

Note: Gain/Decline performance analysis excludes transaction costs and dividends.

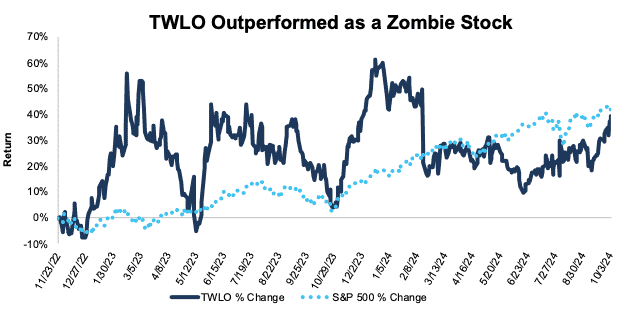

Twilio Inc. (TWLO)

We put Twilio (TWLO: $67/share) in the Danger Zone and named it a Zombie Stock on November 23, 2022. Our thesis highlighted the firm’s poor profitability, slowing revenue growth, increasing expenses, consistent cash burn, and overvalued stock price.

Since we named it a Zombie Stock, TWLO has outperformed as a short by 3%, rising 40% compared to a 43% gain for the S&P 500.

When we added Twilio to our Zombie Stock list, the company could only sustain its cash burn for 10 months.

Since then, the company has reduced losses, as net operating profit after-tax (NOPAT) improved from -$980 million in 2022 to -$348 million over the TTM. FCF was positive in 2023 and the TTM period, yet the company’s ROIC sits at -3%.

With positive FCF, Twilio no longer qualifies as a Zombie Stock. However, given negative margins and ROIC, along with an overvalued stock price, TWLO remains in the Danger Zone. Its current economic book value sits at -$24/share, so while it might not go to $0, the downside risk in owning the stock looms large.

Figure 6: TWLO vs. S&P 500 – Price Return as Zombie Stock – Successful Short Call

Sources: New Constructs, LLC and company filings

Note: Gain/Decline performance analysis excludes transaction costs and dividends.

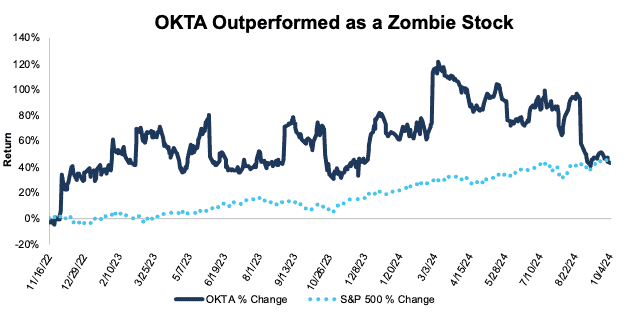

Okta Inc. (OKTA)

We put Okta (OKTA: $72/share) in the Danger Zone and named it a Zombie Stock on November 16, 2022. Our thesis noted Okta’s declining NOPAT, ROIC, and economic earnings, large FCF burn, low profitability relative to competitors, and overvalued stock price. We specifically named Okta a Zombie Stock because it could only sustain its cash burn for two months at the time of the report.

Since our original report, OKTA slightly outperformed as a short by 2%, rising 43% compared to a 45% gain for the S&P 500.

Today, Okta has 77 months before it runs out of cash at its current fiscal TTM cash burn rate. The company’s cash on hand has fallen from $2.5 billion in fiscal 2022 to $2.4 billion in the TTM ended fiscal 2Q25, but its cash burn rate has also decreased. Okta’s FCF was -$6.0 billion in fiscal 2022 and -$357 million in the TTM ended fiscal 2Q25.

Fundamentally, the company still looks weak. Okta generates a negative 3% ROIC, -9% NOPAT margin, and has not generated positive economic earnings in any year of our model. Additionally, the stock still looks expensive, with an economic book value of -$20/share. Poor fundamentals and an overvalued stock earn OKTA an Unattractive rating.

We are taking Okta off the Zombie Stock list due to its extended runway before running out of cash, but with poor fundamentals and an overvalued stock it remains in the Danger Zone.

Figure 7: OKTA vs. S&P 500 – Price Return as Zombie Stock – Successful Short Call

Sources: New Constructs, LLC and company filings

Note: Gain/Decline performance analysis excludes transaction costs and dividends.

