Did you know the Office Properties (OPI) cut its dividend by 96% this year? Leggett & Platt (LEG) cut its dividend by 89%. For dividend investors, huge cuts like these could be devastating to their portfolios and retirement planning.

What’s the best way to avoid this kind of disaster?

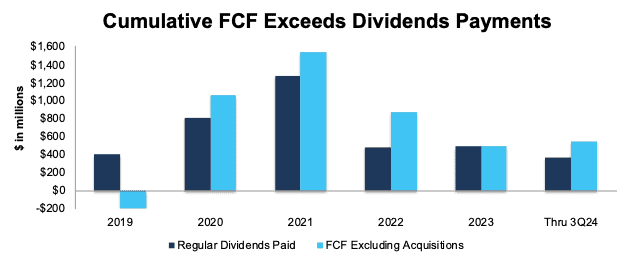

We think the answer is to understand the cash flows of the business and measure how well those cash flows can cover dividend payments. And, that’s what we do in this report and for this model portfolio. For example, see Figure 2 below. It directly compares the featured stock’s dividend payments to its free cash flow (FCF). These numbers tell a compelling story of how this company can afford to pay and even grow its dividend.

With the market running wild post-election, it’s more important than ever to find dividend stocks that aren’t at risk of getting crushed because they have to cut their dividend. Should the market take a breather, the stocks that flew the highest could fall the farthest.

As David shared in a recent training, dividends can be a key factor in improving shareholder return while not chasing the latest momentum or hype train. Our Dividend Growth Model Portfolio consists of stocks which have great potential for dividend growth in the future, and stock valuations that are in line with a business’s fundamentals, or even trading at a discount.

This free report features a stock from our Dividend Growth Model Portfolio and will give you a summary of how we pick stocks for this Model Portfolio. With this report, you can see our approach to picking stocks, as well as the rigor that goes into our research. We believe it is important that you’re able to see our reliable research on stocks on a regular basis, regardless of if you’re a subscriber or not. We’re proud to share our work.

Our write-up is below. We hope you enjoy it. We hope you find value.

We update this Model Portfolio monthly. October’s Dividend Growth Model Portfolio was updated and published for clients on October 30, 2024.

Recap from September’s Model Portfolio Picks

The best performing stock was up 15%. Overall, 11 out of the 25 Dividend Growth Stocks outperformed their benchmark (S&P 500) from September 27, 2024 through October 28, 2024.

This report leverages our cutting-edge Robo-Analyst technology to deliver proven-superior fundamental research and support more cost-effective fulfillment of the fiduciary duty of care.

This Model Portfolio mimics an “All Cap Blend” style with a focus on dividend growth. Selected stocks earn an Attractive or Very Attractive rating, generate positive free cash flow (FCF) and economic earnings, offer a current dividend yield >1%, and have a 5+ year track record of consecutive dividend growth. This Model Portfolio is designed for investors who favor long-term capital appreciation over current income, but still appreciate the power of growing dividends.

Featured Stock for October: Financials Company

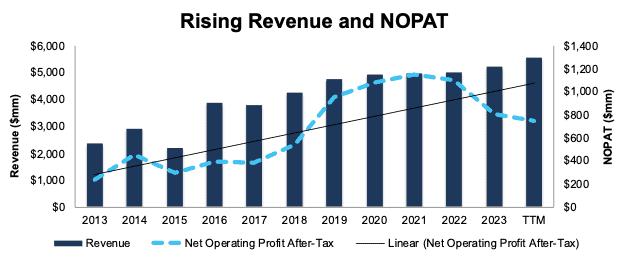

This company has grown revenue and net operating profit after tax (NOPAT) by 8% and 11% compounded annually, respectively, over the past decade. The company’s NOPAT margin increased from 10% in 2013 to 13% in the TTM, while invested capital turns fell from 1.0 to 0.9 over the same time. Rising NOPAT margins are enough to offset falling invested capital turns and drive return on invested capital (ROIC) from 10% in 2013 to 13% in the TTM.

Figure 1: Revenue & NOPAT Since 2013

Sources: New Constructs, LLC and company filings

Free Cash Flow Supports Regular Dividend Payments

This company has increased its regular, quarterly dividend from $0.25/share in 1Q19 to $1.04/share in 4Q24. The quarterly dividend, when annualized, equals $4.16/share and provides a 7.6% dividend yield.

More importantly, the company’s cumulative free cash flow (FCF) easily exceeds its dividend payments (including special dividends). From 2019 through 3Q24, the company generated $4.3 billion (65% of current enterprise value) in FCF while paying $3.8 billion in dividends. See Figure 2.

Figure 2: FCF vs. Dividends Since 2019

Sources: New Constructs, LLC and company filings

Companies with FCF well above dividend payments provide higher-quality dividend growth opportunities. On the other hand, dividends that exceed FCF cannot be trusted to grow or even be maintained.

This Stock Is Undervalued

At its current price of $55/share, this stock has a price-to-economic book value (PEBV) ratio of 0.9. This ratio means the market expects the company’s NOPAT to permanently fall 10% from TTM levels. This expectation seems overly pessimistic given that the company has grown NOPAT by 6% and 11% over the past five and ten years, respectively.

Even if the company’s NOPAT margin falls to 11.5% (below five-year average of 20% and TTM margin of 13%) and revenue grows just 5% compounded annually (compared to 8% compounded annually over the last decade) for the next decade, the stock would be worth $66/share today – a 22% upside. In this scenario, the company’s NOPAT would grow only 2% compounded annually through 2033.

Add in the company’s 7.6% dividend yield and a history of dividend growth, and it’s clear why this stock is in October’s Dividend Growth Stocks Model Portfolio.

Critical Details Found in Financial Filings by Our Robo-Analyst Technology

Below are specifics on the adjustments we make based on Robo-Analyst findings in this featured stock’s 10-K and 10-Q:

Income Statement: we made over $210 million in adjustments with a net effect of removing over $170 million in non-operating expense. Clients can see all adjustments made to the company’s income statement on the GAAP Reconciliation tab on the Ratings page on our website.

Balance Sheet: we made just under $3.3 billion in adjustments to calculate invested capital with a net decrease of just under $2.0 billion. The most notable adjustment was for total reserves. See all adjustments made to the company’s balance sheet on the GAAP Reconciliation tab on the Ratings page on our website.

Valuation: we made over $170 million in adjustments, with a net effect of decreasing shareholder value by over $160 million. The most notable adjustment to shareholder value was for deferred tax liabilities. See all adjustments to the company’s valuation on the GAAP Reconciliation tab on the Ratings page on our website.

….there’s much more in the full report. You can start your membership here to get access to this report and much more.