The market often overlooks hidden gems within beaten-down industries. In the case of automotive parts providers, investors have largely ignored firms that are highly profitable, and more impressively, remained profitable throughout the 2008/2009 recession. With a track record of profit growth, an underpenetrated market, and an undervalued stock price, this week’s Long Idea is also an addition to December’s Most Attractive Stocks Model Portfolio.

Gentex’s Steadily Increasing Profits

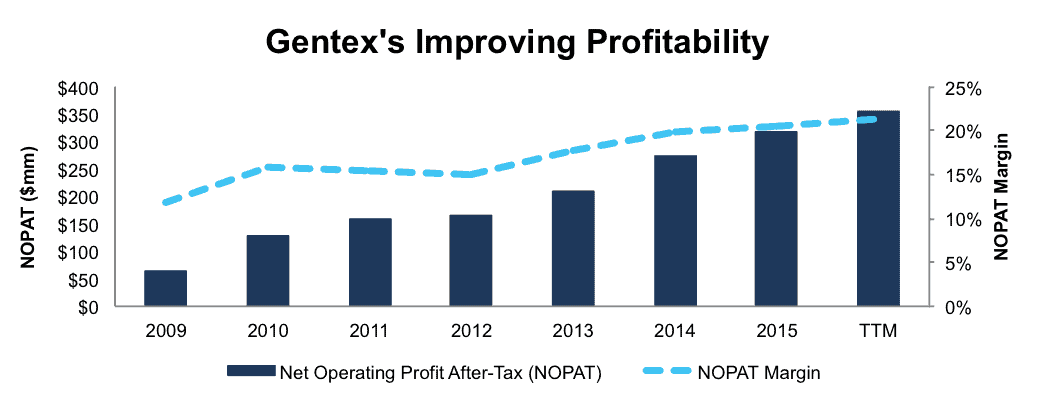

Since 2009, Gentex’s after tax profit (NOPAT) has grown by an impressive 31% compounded annually, to $318 million in 2015 and $353 million over the last twelve months (TTM). Gentex’s NOPAT margin has improved from 12% in 2009 to 21% TTM, per Figure 1.

Figure 1: Gentex’s Profitability Since 2009

Sources: New Constructs, LLC and company filings

In addition to profits, Gentex has grown revenue by 19% compounded annually since 2009 and generated cumulative $80 million in free cash flow (FCF) over the past five years. Throughout the company’s history it has earned a double-digit return on invested capital (ROIC) and currently earns a top-quintile 25% ROIC. Gentex’s fundamentals impress across all metrics.

