The market has paused after rising for most of the past few months. As volatility rises ahead of the election, now is great time to re-evaluate risk. Many stocks have benefited from the rising market when they did not deserve to go up in the first place.

This week’s Danger Zone pick continues to burn cash, face uphill competitive challenges, and lack profitability, yet its stock is up 24% year-to-date.

This Danger Zone call has been great since we first put the stock in the Danger Zone – it has outperformed as a short by 99%.

However, the run-up in the stock this year and over the past year creates a situation where the expectations baked into the current stock price look entirely unrealistic. Unless the company can immediately achieve positive margins and grow revenue to levels that would claim the top spot in its industry, it is not worth its current valuation.

So, how bad could things get? The no-growth value of the business is less -$4/share.

Below is a free excerpt from our latest Danger Zone report, published today to Pro and Institutional members. We hope you enjoy it. Feel free to share with friends and family, and we hope your portfolio stays safe from stocks like this one.

This stock could fall further based on:

- negative margins,

- continuous cash burn,

- lack of competitive advantages, and

- a stock valuation that implies the company will grow to become the largest U.S. retailer in its industry

What’s Working

The company grew its top line by 13% year-over-year (YoY) in 2Q24, grew active customers by 4.5% YoY, and its average revenue per customer by 9% YoY in 2Q24.

The company continues to open new retail stores and opened 11 new stores in the second quarter of 2024.

What’s Not Working

Although the growth that the company achieved is certainly a positive, the company remains an unprofitable cash burning operation with a lack of meaningful competitive advantages, as we’ll show below.

Profitless Growth Continues

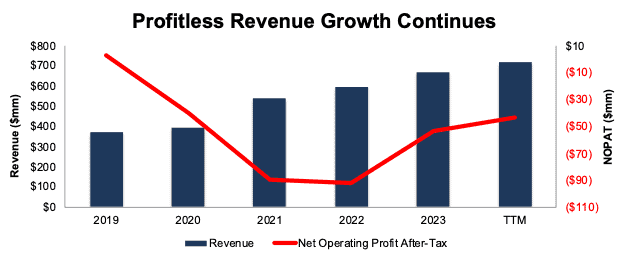

This company has grown revenue 16% compounded annually since 2019 while net operating profit after-tax (NOPAT) fell from $3 million to -$43 million over the same time.

NOPAT margin fell from 1% in 2019 to -6% over the TTM, while invested capital turns fell from 1.8 to 1.4 over the same time. Falling margins and invested capital turns drive return on invested capital (ROIC) from 2% in 2019 to -8% in the TTM.

Figure 2: Revenue and NOPAT: 2019 – TTM

Sources: New Constructs, LLC and company filings

Cash Burn Continues

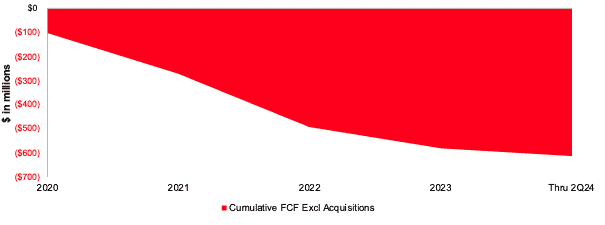

The company has generated negative free cash flow (FCF) in each year of our company model, which dates back to 2019, and every quarter, for which we have data back to 2Q22. The company has burned a cumulative -$615 million (28% of enterprise value) in FCF since 2020.

Following the same trend, the company’s economic earnings, the true cash flows of the business, which take into account changes to the balance sheet, have fallen from -$20 million in 2019 to -$111 in the TTM.

Figure 4: Cumulative Free Cash Flow: 2020 Through 2Q24

Sources: New Constructs, LLC and company filings

….there’s much more in the full report. You can buy the report a la carte here.

Or, become a Professional or Institutional member – they get all Danger Zone reports.

Interested in starting your membership to get access all our Danger Zone picks? Get more details here.