The Health Care sector ranks third out of the ten major sectors as detailed in our sector roadmap. It gets my Neutral rating, which, like my fund ratings, is based on aggregation of stock ratings for each of the companies in the sector. The profitability and valuation of this sector, however, are not quite as good as the Technology and Consumer Staples sectors, which get my Attractive rating as per previous articles. The full series of my reports on the Best & Worst Sector and Style Funds is here.

Nevertheless, Health Care is one of the most defensive sectors. Everyone needs health care at some point in life, and demand for health care is not closely linked to economic conditions. If anything, a poor economy is likely to make people feel sick.

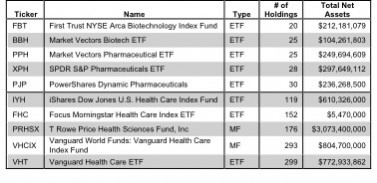

There are 108 funds to chose from within the Health Care sector, and they are all very different. Per Figure 1, the number of holding varies widely (from 20 to 299), which creates drastically different investment implications and ratings. Here is the full list of 108 funds.

How do investors pick the right fund out of the sea of choices that will deliver the best returns?

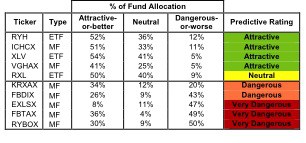

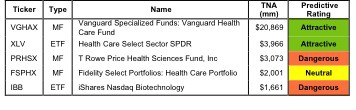

To identify the best funds within a given category, investors need a predictive rating based on analysis of the underlying quality of stocks in each fund. See Figure 2.

Our predictive fund ratings are based on aggregating our stock ratings on each of the fund’s holdings and all of the fund’s expenses. Investors deserve forward-looking fund research that is comparable in quality to stock research.

Investors should not rely on backward-looking research of past performance for investment decisions.

Figure 2 shows the five best and worst-rated funds for the sector. The best funds allocate more value to Attractive-or-better-rated stocks than the worst funds and vice versa. In addition, my ratings account for the total annual cost of investing in a fund or ETF. My ratings (updated daily) on all funds are here.

One of my favorite stocks in the Health Care sector is Johnson& Johnson [s: JNJ], which gets my Very Attractive rating. I also like the fund that makes the largest allocation to JNJ, Heath Care Select Sector SPDR (XLV). JNJ is one of those stocks even a mother can love. It is reliable, profitable and cheap. I an environment where so many investors are looking for the quick an easy route to riches, JNJ may be overlooked. Value investors should stock up.

One of my least favorite Health Care stocks is BioMarin Pharmaceuticals [s: BMRN], which gets my Very Dangerous rating. I also recommend investors steer away from the fund that allocates the most value to BMRN, Market Vectors Biotech ETF (BBH). BMRN is bad investment because the company is not as profitable as it appears and the stock is expensive. Over the last ten years, management has written of over 12 cents for every dollar of equity capital on the balance sheet. Not exactly inspiring performance. The stock’s current valuation seems to ignore that issue. At nearly $36/share, the stock implies the company will grow profits at 20% compounded annual for over 40 years. For investors to make money buying the stock at current levels, expectations for future cash flows will have to rise above the current nosebleed level. Not a good bet.

Figure 2: Funds with the Best & Worst Ratings – Top 5

* Analysis uses the top-ranked or worst-ranked class for each fund

Sources: New Constructs, LLC and company filings

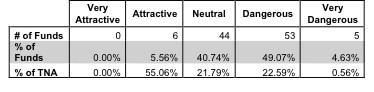

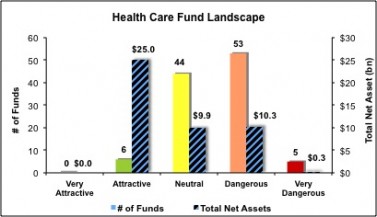

Investors need to tread carefully when considering Health Care funds as most are not worth buying. Only 6 of the 108 funds for the sector allocate enough value to Attractive-or-better-rated stocks to earn an Attractive overall rating. In addition to the four above, ICHEX and VGHCX also get an Attractive rating. We do not show them because they are another class of a more highly-ranked fund. Figure 3 shows the rating landscape of all ETFs and mutual funds in the Health Care sector.

Our Sector Roadmap report ranks all sectors and highlights those that offer the best investments.

Figure 3: Separating the Best Funds From the Worst

Figure 4 offers additional details on the quality of funds in the sector. Of particular note, the 6 Attractive-rated funds in this sector hold over 55% of the assets allocated to the sector.

Figure 4: Health Care Fund Landscape Details

Figure 5 lists our Predictive Fund Rating for the 5 largest and most popular Health Care funds.

Figure 5: Five Largest Health Care Funds

* Analysis uses the top-ranked class for each fund

Sources: New Constructs, LLC and company filings

The full list of Health Care funds and our ratings on each fund is here can be found here.

Disclosure: I receive no compensation to write about any specific stock, sector or theme.