Check out this week’s Danger Zone interview with Chuck Jaffe of Money Life.

Providing components to consumer goods manufacturers in a growing market can be highly profitable. However, this tech firm has been unable to capitalize on impressive growth in its end markets. Now, its falling profits, below average margins, and overvalued stock price earn it a spot in January’s Most Dangerous Stocks Model Portfolio and make Knowles Corporation (KN: $17/share) this week’s Danger Zone pick.

Falling Revenue Leads to Falling Profits

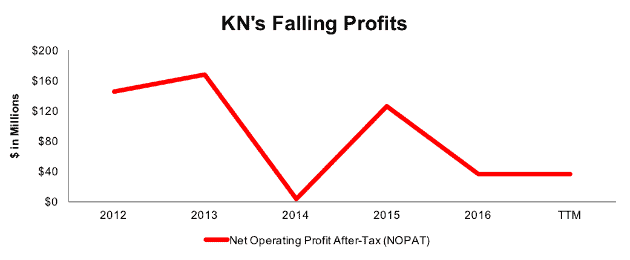

Since 2012, KN’s revenue has fallen 6% compounded annually to $859 million in 2016, and further, to $846 million over the last twelve months (TTM). At the same time, KN’s after-tax profit (NOPAT) has fallen 29% compounded annually to $36 million in 2016 and over the last twelve months (TTM), per Figure 1. The rapid deterioration in profits comes from declining margins. The company’s NOPAT margin fell from 14% in 2013 to 4% TTM. Declining margins and inefficient capital use have knocked KN’s return on invested capital (ROIC) down from 9% in 2013 to a bottom-quintile 2% TTM.

Figure 1: KN’s NOPAT Since 2012

Sources: New Constructs, LLC and company filings

Compensation Plan Allows Execs to Get Paid While Destroying Shareholder Value

Knowles Corporation’s executive compensation plan fails to properly align executives’ interests with shareholders’ interests. The misalignment helps drives the profit decline shown in Figure 1 and enables executives to earn large bonuses while shareholder value is destroyed. Executives’ annual bonuses are tied to many metrics, including revenue, adjusted EBIT, and individual objectives. Adjusted EBIT fails to include items such as stock-based compensation expense and restructuring charges. The individual objectives are filled with vague metrics including “corporate development”, “value creation”, or “supporting corporate development initiatives”.

Beginning in 2017, KN added performance share units to long-term incentive compensation, which previously consisted of stock options and restricted stock units. The performance shares are awarded based on three-year revenue and stock price multiplier goals.

The common thread between all these metrics is that executives are incentivized to meet goals that have little to do with creating true shareholder value. Since 2013, KN’s economic earnings, the true cash flows of the business, have fallen from $4 million to -$121 million TTM.

We’ve demonstrated through numerous case studies that ROIC, not revenue, EBIT, or individual objectives, is the primary driver of shareholder value creation. A recent white paper published by Ernst & Young also validates the importance of ROIC (see here: Getting ROIC Right) and the superiority of our data analytics. Without major changes to this compensation plan (e.g. emphasizing ROIC), investors should expect further value destruction.

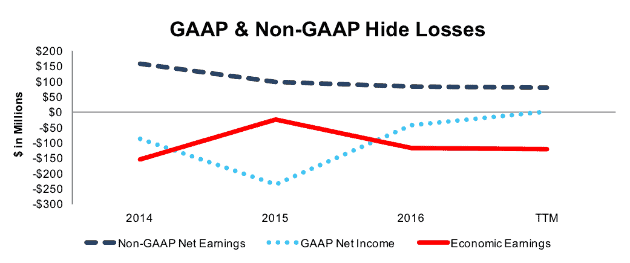

Non-GAAP Metrics Hide Losses

Knowles is another on the long list of firms that use non-GAAP metrics, such as non-GAAP gross profit, non-GAAP operating income, and non-GAAP net earnings to present “profit” metrics that mask the true economics of the business. Our research digs deeper so our clients see through these misleading financial metrics. Below are some of the items Knowles removes for its non-GAAP net earnings:

- Stock-based compensation expense

- Intangibles amortization expense

- Impairment charges

- Restructuring charges

- Production transfer costs

These adjustments have a large impact on the disparity between GAAP net income, non-GAAP net earnings, and economic earnings. Over the TTM period and in 2016, KN removed $24 million (over 11 times TTM GAAP net income) and $22 million (compared to -$42 million 2016 GAAP net income), respectively, in stock-based compensation expense to calculate non-GAAP net earnings. Combined with other adjustments, KN reported TTM non-GAAP net earnings of $82 million. Per Figure 2, GAAP earnings were $2 million and economic earnings were -$121 million TTM.

