This holiday-shortened week started with U.S. stocks climbing as Trump announced Scott Bessent as his choice for Treasury secretary. The S&P 500 was up around 0.5%, and the DOW was up around 1% in the first half hour of trading today.

I know most everyone loves the market going up, but investors should be careful not to get caught up in the hype around certain stocks.

This week’s Danger Zone pick is a great example of how much damage a hyped-up stock can do to a portfolio. This long-time pick has, as a short call, outperformed the market by 200%, yet its stock is still overvalued. In fact, we think this stock could go to zero. More on that later.

The company’s fundamentals continue to deteriorate, yet the expectations baked into its current stock price imply that the company will reverse years of unprofitability while also doubling its global market share. It’s like the stock is pricing in the greatest business turnaround of all time. In reality, we do not think any kind of turnaround will happen given how competitive the industry is and how uncompetitive this company is.

Considering that the no-growth value, i.e. economic book value, of this stock is -$61/share, the possibility of equity investors losing everything is real.

Below is a free excerpt from our latest Danger Zone report, published today to Pro and Institutional members. We’re not sharing the name of the company because that’s for our paying clients. However, we think you’ll greatly enjoy the research because it provides insights into how hard we work to give you the best ideas and the smartest warnings.

We hope you enjoy it. Feel free to share with friends and family, and we hope your portfolio stays safe from stocks like this one.

This stock could fall further based on:

- declining revenue amid high expenses,

- competitive disadvantages in a competitive industry,

- declining demand for plant-based meat and foods, and

- the stock’s current valuation implies the company will improve profitability while more than doubling its global market share.

What’s Working for the Business

The are few positives for the company in 3Q24. The company reported gross profit of $14.3 million in 3Q24, which was up from -$7.3 million in 3Q23. The company attributed the gross profit improvement to decreased cost of goods sold per pound, which was achieved by lower inventory provision, lower logistics costs, and reduced materials costs.

Additionally, the company’s adjusted EBITDA (a flawed measure of profits) improved from -$58 million in 3Q23 to -$20 million in 3Q24.

What’s Not Working for the Business

Business Model Is Still Unprofitable

The company did meet Wall Street’s top- and bottom-line expectations, but those expectations don’t mean the company is on an upward trajectory.

The company’s revenue declined year-over-year in the first nine months of 2024 as well as the trailing-twelve-months (TTM) ended 3Q24.

The company hasn’t earned positive net operating profit after tax (NOPAT) on an annual basis since 2019 (its only year of profitability) or on a quarterly basis since 1Q20.

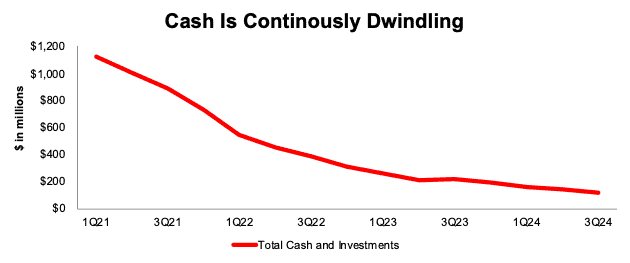

Almost Out of Cash

Dwindling cash balances have been an issue at the company for quite some time. Since 1Q21, the company’s total cash and investments has fallen from $1.1 billion to $122 million in 3Q24.

Figure 2: Cash on Hand: 1Q21 – 3Q24

Sources: New Constructs, LLC and company filings

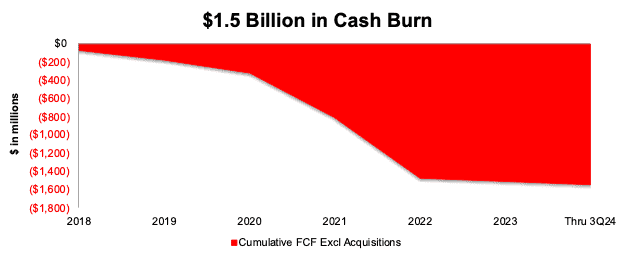

Cash Furnace is Burning the “Meat”

The company has never achieved positive free cash flow on an annual basis (going back to 2018), and only achieved a positive free cash flow on a quarterly basis three times in our model (going back to 2Q19). The company’s FCF sits at -$17 million in 3Q24 and at -$46 over the TTM.

From 2018 through 3Q24, the company burned through a cumulative $1.5 billion (97% of enterprise value) in FCF.

Figure 3: Cumulative Free Cash Flow: 2018 through First Nine Months of 2024

Sources: New Constructs, LLC and company filings

….there’s much more in the full report. You can buy the report a la carte here.

Or, become a Professional or Institutional member – they get all Danger Zone reports.

Interested in starting your membership to get access all our Danger Zone picks? Get more details here.