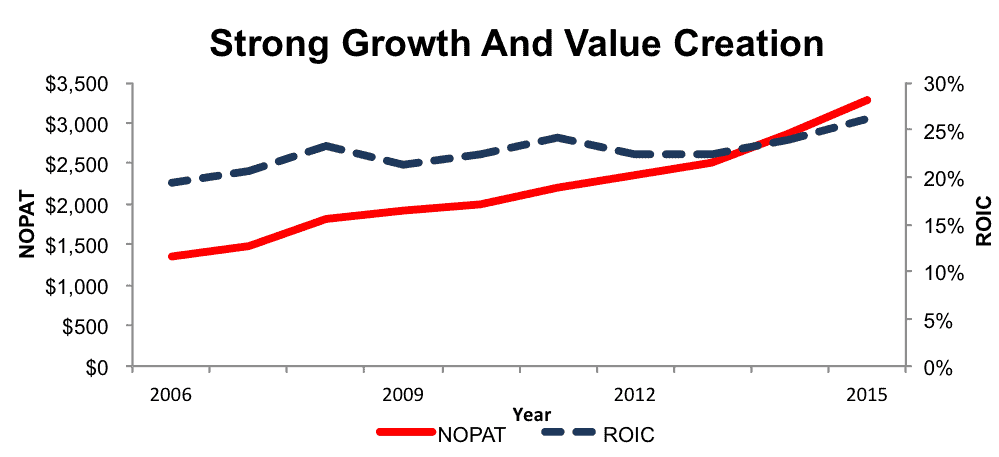

Last month, Fortune released its list of the top 50 businesspeople of the year, according to their measures of profitability, growth, shareholder return, and subjective measures of leadership and strategic initiatives. Nike (NKE) CEO Mark Parker headlined the list, a choice we applaud given his impressive track record of value creation. As shown in Figure 2, since his promotion to CEO in 2006, Parker has nearly tripled after-tax profit (NOPAT) while improving return on invested capital (ROIC) from 19% to 26%.

Figure 1: Nike Profitability Under Parker

Sources: New Constructs, LLC and company filings.

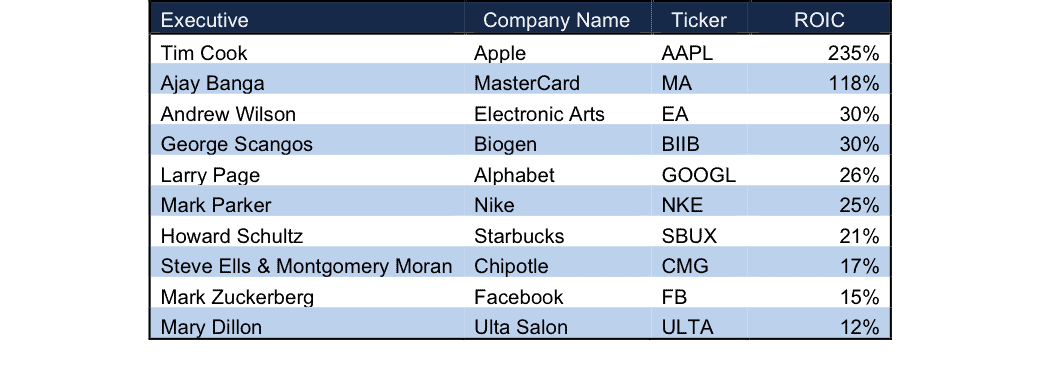

In fact, a closer look at the list revealed a remarkable pattern. The top 10 CEOs from companies in our database all earn double-digit ROICs. Whether it’s apparel, biotech, restaurants, or online services, these companies aren’t just growing, they’re also creating real value for investors.

Figure 2: Only High ROIC Companies Make The List

Sources: New Constructs, LLC and company filings.

In fact, you have to go all the way down to Matthew Missad at #45 to find a CEO of an American company with an ROIC below 10%. And even then, Missad’s Universal Forest Products (UFPI) has a 9% ROIC that has been steadily increasing for several years in an industry with significant headwinds.

The recognition these CEO’s are receiving shows that the market cares about ROIC, even if many investors aren’t explicitly talking about it. We’ve shown that ROIC is the primary driver of valuation. This idea is hardly new. Michael Maboussin of Credit Suisse wrote extensively on the subject in the 1990’s.

What’s changed today is that we now have the tools and technology to create accurate models of ROIC for thousands of companies. Calculating ROIC is difficult and requires numerous adjustments to reverse accounting loopholes.

In the past, individuals had no way to create good ROIC-based models for a large number of companies. Today, with the technology to help our analysts quickly parse filings, we can reverse accounting distortions and don’t have to rely on less reliable metrics or models.

Disclosure: David Trainer and Sam McBride receive no compensation to write about any specific stock, sector, style, or theme.

Click here to download a PDF of this report.

Photo Credit: Jason Devaun (Flickr)