Figure 2: KN’s Non-GAAP Metrics Hide Declining Economic Earnings

Sources: New Constructs, LLC and company filings

Falling Margins are Troublesome in a Competitive Industry

Knowles produces audio processing devices, micro-electro-mechanical systems (MEMS) microphones, and specialty audio components. It sells its products to mobile consumer electronics manufacturers and the medical, aerospace, and industrial markets. Despite being a leader in the MEMS microphone and hearing aid markets, KN does not achieve the high margins and the competitive advantages one would expect. The industry consists of a few large players, each fighting for a piece of the global smartphone market. Competitors include AAC Technologies, Goertek, InvenSense, Cirrus Logic (CRUS) and ST Microelectronics (STM), among others.

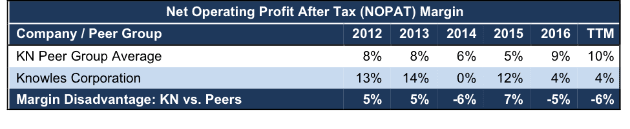

Despite the growth in smartphone shipments worldwide and the growing adoption of smart speakers and wearables, KN has not been able to increase margins on par with its peers. Per Figure 3, the gap between Knowles and the market weighted-average NOPAT margin of its peers has increased dramatically and turned what was once an advantage into a disadvantage.

Figure 3: Knowles’ NOPAT Margin Disadvantage is Growing

Sources: New Constructs, LLC and company filings

Bull Case Ignores KN’s Falling Profits in Rising Markets

As we explained in our report “Selling Shovels in a Gold Rush”, the suppliers in a booming market are, often, the ones to have the greatest success. While KN would fall into the “supplier” category of the growing smartphone, wearables, and smart speaker categories, it’s not clear whether it can provide these devices profitably. Any bull of Knowles is betting on the continued growth of these categories while ignoring the firm’s inability to grow profits during a time where usage of these devices was rapidly growing across the globe.

KN derives 49% of revenue from its Specialty Component division, which includes hearing aid products. Since 2007, hearing aid unit sales in the United States have grown 5% compounded annually, which should translate into consistent profit growth for a supplier such as Knowles. But, it has not. Going forward, RnR Market Research expects the global hearing aid market to grow 7% compounded annually through 2022. Knowles’ inability to grow profits in the past doesn’t inspire confidence in its ability to take advantage of a growing global hearing aid market.

The other half of revenue comes from the Mobile Consumer Electronics division, which includes smartphones, wearables, and other consumer electronic devices. From 2012-2017, global smartphone shipments grew 15% compounded annually. In addition, wearable devices have seen growth rates in the high 20% range and smart speakers have grown from nothing to an expected 56.3 million shipments in 2018. Despite the impressive growth in these key categories, Knowles’ NOPAT fell 29% compounded annually since 2012.

Despite the poor historical performance in a booming market, bulls will still point to future growth opportunities as reason to believe in KN. However, the smartphone markets’ hyper growth days may be a thing of the past. IDC projects global smartphone shipments to grow just 3% compounded annually through 2021 compared to 15% compounded annually since 2012.

The other ripe market for growth and one of the fastest growing markets in consumer electronics is Internet of Things (IoT) devices, which include smart speakers and other electronics now connected to the Internet. In its 3Q17 conference call, management noted that IoT sales would rise to 10% of revenue in 2018. However, any growth in this rising market could be offset by a (company expected) 6-10% decline in average selling prices on matured products through 2018. Ultimately the Internet of Things market cannot alone make up for falling prices and is simply not large enough (relative to smartphone market) to drive the profit growth expectations baked into the stock price, as we’ll show below

KN’s Valuation Implies Overly Optimistic Profit Growth

After shares more than halved from the 2014 IPO price, KN has risen 32% over the past two years, which is less than the 48% increase in the S&P 500. This underperformance could be a sign of what’s to come as investors realize the disconnect between the company’s fundamentals and the valuation of the stock price.

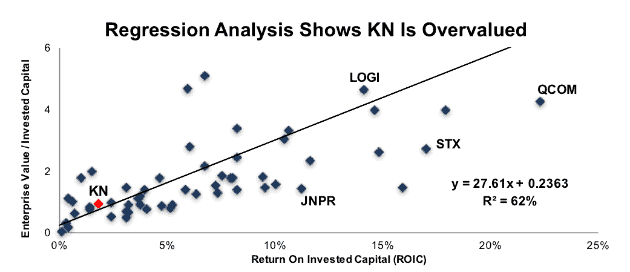

Figure 4 regresses the ROIC of KN and the 66 communications and computer hardware peers against enterprise value divided by invested capital (a cleaner version of price to book). As you can see, ROIC explains 62% of the changes in valuation for KN’s peers.

