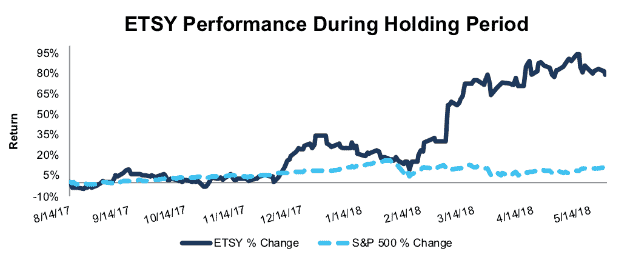

Etsy Inc. (ETSY: $29/share) – Closing Short Position – up 81% vs. S&P up 10%

Etsy was originally selected as a Danger Zone pick on 8/14/17. At the time of the report, the stock received a Very Unattractive rating. Our short thesis highlighted slowing growth in revenue, gross merchandise sales, and active sellers, low margins, heavy competition in the e-commerce market, and a vastly overvalued stock price. We added the stock to our Focus List – Short Model Portfolio on 11/3/17.

During the 282-day holding period, ETSY underperformed as a short position, rising 81% compared to a 10% gain for the S&P 500. Since being added to the focus list, ETSY is up 75% while the S&P is up 5%.

ETSY was upgraded to Neutral on 5/10/18 after we parsed its latest 10-Q filing. Since putting new management in place, ETSY appears to have revitalized the platform and cut costs significantly. Revenue and gross merchandise sales growth accelerated year-over-year in 1Q18. At the same time, SG&A as a percent of revenue was 37% in 1Q18, down from 48% in 1Q17 while the company reduced its employee count from 1,043 to 744. Strict cost controls and employee reduction helped Etsy’s NOPAT margin rise from -1% when we placed it in the Danger Zone to 10% TTM.

ETSY’s valuation still remains optimistic, with a price-to-economic book value (PEBV) ratio of 6.2 and a growth appreciation period of over 100 years. However, the valuation alone is not enough to justify keeping this position open given the large improvement in the firm’s fundamentals led by a new management team. As a result, we are closing this position and removing it from our Focus List – Short Model Portfolio.

Figure 1: ETSY vs. S&P 500 – Price Return

Note: Gain/Decline performance analysis excludes transaction costs and dividends.

This article originally published on May 24, 2018.

Disclosure: David Trainer, Kyle Guske II, and Sam McBride receive no compensation to write about any specific stock, style, or theme.

Follow us on Twitter, Facebook, LinkedIn, and StockTwits for real-time alerts on all our research.