We closed this position on May 17, 2022. A copy of the associated Position Update report is here.

Danger Zone: ICON Health Care Fund (ICHAX)

Check out this week’s Danger Zone interview below with Chuck Jaffe of Money Life and MarketWatch.com.

ICON Health Care Fund (ICHAX) is in the Danger Zone this week due to its high costs. While this fund has a good number of quality holdings, its high costs land it on our list of the five worst mutual funds in the Health Care sector. This makes it the second most expensive fund out of over 100 health care mutual funds.

We’ll show how investors can be better served by paying less for very similar (or better) holdings in other funds.

Some Good Holdings…

We like to rate our ETFs and mutual funds based primarily on the quality of their holdings. All too often, we find that funds with poor holdings are highly rated based on less important factors, like good past performance or star fund managers. We put Berkshire Focus Fund (BFOCX) in the Danger Zone in December for this very reason.

ICHAX does not have this problem. In fact, 28% of this fund’s holdings receive our Attractive or Very Attractive ratings, and only 22% of ICHAX’s holdings receive our Dangerous or Very Dangerous ratings.

Some of ICHAX’s top holdings are actually some of our favorite stocks. We’ve recently written favorably on Gilead Sciences (GILD), Johnson & Johnson (JNJ), and AbbVie (ABBV) currently earns our Attractive rating. ICHAX allocates 5% or more to each of these stocks. However, there’s not much else to like among ICHAX’s top 10 holdings, the rest of which earn Neutral or worse ratings. Admittedly, there are slim pickings in the Health Care sector, which ranked eighth out of the ten sectors in our latest sector analysis reports.

But at What Cost?

The primary reason that ICHAX landed in the Danger Zone this week is its unacceptably high costs. While ICHAX advertises an expense ratio of 1.62%, our total annual costs calculation (TAC) shows total annual costs of 4.45%. This makes ICHAX the second most expensive fund in the entire Health Care sector, and in the top 100 of the 6,000 ETFs and mutual funds we cover. We calculate TAC, which is the all-in-costs of being in a given fund for three years, for each ETF and mutual fund under our coverage.

For comparison, the Health Care sector SPDR (XLV) has total annual costs of just 0.2%. But despite this significant discrepancy in costs between ICHAX and XLV, the overlap between the two funds’ holdings is significant. Among ICHAX’s top 25 holdings, 12 are also in the top 25 holdings of XLV, which makes 48% of ICHAX’s equity holdings overlap with the top holdings of XLV. There are only eight stocks found in the top 25 holdings of ICHAX that are not found at all in XLV.

Over 30% of XLV’s holdings receive our Attractive or Very Attractive ratings, while just 26% of ICHAX’s holdings receive our Attractive or better ratings. Investors really are paying more for lower-quality holdings in ICHAX.

How Does the Performance Stack Up?

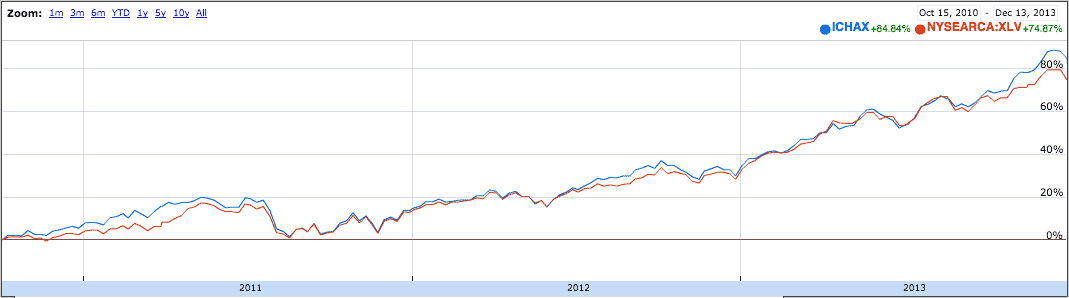

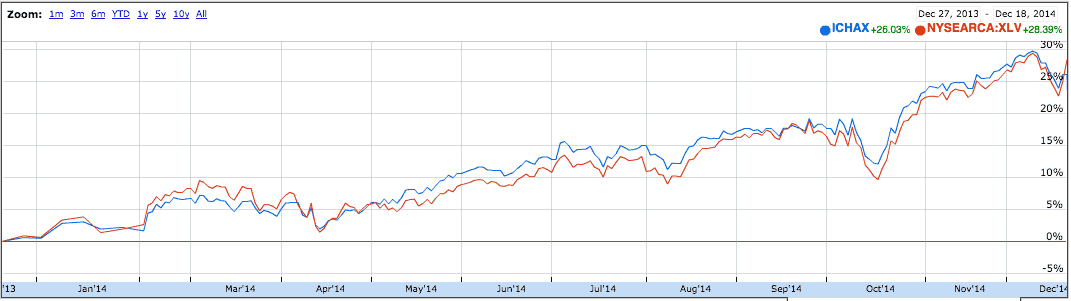

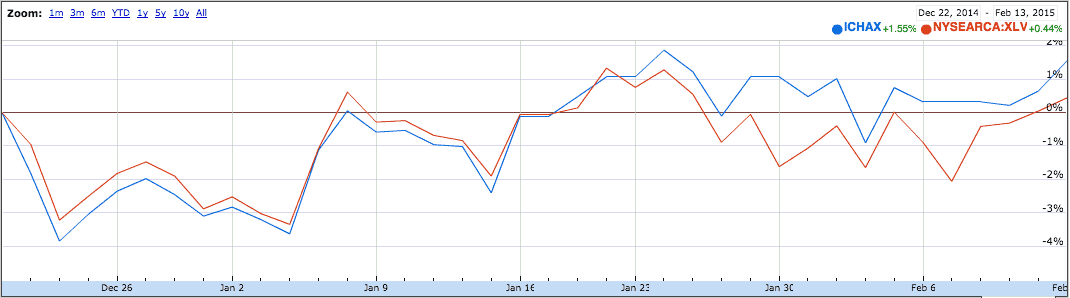

This similarity in holdings is reflected in the funds’ performance over time. Figure 1 below shows the cumulative returns of ICHAX (blue) and XLV (red) over three consecutive periods of time (due to the distortions of two separate capital distributions of ICHAX).

Figure 1: Performance Doesn’t Justify Higher Costs

Source: Google Finance

These returns detailed above neglect the expense ratio and load costs, so the graphs are significantly overstating the returns experienced by investors in ICHAX.

How Much Can High Fees Cost You?

Before its capital redemption, ICHAX had a 25% return in 2014, just below XLV’s 27% over the same timeframe. Not bad.

But when considering ICHAX’s total annual costs, the real return was closer to 21%, while XLV’s low TAC of 0.2% barely lowered its real return at all. The difference between ICHAX and XLV’s total annual costs is 4.25 percentage points, which compounds to a 13% difference over three years and 52% over 10 years.

This example illustrates that hidden costs in an ETF or mutual fund can have a substantial impact on your returns. You should be aware of all of the costs beyond the expense ratio — front end load, back end load, redemption — before investing in any given fund. If the costs are high, there is likely a fund out there that provides similar performance but lets you keep more of your returns.

Disclosure: David Trainer and André Rouillard receive no compensation to write about any specific stock, sector, or theme.

Click here to download a PDF of this report.

Photo credit: Simon Cunningham