Figure 4: ROIC Explains 62% of Valuation for Knowles’ Peers

Sources: New Constructs, LLC and company filings

KN’s position above the trend line means its shares trade at a premium to its peers. If the stock were to trade at parity with the peer group, it would be $11/share – 28% below the current stock price. Given the firm’s subpar and declining fundamentals, we don’t think KN deserves a premium valuation.

Our discounted cash flow model quantifies the expectations baked into that premium valuation. To justify its current price of $17/share, KN must maintain TTM margins (4%) and grow NOPAT by 17% compounded annually for the next 11 years. This expectation seems overly optimistic for a firm with falling NOPAT and slowing revenue growth rates in its largest markets.

Even if we assume KN can achieve a 5% NOPAT margin (average of last three years) and grow NOPAT by 10% compounded annually for the next decade, the stock is still worth only $7/share today – a 58% downside.

Each of these scenarios also assumes KN is able to grow revenue, NOPAT and FCF without increasing working capital or investing in fixed assets. This assumption is unlikely but allows us to create optimistic scenarios that demonstrate just how high expectations embedded in the current valuation really are. For reference, KN’s invested capital has grown on average $28 million (3% of 2016 revenue) each year for the past four years.

Is KN Worth Acquiring?

The largest risk to any bear thesis is what we call “stupid money risk”, which means an acquirer comes in and pays for KN at the current, or higher, share price despite the stock being overvalued. Any acquisition would likely come from a firm looking to bring certain components in house, or a direct competitor looking to create a larger audio components manufacturer to provide better leverage (pricing, distribution) over consumer electronics firms. These firms would be better suited to continue sourcing components or simply out compete KN rather than imprudently allocate capital and destroy substantial shareholder value in an acquisition.

We show below how expensive KN remains even after assuming an acquirer can achieve significant synergies.

Walking Through the Acquisition Value Math

To begin, Knowles has liabilities of which investors may not be aware that make it more expensive than the accounting numbers suggest.

- $55 million in off-balance-sheet operating leases (4% of market cap)

- $18 million in outstanding employee stock options (1% of market cap)

- $10 million in underfunded pensions (<1% of market cap)

- $7 million in deferred tax liability (<1% of market cap)

After adjusting for these liabilities, we can model multiple purchase price scenarios. Even in the most optimistic of scenarios, KN is worth less than its current share price.

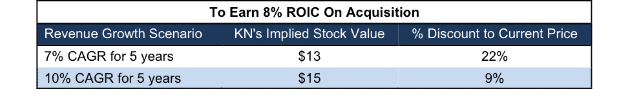

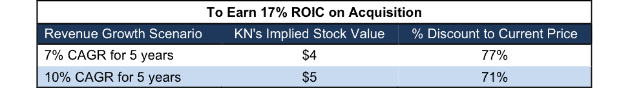

Figures 5 and 6 show what we think Cirrus Logic (CRUS) should pay for KN to ensure it does not destroy shareholder value. CRUS competes with KN in the MEMS microphone market while also developing tools to enhance voice capture and audio playback in devices. Purchasing KN would immediately provide CRUS a larger footprint in the industry and give the firm increased negotiating power over manufacturers. However, there are limits on how much CRUS would pay for KN to earn a proper return, given the NOPAT or free cash flows (or lack thereof) being acquired.

Each implied price is based on a ‘goal ROIC’ assuming different levels of revenue growth. In scenario one the estimated revenue growth rate is 7%, which is the consensus estimate of CRUS’s revenue growth next year (compared to -4% for KN). In scenario two, the estimated revenue growth rate is 10% because it assumes a merger with CRUS would create additional revenue growth opportunities.

We conservatively assume that CRUS can grow KN’s revenue and NOPAT without spending anything on working capital or fixed assets beyond the original purchase price. We also assume KN immediately achieves a 10% NOPAT margin, which is the average of CRUS’ and KN’s current NOPAT margin. For reference, KN’s TTM NOPAT margin is 4%, so this assumption implies immediate improvement and allows the creation of a truly best-case scenario.

Figure 5: Implied Acquisition Prices for CRUS to Achieve 8% ROIC

Sources: New Constructs, LLC and company filings.