Improving ROIC Correlated With Creating Shareholder Value

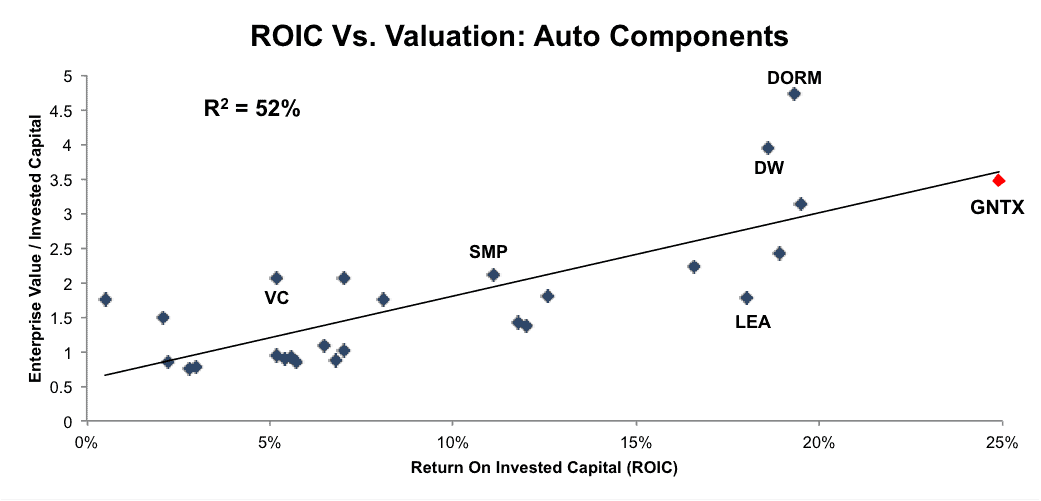

Gentex’s 25% and top-quintile ROIC is more than double the 10% average of the 30 Auto Component firms under coverage. Companies with a top-quintile ROIC tend to have wider moats and, on average, premium valuations. However, GNTX has not been awarded a premium valuation. Figure 2 shows that ROIC explains 52% of the changes in stock valuation for the 30 Auto Component firms and that GNTX falls just below the trend line, which means the company is undervalued relative to peers.

Figure 2: ROIC Explains 52% Of Valuation for Auto Components Firms

Sources: New Constructs, LLC and company filings

High Profitability Gives Gentex A Competitive Advantage

Gentex’s product lineup largely consists of interior and exterior auto-dimming mirrors and corresponding electronics. The company also develops auto-dimming aircraft windows and certain fire protection devices such as smoke detectors and alarms. With 98% of 2015 revenue coming from its automotive products, it’s clear that Gentex’s main competition stems from within this industry and includes Magna International, YH America, BYD Auto Company, Tokai Rika Company, and Beijing Sincode. Many of these are foreign or private firms, but Gentex’s dominant auto-dimming mirror market share (91% in 2015) is a testament to its strength when it comes to pricing power and operational abilities. Furthermore, some of the competitors listed purchase assemblies and parts from Gentex, which only helps to further expand its operational moat.

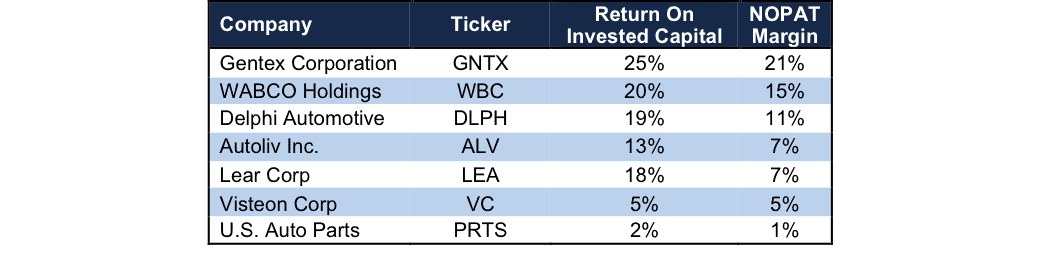

To get a sense of Gentex’s profitability, we can compare the firm to similar auto component providers, some of which compete on the fringes of the auto-dimming mirror market through parts or electronic systems. As can be seen in Figure 3, Gentex’s NOPAT margin and ROIC are higher than each of its peers, which include WABCO Holdings (WBC), Delphi Automotive (DLPH), Autoliv (ALV), Lear Corp (LEA) and Visteon Corp (VC), among others. With high margins, Gentex has significant pricing power to ride out economic downturns, better withstand competition, and continually invest in the future of the business, such as video camera systems or other future innovations.

Figure 3: Gentex’s Leading Profitability

Sources: New Constructs, LLC and company filings.

Bear Concerns Assume 2008 Happens Again

It’s no secret that car manufacturers have had a tremendous 2016. Ford (F) achieved record first half results, General Motors (GM) achieved record sales in China in 2Q16, and more recently, Toyota (TM) and Ford announced November sales that beat estimates while achieving year-over-year growth. With record sales, bears are now calling for “the top” of the automotive industry and proclaiming that upside in automobile manufacturers and parts makers alike have been priced in. Such a point of view not only ignores common industry forecasts, but also values GNTX at levels not seen since 2008.

