Recap from November Picks

Our Most Attractive Stocks (+11.4%) outperformed the S&P 500 (+5.3%) last month. Most Attractive Large Cap stock LaSalle Hotel Properties (LHO) gained 21% and Most Attractive Small Cap stock Sierra Bancorp (BSRR) was up 31%. Overall, 33 out of the 40 Most Attractive stocks outperformed the S&P 500 in November.

Most Dangerous Large Cap stock Netflix (NFLX) fell by 4% and Most Dangerous Small Cap Stock Amedisys Inc. (AMED) fell by 10%. Overall, nine out of the 40 Most Dangerous stocks outperformed the S&P 500 in November.

The successes of the Most Attractive and Most Dangerous stocks highlight the value of our forensic accounting as featured in Barron’s. Our research helps clients fulfill fiduciary duties when making investment recommendations.

22 new stocks make our Most Attractive list this month and 20 new stocks fall onto the Most Dangerous list this month. December’s Most Attractive and Most Dangerous stocks were made available to members on 12/1/2016.

Our Most Attractive stocks have high and rising returns on invested capital (ROIC) and low price to economic book value ratios. Most Dangerous stocks have misleading earnings and long growth appreciation periods implied by their market valuations.

Most Attractive Stocks Feature for December: Gentex Corporation (GNTX: $19/share)

Gentex Corporation (GNTX), automobile parts supplier, is one of the additions to our Most Attractive stocks for December. We first featured Gentex in December 2015 when it first made our Most Attractive stocks list and despite the stock price rising 19% since the publish date, GNTX remains undervalued.

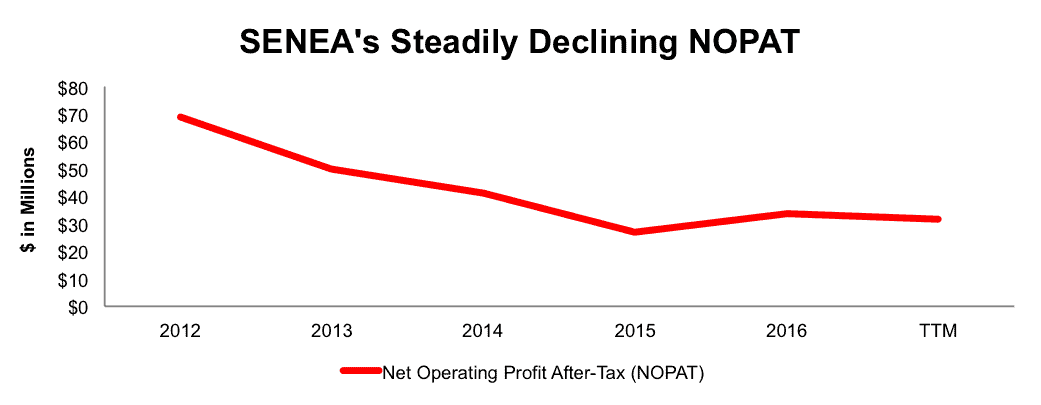

Gentex has built a highly profitable business supplying automatic-dimming rearview mirrors and electronics to the automotive and aviation markets. Since 2009, Gentex has grown after-tax profit (NOPAT) by an impressive 31% compounded annually, to $318 million in 2015 and $353 million over the last twelve months, per Figure 1.

Figure 1: NOPAT Growth Since 2009

Apart from profit growth, Gentex currently earns a top-quintile return on invested capital (ROIC) of 25% and has grown its NOPAT margin from 12% in 2009 to 21% TTM. Over the past five years, Gentex has generated cumulative $80 million in free cash flow, and currently pays a dividend that yields 1.9%.

Impacts of Footnotes Adjustments and Forensic Accounting

In order to derive the true recurring cash flows, an accurate invested capital, and an accurate shareholder value, we made the following adjustments to Gentex’s 2015 10-K:

Income Statement: we made $9 million of adjustments, with a net effect of removing $1 million in non-operating income (<1% of revenue). We removed $5 million in non-operating income and $4 million in non-operating expenses. You can see all the adjustments made to GNTX’s income statement here.

Balance Sheet: we made $756 million of adjustments to calculate invested capital with a net decrease of $594 million. The largest adjustment was $620 million due to excess cash. This adjustment represented 31% of reported net assets. You can see all the adjustments made to GNTX’s balance sheet here.

Valuation: we made $1 billion of adjustments with a net effect of increasing shareholder value by $389 million. Apart from the excess cash noted above, one of the notable adjustments was the removal of $76 million due to outstanding employee stock options. This adjustment represents 1% of Gentex’s market cap.

Gentex Shares Remain Undervalued

The market has rewarded Gentex for its consistent profit growth and the stock is up 18% year-to-date. In spite of this price increase, shares remain undervalued. At its current price of $19/share, GNTX has a price-to-economic book value (PEBV) ratio of 1.1. This ratio means the market expects Gentex’s NOPAT to grow by only 10% over the remainder of its corporate life. This expectation seems awfully pessimistic for a firm that has grown NOPAT by 30% a year for the past seven years.