Figure 5 shows the ‘goal ROIC’ for CRUS as its weighted average cost of capital (WACC) or 8%. Even if KN can grow revenue by 10% compounded annually with a 10% NOPAT margin for the next five years, the firm is worth less than its current price of $17/share. It’s worth noting that any deal that only achieves an 8% ROIC would only be value neutral and not accretive, as the return on the deal would equal CRUS’ WACC.

Figure 6: Implied Acquisition Prices for CRUS to Achieve 17% ROIC

Sources: New Constructs, LLC and company filings.

Figure 6 shows the next ‘goal ROIC’ of 17%, which is CRUS’ current ROIC. Acquisitions completed at these prices would be truly accretive to CRUS shareholders. Even in the best-case growth scenario, the most CRUS should pay for KN is $5/share (71% downside to current valuation). Even assuming this best-case scenario, CRUS would destroy over $1 billion by purchasing KN at its current valuation. Any scenario assuming less than 10% compound annual growth in revenue would result in further capital destruction for CRUS.

Earnings Could Send Shares Lower Despite “Beating” Consensus

Knowles Corp currently has an impressive streak of beating both top and bottom line expectations: seven consecutive quarters. However, this streak looks less impressive compared to the declining trend in analyst expectations. 2016 EPS expectations fell from $0.86/share to $0.67/share throughout 2016. 2017 EPS expectations followed a similar trend and fell from $0.73/share to $0.62/share in 2017. Looking forward, EPS expectations for 2018 have fallen from $0.94/share to $0.74/share. Given this trend, it appears that KN’s quarterly “beats” are more of a “beating a lowered bar” rather than improving the profitability of the business.

Quarterly earnings have also proven a catalyst to send shares lower. In two of the last three quarters, shares have fallen after earnings.

- 1Q17 – KN fell 10% the following week

- 2Q17 – KN fell 7% the following three days

As the smartphone market matures and competition to supply the wearable and speaker markets increases, KN could see another earnings beat lead to a slash in valuation. Investors may see KN as the “past” in the market, while firms such as Cirrus Logic, which earns a Very Attractive rating, represent the future.

Over the long-term, investors often recognize disconnects between market expectations and reality. When this recognition occurs, KN could fall to a more rational level.

Insider Trading is Minimal While Short Interest is Rising

Over the past 12 months, 300 thousand insider shares have been purchased and 139 thousand have been sold for a net effect of 161 thousand insider shares purchased. These sales represent less than 1% of shares outstanding.

Short interest is currently 12.8 million shares, which equates to 14% of shares outstanding and 19 days to cover. Short interest has grown nearly 7% since mid-December, which would seem to imply we’re not the only ones who recognize the issues facing KN and its lofty valuation.

Auditable Impact of Footnotes & Forensic Accounting Adjustments[1]

Our Robo-Analyst technology enables us to perform forensic accounting with scale and provide the research needed to fulfill fiduciary duties. In order to derive the true recurring cash flows, an accurate invested capital, and an accurate shareholder value, we made the following adjustments to Knowles’ 2016 10-K:

Income Statement: we made $121 million of adjustments, with a net effect of removing $79 million in non-operating expense (9% of revenue). We removed $21 million in non-operating income and $100 million in non-operating expenses. You can see all the adjustments made to KN’s income statement here.

Balance Sheet: we made $750 million of adjustments to calculate invested capital with a net increase of $672 million. One of the largest adjustments was $411 million due to asset write-downs. This adjustment represented 30% of reported net assets. You can see all the adjustments made to KN’s balance sheet here.

Valuation: we made $417 million of adjustments with a net effect of decreasing shareholder value by $387 million. The largest adjustment to shareholder value was $367 million in total debt, which includes $55 million in off-balance sheet operating leases. This lease adjustment represents 4% of KN’s market cap.

Unattractive Funds That Hold KN

The following funds receive our Unattractive-or-worse rating and allocate significantly to Knowles Corp.

- AMG SouthernSun US Equity Fund (SSEIX) – 3.4% allocation and Unattractive rating

- Bernzott US Small Cap Value Fund (BSCVX) – 3.2% allocation and Unattractive rating

- Linde Hansen Contrarian Value Fund (LHVAX) – 3.1% allocation and Very Unattractive rating

This article originally published on January 22, 2018.

Disclosure: David Trainer and Kyle Guske II receive no compensation to write about any specific stock, style, or theme.

Follow us on Twitter, Facebook, LinkedIn, and StockTwits for real-time alerts on all our research.

[1] Ernst & Young’s recent white paper, “Getting ROIC Right”, proves the superiority of our research and analytics.

Click here to download a PDF of this report.

Photo Credit: Tony (Flickr)