According to industry leaders IHS, Kelley Blue Book, and the National Automobile Dealers Association, the outlook for auto sales is better than many think:

- IHS expects U.S. car sales to peak in 2017, before leveling off through 2020

- National Automobile Dealers Association expects sales to peak in 2016, fall in 2017, and rebound by 2020

- Kelley Blue Book forecasts slight growth in 2017 U.S. Auto Sales.

The important item to note is that no one is expecting sales to crater as they did in 2008 during the last economic crisis. In 2008, sales fell to 13.2 million, a far cry from the 17-18 million many expect in 2016 alone. In order to buy into the fear of an automotive crash, as bears would have you believe, one must expect car sales to fall to levels last seen in 2008/2009, when sales fell 18% and 21% YoY respectively.

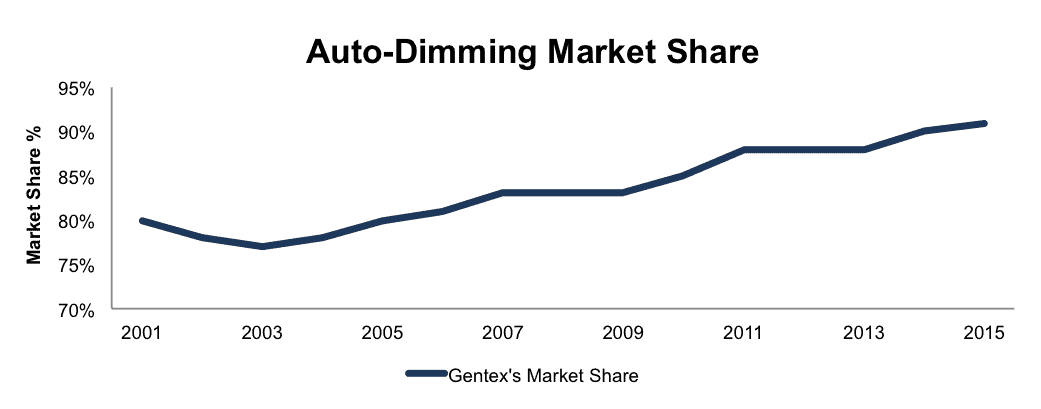

Herein lies the good news for GNTX investors. Despite sales cratering in 2008 and multiple bankruptcies across the industry, Gentex not only remained profitable in 2008/2009, but NOPAT soared 101% year-over-year in 2010. Better yet, Gentex has grown its market share of the global auto-dimming mirror market significantly since 2008, which helps diversify its business across the globe. As can be seen in Figure 4, Gentex’s market share has grown from 83% in 2008 to 91% in 2009.

Figure 4: Gentex’s Growing Market Share

Sources: New Constructs, LLC and company filings.

The growth in global market share also insulates Gentex from country specific headwinds. Were U.S. sales to drastically decline, the company generates 68% of 2015 sales from outside the U.S. Furthermore, IHS auto forecasts project 2016 sales to grow in both North America and Europe, and despite forecasts being lowered, Gentex management still expects revenue growth to fall between 6-10% year-over-year in 2017.