The Full Zombie Stock List

15 stocks remain on the Zombie Stock list after this report.

Figure 8 shows all 33 Zombie Stocks. We mark those that have been removed from the list with an asterisk.

Figure 8: Zombie Stock Reports: Performance Since Publish Date Through 10/4/24

| Company Name | Ticker | Date Added | Return Since Add Date | Return as Short Vs. S&P 500 |

| Freshpet Inc.* | FRPT | 6/23/22 | -16% | 9% |

| Peloton Interactive | PTON | 6/23/22 | -57% | 104% |

| Carvana Co. | CVNA | 6/23/22 | 472% | -425% |

| Snap Inc.* | SNAP | 7/22/22 | 9% | 36% |

| Beyond Meat, Inc. | BYND | 8/1/22 | -60% | 101% |

| Rivian Automotive* | RIVN | 8/8/22 | -61% | 94% |

| DoorDash, Inc. | DASH | 8/10/22 | 86% | -49% |

| Shake Shack, Inc.* | SHAK | 8/10/22 | 112% | -75% |

| AMC Entertainment | AMC | 8/15/22 | -98% | 132% |

| GameStop Corporation* | GME | 8/15/22 | -68% | 69% |

| Chewy Inc.* | CHWY | 8/17/22 | -55% | 57% |

| Uber Technologies* | UBER | 8/17/22 | 146% | -112% |

| Robinhood Markets | HOOD | 8/22/22 | 149% | -110% |

| Tilray Brands* | TLRY | 9/7/22 | -49% | 92% |

| Affirm | AFRM | 9/19/22 | 78% | -29% |

| Sunrun | RUN | 9/21/22 | -46% | 102% |

| Blue Apron * | APRN | 9/26/22 | -79% | 95% |

| RingCentral | RNG | 10/3/22 | -27% | 79% |

| Allbirds Inc.* | BIRD | 10/17/22 | -71% | 89% |

| Wayfair | W | 11/14/22 | 32% | 12% |

| Atlassian* | TEAM | 11/16/22 | 43% | -32% |

| Bill.com | BILL | 11/16/22 | -53% | 99% |

| Okta* | OKTA | 11/16/22 | 47% | -2% |

| Oatly* | OTLY | 11/21/22 | -62% | 71% |

| Twilio* | TWLO | 11/23/22 | 39% | 4% |

| Ceridian* | CDAY | 11/23/22 | -3% | 11% |

| Redfin | RDFN | 11/30/22 | 102% | -61% |

| Five9 Inc.* | FIVN | 12/5/22 | -37% | 72% |

| Opendoor* | OPEN | 1/30/23 | -9% | 50% |

| Compass Inc. | COMP | 2/6/23 | 44% | -5% |

| Sweetgreen Inc. | SG | 3/13/23 | 391% | -344% |

| Lucid Group* | LCID | 4/10/23 | -23% | 31% |

| Trupanion | TRUP | 5/1/23 | 24% | 16% |

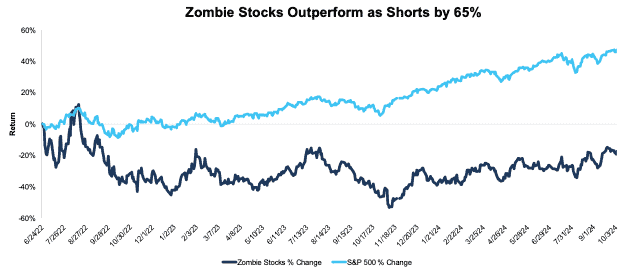

| Overall Portfolio Return | -18% | 65% | ||

Sources: New Constructs, LLC and company filings.

*Stocks removed from the Zombie Stock List. Performance tracked through the date each was removed. Linked report goes to the report in which the stock was removed.

Since our first report on June 23, 2022, the Zombie Stocks have fallen 18% while the S&P 500 is up 47%. See Figure 9.

Figure 9: Combined Performance of Zombie Stocks List Through 10/4/24

Sources: New Constructs, LLC and company filings.

This article was originally published on October 8, 2024.

Disclosure: David Trainer, Kyle Guske II, and Hakan Salt receive no compensation to write about any specific stock, style, or theme.

Questions on this report or others? Join our online community and connect with us directly.