F5 Networks (FFIV: $145/share) – Closing Long Position – Up 23% vs. S&P +6%

F5 Networks was originally selected as a Long Idea on 10/18/17 and added to our initial Focus List – Long Model Portfolio. At the time of the report, the stock received a Very Attractive rating. Our investment thesis highlighted a low PEBV ratio that implied pessimistic expectations baked into the stock price despite the firm’s multi-year history of profit growth.

During the subsequent 127 day holding period, FFIV outperformed, rising 23% compared to a 6% gain for the S&P 500. FFIV has since been downgraded to Neutral on 2/6/18 after our Robo-Analyst parsed the most recent 10-Q. While FFIV’s valuation remains attractive, the stock was downgraded due to a misleading trend in economic earnings vs. reported earnings. Due to this change, we are closing this position and removing it from our Focus List – Long Model Portfolio.

We hope investors were able to participate in the 23% rise in stock price since we first featured FFIV.

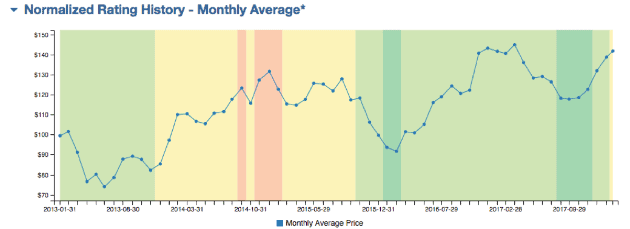

Figure 1: FFIV Stock Price and Risk/Reward Rating History

Sources: New Constructs, LLC and company filings

This article originally published on February 22, 2018.

Disclosure: David Trainer, Kyle Guske II, and Sam McBride receive no compensation to write about any specific stock, style, or theme.

Follow us on Twitter, Facebook, LinkedIn, and StockTwits for real-time alerts on all our research.