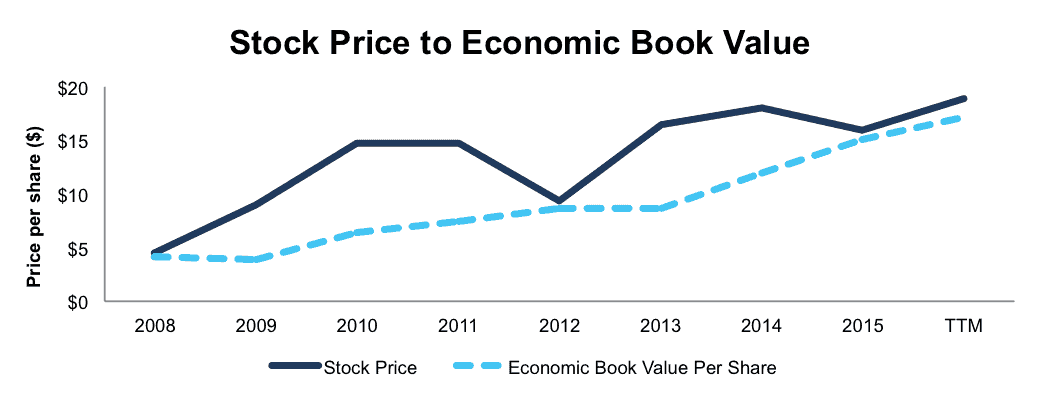

As noted earlier, despite the automobile market appearing much healthier than bears suggest, such concerns have taken a toll on GNTX’s valuation, which now implies a significant cut in profit growth when compared to the company’s history. In fact, GNTX trades at a historically low price to economic book value (PEBV) ratio, which measures the difference between the market’s expectations for future profits and the no growth value of the stock. Per Figure 5, the last time GNTX’s stock price traded near its economic book value was 2012 and prior to that, 2008. At 1.1, GNTX’s PEBV ratio means the market’s expectations for GNTX’s future profit growth have fallen to the same expectation level as 2008.

Figure 5: GNTX Trading Near All Time Lows

Sources: New Constructs, LLC and company filings.

Valuation Implies Large Slowdown In Profits

The market has rewarded Gentex for its consistent profit growth and the stock is up 18% year-to-date, yet shares remain undervalued. At its current price of $19/share, GNTX has a price-to-economic book value (PEBV) ratio of 1.1. This ratio means the market expects Gentex’s NOPAT to grow by only 10% over the remainder of its corporate life. This expectation seems awfully pessimistic for a firm that has grown NOPAT by 30% a year for the past seven years.

If Gentex can grow NOPAT by 8% compounded annually for the next decade, the stock is worth $23/share today – a 21% upside. This scenario assumes GNTX can grow revenue by consensus estimates in 2016 (10%) and 2017 (8%), and the same level as 2017 each year thereafter. Given the low market penetration of Gentex’s dimming mirror products and potential for further innovation in the market, GNTX could easily meet or even surpass these expectations. Add in the 1.9% dividend yield and its clear why GNTX was added to this month’s Most Attractive Stocks Model Portfolio and could be an excellent portfolio addition.

Buy Back Plus Dividend Could Yield 4.8%

In 2015, Gentex repurchased $111 million worth of stock. Through 3Q16, the company has repurchased $123 million worth of stock. As of 3Q16 the company has ~$171 million remaining under its current authorization, based on the current market price. If Gentex were to maintain its repurchase activity consistent with the first three quarters of 2016, the remaining authorization will last just over 4 quarters, and the firm would repurchase a total of $164 million in 2016. A repurchase of this size is 2.9% of the current market cap. When combined, Gentex’s 1.9% dividend yield and 2.9% repurchase yield offer investors a total potential yield of 4.8%

GNTX Rises With The Growth of the Smart Car

Rear video cameras are becoming standard equipment, connectivity, such as Bluetooth and Wi-Fi are being integrated into even base car models, and driver assistance functions are greatly expanding. This innovation has left many wondering how Gentex can compete in the new car world when its known largely for its basic auto-dimming mirrors.

However, Gentex has used the resources from its traditional mirror segment to position the firm for the future. The company is investing in technology such as video rear view mirrors, blind zone alert systems, “smart” lighting (SmartBeam) to automate high beam/low beam function, and HomeLink, a smart home/smart car connected technology. Additionally, the company is developing mirror technology to provide one-stop payment access to every major U.S. tolling system without the need for individual toll tags.

While the ultimate goal of autonomous driving may be years away, consumers will still need certain functions of a car, visibility being one of the main components. Look for growth in connected technologies, more advanced mirror functions, and autonomous driving to provide an opportunity for Gentex, not a death sentence.

Despite Gentex’s large market share (91% as noted above), the auto-dimming mirror market remains largely under-penetrated. Interior auto-dimming mirrors and exterior auto-dimming mirrors hold a 26% and 9% global penetration rate respectively. With much of the industry still not using auto-dimming mirrors, Gentex’s growth runway remains in tact. Look for continued profit growth to drive shares higher. In the meantime, investors are rewarded with a 1.9% dividend yield, with potential for 4.8% yield when including buybacks, for their patience.

