Recap from December Picks

Our Most Attractive Stocks (-5.4%) underperformed the S&P 500 (-3.8%) last month. Most Attractive Large Cap stock Tanger Factory Outlet Stores (SKT) gained 1% and Most Attractive Small Cap stock Highway Holdings (HIHO) was up 4%. Overall, 15 out of the 40 Most Attractive stocks outperformed the S&P 500 in December.

Our Most Dangerous Stocks (-5.7%) outperformed the S&P 500 (-3.8%) last month. Most Dangerous Large Cap stock Brookfield Asset Management (BAM) fell by 12% and Most Dangerous Small Cap Stock ENGlobal Corporation (ENG) fell by 16%. Overall, 27 out of the 40 Most Dangerous stocks outperformed the S&P 500 in December

The successes of the Most Attractive and Most Dangerous stocks highlight the value of our forensic accounting. Being a true value investor is an increasingly difficult, if not impossible, task considering the amount of data contained in the ever-longer annual reports. By analyzing key details in these SEC filings, our research protects investors’ portfolios and allows our clients to execute value-investing strategies with more confidence and integrity.

15 new stocks make our Most Attractive list this month and 18 new stocks fall onto the Most Dangerous list this month. January’s Most Attractive and Most Dangerous stocks were made available to members on January 6, 2016.

Our Most Attractive stocks have high and rising return on invested capital (ROIC) and low price to economic book value ratios. Most Dangerous stocks have misleading earnings and long growth appreciation periods implied by their market valuations.

Most Attractive Stock Feature for January: Hyatt Hotels (H: $39/share)

Hyatt Hotels (H), worldwide hotel and resort operator, is one of the additions to our Most Attractive stocks for January.

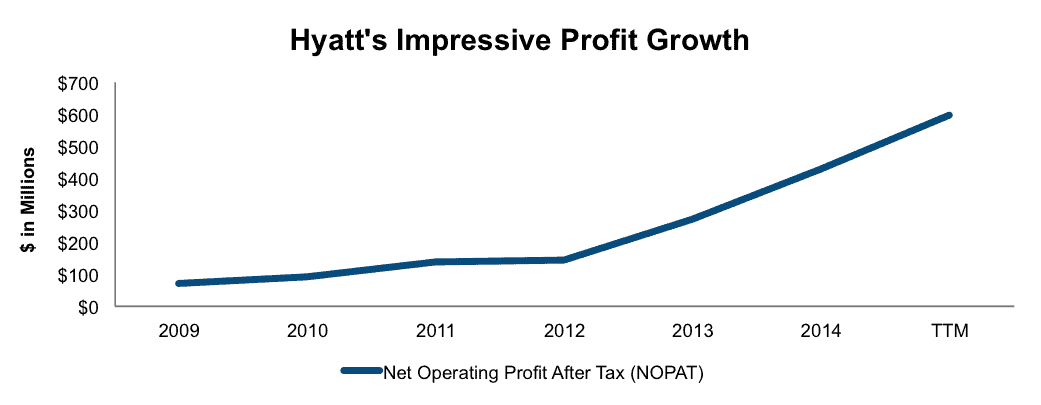

Hyatt Hotels has built a highly profitable hospitality business. Since 2009, Hyatt has grown after-tax profit (NOPAT) by an impressive 43% compounded annually. This growth can be seen in Figure 1.

Figure 1: Consistent Profit Growth At Hyatt

Sources: New Constructs, LLC and company filings

In addition to growing profits, Hyatt has steadily improved its return on invested capital (ROIC) to 8%, up from 1% in 2009. NOPAT margins have also increased from 2% in 2009 to 14% over the last twelve months.

Impact of Footnotes Adjustments and Forensic Accounting

In order to derive the true recurring cash flows, an accurate invested capital, and a real shareholder value, we made the following adjustments to Hyatt’s 2014 10-K:

Income Statement: we made $175 million of adjustments with a net effect of removing $84 million (2% of revenue) in non-operating income. We removed $129 million in non-operating expenses, including $17 million in asset impairments, and $46 million in non-operating income.

Balance Sheet: we made $1.9 billion of adjustments to calculate invested capital with a net decrease of $39 million. One notable adjustment was the inclusion of $441 million due to operating leases. This adjustment represented 6% of reported net assets.

Valuation: we made $2.6 billion of adjustments with a net effect of decreasing shareholder value by $1.1 billion. The largest adjustment was the removal of $1.5 billion due to the fair value of total debt, which includes the operating leases from above. This adjustment represents 29% of Hyatt’s market cap.