If Gentex can grow NOPAT by 8% compounded annually for the next decade, the stock is worth $23/share today – a 21% upside. Add in the 1.9% dividend yield and its clear why GNTX was added to this month’s Most Attractive Stocks Model Portfolio.

Most Dangerous Stocks Feature: Seneca Foods (SENEA: $38/share)

Seneca Foods (SENEA), engaged in the packaging of fruit and vegetables, is one of the additions to our Most Dangerous stocks for December.

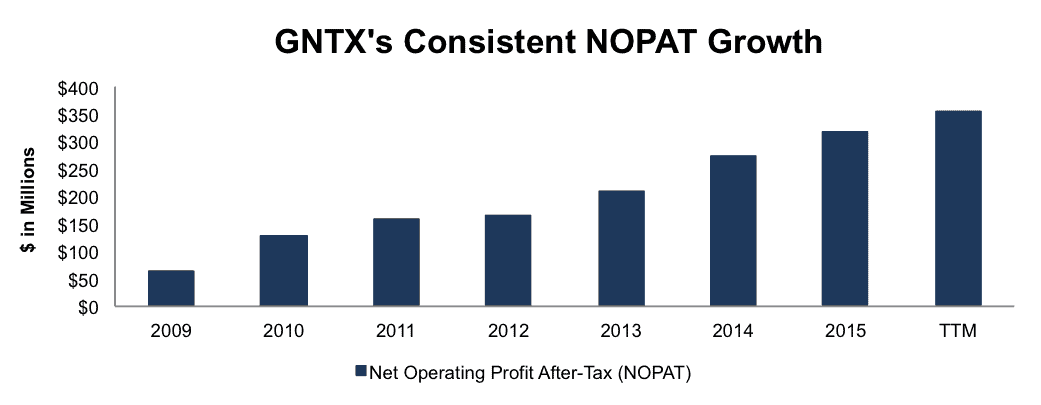

Seneca Foods’ NOPAT has declined from $69 million in 2012 to 32 million TTM, or -16% compounded annually, per Figure 2

Figure 2: Profit Headed The Wrong Way

Sources: New Constructs, LLC and company filings

Unfortunately for investors in SENEA, the problems don’t end with declining NOPAT. The company’s ROIC has fallen from 12% in 2009 to a bottom-quintile 3% TTM while its NOPAT margin has fallen from 7% to 2% over the same time.

Impacts of Footnotes Adjustments and Forensic Accounting

In order to derive the true recurring cash flows, an accurate invested capital, and an accurate shareholder value, we made the following adjustments to Seneca Foods’ 2016 10-K:

Income Statement: we made $103 million of adjustments, with a net effect of removing $19 million in non-operating income (1% of revenue). We removed $61 million in non-operating income and $42 million in non-operating expenses. You can see all the adjustments made to SENEA’s income statement here.

Balance Sheet: we made $679 million of adjustments to calculate invested capital with a net increase of $571 million. One of the largest adjustments was $167 million due to operating leases. This adjustment represented 34% of reported net assets. You can see all the adjustments made to SENEA’s balance sheet here.

Valuation: we made $595 million of adjustments with a net effect of decreasing shareholder value by $585 million. Apart from total debt, which includes $167 million in off-balance-sheet operating leases, the largest adjustment was $38 million in underfunded pensions. This adjustment represents 10% of Seneca Foods’ market cap.

Fundamental Weaknesses Leave SENEA Overvalued

Despite clear deterioration in the fundamentals of the business, SENEA is up 37% year-to-date, which makes shares significantly overvalued. In order to justify its current price of $38/share, SENEA must grow NOPAT by 5% compounded annually for the next 12 years. This expectation may seem reasonable for a highly profitable company, but SENEA’s NOPAT has declined by 16% per year over the last five years.

Even if SENEA can grow NOPAT by 4% compounded annually for the next decade, the stock is only worth $22/share today – a 42% downside. This scenario assumes SENEA is also able to grow revenue by 5% each year, well above the 1% average over the last five years. Each of these scenarios also assumes SENEA is able to grow NOPAT/free cash flow without spending on working capital or fixed assets. This assumption is unlikely but allows us to create very optimistic scenarios that demonstrate how high expectations in the current valuation are. For reference, SENEA’s invested capital has grown on average $54 million (4% of 2016 revenue) per year over the past decade.

This article originally published here on December 7, 2016.

Disclosure: David Trainer, Kyle Guske II, and Kyle Martone receive no compensation to write about any specific stock, style, or theme.

Scottrade clients get a Free Gold Membership ($588/yr value) as well as 50% discounts and up to 20 free trades ($140 value) for signing up to Platinum, Pro or Unlimited memberships. Login or open your Scottrade account & find us under Quotes & Research/Investor Tools.

Click here to download a PDF of this report.

Photo Credit: Lendingmemo.com (Flickr)