Insider Trends Offsetting While Short Interest Shows Market Pessimism

Over the past 12 months, insiders have purchased 18 thousand shares and sold 1.4 million shares for a net effect of just under 1.4 million insider shares sold. This amount represents less than 1% of shares outstanding. Short interest sits at 23 million shares, or 8% of shares outstanding. It would appear the market is buying into the fear of an automotive downturn despite GNTX proving its ability to operate profitably during the last automotive crisis.

Executive Compensation Should Be Tied To ROIC

Gentex’s executive compensation plan includes base salary, annual bonuses, and long-term stock-based compensation. Annual profit sharing bonuses are paid based on the achievement of a pre-tax income threshold and annual performance bonuses are tied to EBITDA, Diluted EPS, and Quality. Long-term stock based compensation is awarded through options and restricted stock and is used to ensure overall compensation is competitive within the automotive industry. Gentex’s decision to base compensation on EBITDA and Quality, both non-GAAP metrics, would be a red flag were the firm using such metrics to overstate the economics of the business while lining the pockets of executives. However, an examination of Gentex’s fundamentals reveals the firm has created significant shareholder value. Over the past decade, Gentex has grown economic earnings, the true cash flows of the business, from $68 million in 2005 to $207 million in 2015, and even further, to $243 million TTM. We would still much rather see Gentex tie its executive compensation to ROIC, as there is a strong correlation between ROIC and shareholder value, but as it stands, Gentex’s compensation plan has not led to shareholder value destruction.

Impact of Footnotes Adjustments and Forensic Accounting

In order to derive the true recurring cash flows, an accurate invested capital, and an accurate shareholder value, we made the following adjustments to Gentex’s 2015 10-K:

Income Statement: we made $9 million of adjustments, with a net effect of removing $1 million in non-operating income (<1% of revenue). We removed $5 million in non-operating income and $4 million in non-operating expenses. You can see all the adjustments made to GNTX’s income statement here.

Balance Sheet: we made $756 million of adjustments to calculate invested capital with a net decrease of $594 million. The largest adjustment was $620 million due to excess cash. This adjustment represented 31% of reported net assets. You can see all the adjustments made to GNTX’s balance sheet here.

Valuation: we made $1 billion of adjustments with a net effect of increasing shareholder value by $389 million. Apart from the excess cash noted above, one of the notable adjustments was the removal of $76 million due to outstanding employee stock options. This adjustment represents 1% of Gentex’s market cap.

Attractive Funds That Hold GTNX

The following funds receive our Attractive-or-better rating and allocate significantly to Gentex.

- USCF ETF Trust: Stock Split Index Fund (TOFR) – 3.3% allocation and Very Attractive rating

- Scharf Global Opportunity Fund (WRLDX) – 3.0% allocation and Attractive rating

- Motley Fool Great America Fund (FOGIX) – 2.6% allocation and Attractive rating.

- Smith Group Large Cap Core Growth Fund (BSLGX) – 2.5% allocation and Attractive rating.

This report originally published here on December 9, 2016.

Disclosure: David Trainer, Kyle Martone, and Kyle Guske II receive no compensation to write about any specific stock, style, or theme.

Click here to download a PDF of this report.

Scottrade clients get a Free Gold Membership ($588/yr value) as well as 50% discounts and up to 20 free trades ($140 value) for signing up to Platinum, Pro or Unlimited memberships. Login or open your Scottrade account & find us under Quotes & Research/Investor Tools.

2 replies to "Long Idea: Don’t Throw The Baby Out With the Bathwater"

needs valulation for Cincinati financial corporation 2016

Cincinnati Financial Corporation is among the over 2,800 stocks currently under our coverage. You can see all the stocks we cover at this link:

https://client.newconstructs.com/nc/coverage/view.htm