We published an update on this Long Idea on December 10, 2025. A copy of the associated report is here.

The market cheered the election results as stocks soared to new record highs and had their best day since late 2022. If you’ve been reading our reports lately, you know this means one thing – already expensive stocks just got even more expensive, which makes finding undervalued stocks even more difficult.

Soaring valuations makes quantifying expectations even more insightful. By levering our reverse discounted cash flow model, we can identify stocks where expectations for future profits are too low (or vice versa) in any kind of market – undervalued, overvalued, bull, bear, and anything in between.

We leverage our proven-superior fundamental data to identify the true profitability of 3,400+ stocks. Only by understanding the true cash flows of a business can investors know if a company’s stock price is justified.

This week’s Long Idea presents a profitable business trading at a significant discount. The company’s profits strongly rebounded from 2022 lows as management took a prudent approach to managing growth in the face of market headwinds. Now, with profitability on the rise, the company is looking to grow and expand its market share once again.

We believe this business, along with its strong cash flows, strong dividend yield, and opportunity to grow profits in the future presents quality risk/reward.

Our process for picking stocks is about as rigorous as it gets, and we’re proud to show our work. We’re not giving you the ticker for this pick, but we are happy to share large excerpts from the report.

The information below comes from the recent update on our thesis for this stock, available to Pro and Institutional members. And, you can buy the full report a la carte here.

This stock presents quality Risk/Reward based on the company’s:

- position to profit from rising insurance demand,

- rebounding profitability after 2022 losses,

- strong cash flows and quality shareholder return, and

- potential upside in the valuation of the stock.

What’s Working

Demand for Insurance Continues to Rise

Insurance is largely a necessity (and often a requirement) of owning, renting, or leasing a home or vehicle. As the country builds more housing and consumers use their vehicles more, the demand for insurance will rise.

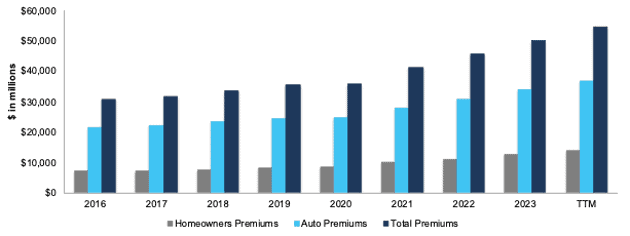

This company has successfully captured this market dynamic and consistently grown its premiums written. The company’s auto premiums written have increased 7% compounded annually since 2016 while home premiums have increased 9% compounded annually over the same time. Total premiums, which also include personal and commercial lines of business, have grown 8% compounded annually since 2016. See Figure 1.

Figure 1: Home, Auto, and Total Premiums Written: 2016 – TTM ended 3Q24

Source: New Constructs, LLC and company filings

As we noted in another recent Long Idea, consumers are also expected to purchase more vehicles long-term. S&P Global projects global light vehicle sales to rise from 94 million in 2025 to over 100 million in 2030, which provides additional tailwinds for the company to grow its auto business.

Profits Rebounding from Two Year Slump

The company’s profitability took a hit in 2022 and the first half of 2023, as rising inflation pushed auto repair costs, and in turn, losses on auto underwriting higher. In 2022, the company implemented underwriting restrictions to reduce new business until profitability reached “acceptable” levels while also cutting costs, such as marketing, across the business.

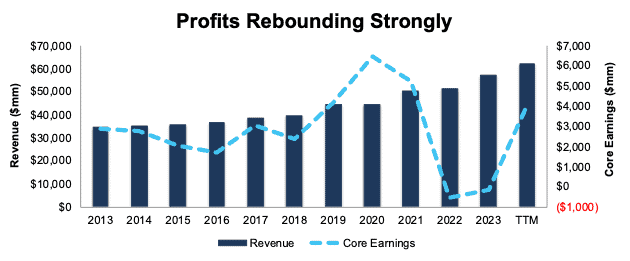

See the results of this strategy in Figure 2. The company has improved Core Earnings from -$528 million in 2022 to $4.1 billion in the TTM ended 3Q24. The company increased its net operating profit after-tax (NOPAT) margin from -1% in 2022 to 6.6% over the TTM, while return on invested capital (ROIC) improved from -2% to 17% over the same time.

Looking beyond the last few years, the company has grown revenue 6% compounded annually over the past 10 years and 3% compounded annually since 1998. The company has also grown Core Earnings 3% and 1% over the same times.

Figure 2: Revenue and Core Earnings: 2013 – TTM Ended 3Q24

Sources: New Constructs, LLC and company filings

….there’s much more in the full report. You can buy the report a la carte here.

Or, become a Professional or Institutional member – they get all Long Idea reports.