Crypto is running, the market is reaching record highs, and even Zombie Stocks are soaring once again. Buyer beware. Chasing momentum can be devastating to a portfolio when the music stops. If you don’t have a good handle on fundamentals and valuation, you might as well be driving at night without headlights.

This week we’re bringing a long-time Danger Zone pick back to your attention. It continues to burn cash, remains unprofitable, and has little to no competitive advantages. However, the stock is up 184% over the past 90 days.

Even with the surge in the past three months, this pick has been a great Danger Zone performer, as it has outperformed as a short by 172%.

However, hype and momentum have taken over the past 90 days. Unfortunately for those looking to buy the company on the back of this recent momentum, the company’s fundamentals have not seen a commensurate improvement, and now the expectations baked into the current stock price look entirely unrealistic. Unless the company can immediately achieve positive margins and grow revenue at double digit rates for multiple years, it is not worth its current valuation.

Just how bad could the damage be? The no-growth value of the business is -$13/share. Watch out below.

Below is a free excerpt from our latest Danger Zone report, published today to Pro and Institutional members. We hope you enjoy it. Feel free to share with friends and family, and we hope your portfolio stays safe from stocks like this one.

This stock could fall further based on the company’s:

- lack of subscription growth,

- massive cash burn,

- expenses that are consistently higher than revenue,

- poor Credit Rating, and

- an unrealistic valuation that implies a substantial improvement in margins while also growing revenue at double digit rates.

What’s Working

This company has beaten revenue and earnings estimates in each of the past four quarters, which helped bring momentum to the stock. The company also managed to cut down expenses through numerous layoffs in recent years.

What’s Not Working

However, despite beating consensus estimates, the company’s fundamentals remain poor. Sure, the company has improved from the depths of its post COVID inventory glut and profitability collapse, but it remains an unprofitable operation with a service that’s bleeding customers.

Growth Has Stopped

The large subscription growth the company managed to capitalize on during Covid years (2020 and 2021) has reversed course.

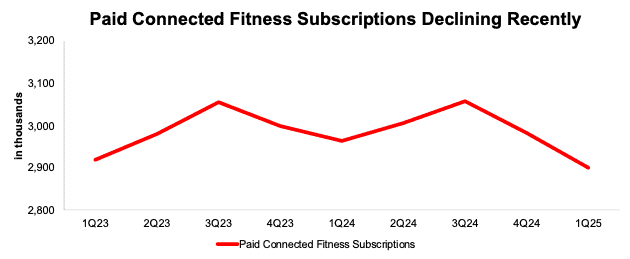

The company’s app subscriptions fell 6% quarter-over-quarter (QoQ) and 24% year-over-year (YoY) in fiscal 1Q25. Fitness subscriptions fell 3% QoQ and 2% YoY in fiscal 1Q25.

Going forward, the company’s guidance implies it will lose another 50,000 paid connected fitness subscriptions and 12,000 paid app subscriptions in fiscal 2Q25.

Figure 2: Paid Connected Fitness Subscriptions: Fiscal 1Q23 – 1Q25

Sources: New Constructs, LLC and company filings

Cash Burn Issue Hasn’t Been Resolved

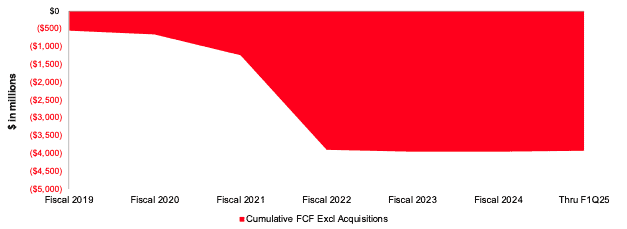

We analyzed the company’s alarming free cash flow (FCF) burn in our original Danger Zone report, and the company’s continued cash burn was one of the main reasons we named it a Zombie Stock. Since 2019, the company has burned $3.9 billion (75% of enterprise value) in FCF excluding acquisitions. See Figure 3.

As we mentioned in our most recent report on the company, the company technically doesn’t qualify as a Zombie Stock because its TTM FCF is positive. However, the positive FCF doesn’t mean the company improved its underlying business. Instead, positive FCF is byproduct of selling off assets, not improved operations, which is why it remains a Zombie Stock.

For example, the company’s TTM net operating profit after tax (NOPAT), at -$290 million, remains highly negative. Meanwhile, over the past year, the company’s invested capital has fallen by $454 million. The company’s $164 million in FCF over the TTM comes from selling assets, not generating profits.

The decline in TTM invested capital comes from a $181 million reduction in inventory and a $90 million reduction in plant, property, and equipment (PP&E) from the year ago period. Meanwhile, the company’s total cash and investments fell from $749 million in the TTM ended fiscal 1Q24 to $722 million in the TTM ended fiscal 1Q25.

Selling off assets isn’t a sustainable way to generate positive cash flow, which is why we still believe this stock could go to $0, even as its FCF is positive in the most recent period.

Figure 3: Cumulative Free Cash Flow Since 2019

Sources: New Constructs, LLC and company filings.

….there’s much more in the full report. You can buy the report a la carte here.

Or, become a Professional or Institutional member – they get all Danger Zone reports.

Interested in starting your membership to get access all our Danger Zone picks? Get more details here.