Hyatt Remains Undervalued

Despite the strength of Hyatt’s business operations (as shown above), H is down 21% in 2016 alone. This price decline has left H significantly undervalued. At its current price of $39/share, H has a price to economic book value (PEBV) ratio of 0.8. This ratio means that the market expects Hyatt’s NOPAT to permanently decline by 20%. This expectation seems rather pessimistic given Hyatt’s ability to grow NOPAT by over 40% compounded annually over the past six years. If Hyatt can grow NOPAT by just 7% compounded annually for the next decade, shares are worth $$58/share today – a 49% upside.

Most Dangerous Stock Feature: Whitewave Foods Company (WWAV: $37/share)

Whitewave Foods Company (WWAV), a consumer food and beverage company, is one of the additions to our Most Dangerous stocks for January.

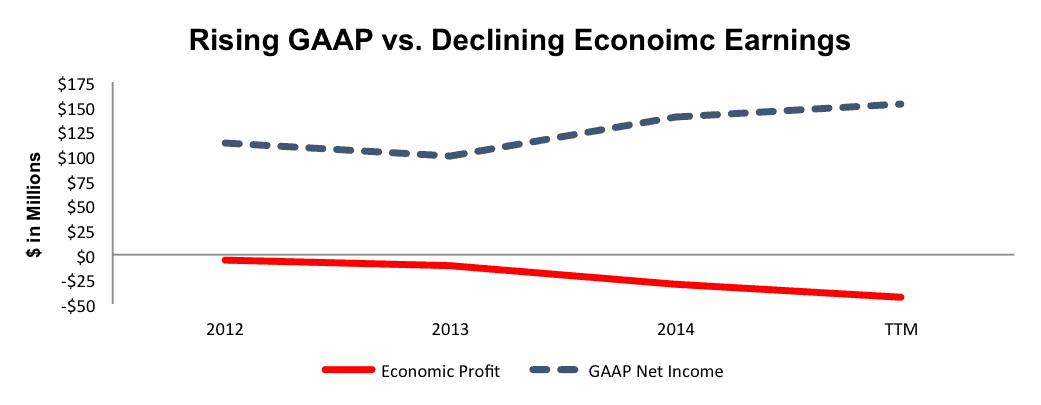

Much like we saw when we placed Whitewave competitor Snyder’s Lance in the Danger Zone, Whitewave’s history of acquisitions have succeeded only in growing GAAP EPS while destroying shareholder value. Whitewave’s GAAP net income has increased from $113 million in 2012 to $153 million on a TTM basis while economic earnings have declined from -$5 million to -$43 million over the same time period. See Figure 2 for more details. These acquisitions that exist to boost EPS while ignoring the economics of the deal are an example of what we like to call the high-low fallacy.

Figure 2: Whitewave’s Acquisition Growth Had Destroyed Shareholder Value

Sources: New Constructs, LLC and company filings

While WWAV has been reporting growing EPS, the company’s debt has grown from $832 million in 2012 to $2.3 billion on a TTM basis. Furthermore, the company’s ROIC has fallen from 7% to 6% over the same time frame.

Forensic Accounting Reveals Overstated EPS

In order to derive the true recurring cash flows, an accurate invested capital, and a real shareholder value, we made the following adjustments to Whitewave’s 2014 10-K:

Income Statement: we made $76 million of adjustments with a net effect of removing $42 million in non-operating expenses (1% of revenue). We removed $59 million related to non-operating expenses, including $1 million in asset disposal costs, and $17 million related to non-operating income.

Balance Sheet: we made $490 million of adjustments to calculate invested capital with a net decrease of $120 million. The most notable adjustment was $167 million (6% of net assets) related to midyear acquisitions. Without adjusting we would be measuring NOPAT for the portion of time the assets were under control against total assets, thereby skewing our ROIC calculation.

Valuation: we made $2.7 billion of adjustments that decrease shareholder value. There were no adjustments that increased shareholder value. The largest adjustment was the removal of $2.3 billion in total debt, which includes $83 million in off balance sheet operating leases. This adjustment represents 36% of Whitewave’s market cap.

WWAV Valuation Is Too High

Playing the Wall Street favorite roll up role, WWAV is up over 100% since going public in late 2012, which is over three times the return of the S&P 500. This large price increase has left shares greatly overvalued. To justify its current price of $37/share, Whitewave must grow NOPAT by 15% compounded annually for the next 14 years. In this scenario, Whitewave would be generating $24 billion in revenue in 14 years, which is greater than Starbuck’s (SBUX) 2015 revenue.

If we take a more conservative approach, and give Whitewave credit for 8% compounded annual NOPAT growth for the next decade, the stock is worth $8/share today – a 78% downside.

Not already a member? Click here to receive February’s Most Attractive Stocks list, scheduled to be published on Wednesday, February 3, 2016.

Disclosure: David Trainer and Kyle Guske II receive no compensation to write about any specific stock, style, or theme.