In a market that just keeps rising, investors can ground themselves by getting back to the basics: evaluating risk/reward. A high-flying stock with great momentum might offer significant reward, but the risks could be even higher. Understanding the risk/reward of an investment helps any investor build a portfolio that can provide upside yet also weather a market downturn.

But, how can you measure risk reward? It starts with understanding the fundamentals of a business. Our superior fundamental data on ~3,400 stocks can help investors scan the ENTIRE market to find businesses that generate real cash flows. Then, one must analyze the valuation of a business. If the valuation of a business already reflects all future profit growth opportunities, the risk/reward may not be worth it. We leverage our reverse discounted cash flow model to quantify the expectations for future profit growth baked into stock prices to find opportunities where a good business (based on fundamentals) also trades at a discount.

This week’s Long Idea is a stock that we remain bullish on and consider one of very few attractive opportunities in a stock market increasingly overrun with overvalued stocks.

Our process for picking stocks is about as rigorous as it gets, and we’re proud to show our work. We’re not giving you the ticker for this pick, but there’s so much here to share; so, you know where to set the bar when evaluating research providers.

Below is an excerpt from the full update on our thesis, available to Pro and Institutional members. And, you can buy the full report a la carte here.

This stock presents quality Risk/Reward based on the company’s:

- position to profit from persistent demand for oil and gas,

- plant and well investments to lower costs, expand margins, and increase capacity,

- industry-leading profitability,

- quality yield supported by strong cash flows, and

- cheap valuation.

What’s Working

Oil & Gas on the Rise in the Near-Term

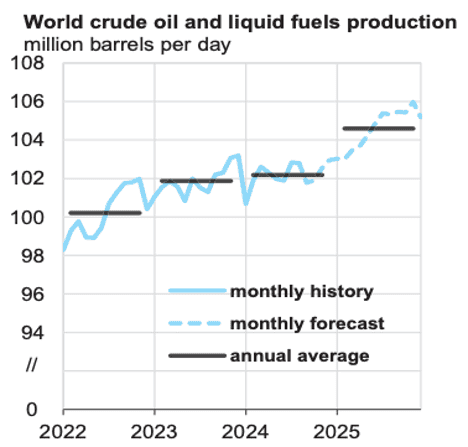

The U.S. Energy Information Administration (EIA), in its September 2024 Short-Term Energy Outlook, projects global crude oil production to grow 3% year-over-year (YoY) in 2025.

The EIA projects global liquid fuel consumption will increase by 0.9 million barrels per day in 2024 and 1.5 million barrels per day in 2025.

Additionally, and as we pointed out in our original report on this company, the transition away from oil and gas in energy markets across the globe will take decades. This long transition creates opportunity for sustained demand, exploration, and profitable production of fossil fuels for the foreseeable future.

Figure 1: Global Crude Oil and Fuels Production Estimate: 2022-2025

Sources: U.S. Energy Information Administration, Short-Term Energy Outlook, September 2024

Investments Help Drive Down Costs

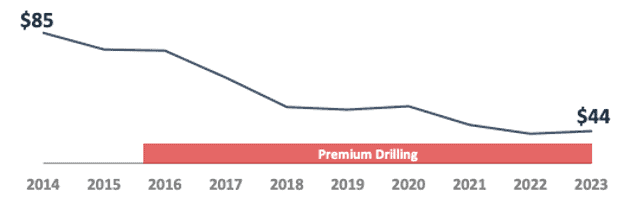

This company has proven that its investments in infrastructure, when coupled with operational expertise, lower costs and improve profitability. Per Figure 2, the company has improved its efficiency significantly. It has lowered the oil price required to generate a 10% return on capital employed (ROCE) – a similar metric to return on invested capital (ROIC) – from $85/barrel in 2014 to just $44/barrel in 2023.

Figure 2: Oil Price Required for 10% Return on Capital Employed

Sources: Company 2Q24 Earnings Presentation

Focus On ROCE is Not by Accident

The company’s focus on improving its ROCE is a direct result of a management team that is incentivized to create shareholder value.

Quality corporate governance holds executives accountable to shareholders by incentivizing prudent capital allocation. It’s also one of the clues we use to know if we can trust a company and its management – as detailed in this training session. By evaluating executive compensation plans, investors can find the few companies that align executives’ interests with shareholders’ interests.

The company’s performance units, which represent 60% of long-term incentives, include a return on capital employed performance modifier. The modifier can adjust the performance unit payout by anywhere from -70% to +70% based on the company’s three-year average ROCE. ROCE is similar to our measure of ROIC, in that the company adjusts for items such as impairments, gains on asset sales, short and long-term debt, and cash on hand, to derive a return metric more reliable than a traditional return on capital employed.

The company’s primary performance metric remains total shareholder return, which we would prefer be replaced altogether with ROCE or ROIC. However, including the ROCE modifier places the company’s executive compensation plan above many others that fail to properly align executives’ interests, and is why this company is in the most recent Exec Comp Aligned with ROIC Model Portfolio.

….there’s much more in the full report. You can buy the report a la carte here.

Or, become a Professional or Institutional member – they get all Long Idea reports.