We closed this position on January 29, 2021. A copy of the associated Position Update report is here.

Struggling retailers can often represent appealing investment opportunities due to their dirt-cheap valuations. However, one big risk with this strategy is that the negative sentiment will continue to drive the stock down despite the fundamentals supporting a higher valuation.

The remedy for this is often a buyout from a private equity firm. Private equity takeovers have led to quick returns on some of our previous Long Ideas such as PetSmart and PlyGem Holdings. This week, we’ve got another cheap retailer that was recently confirmed as a buyout target. This potential catalyst, along with a high and sustainable dividend yield, makes GameStop (GME: $16/share) is this week’s Long Idea.

Accounting Earnings Overstate Profit Decline

GameStop is in the news this week after the company confirmed a report from Reuters that it is exploring the possibility of a sale. Private equity firm Sycamore Partners – which has previously taken over other struggling retailers such as Staples and Belk – is reported to be one of the firms that have expressed interest.

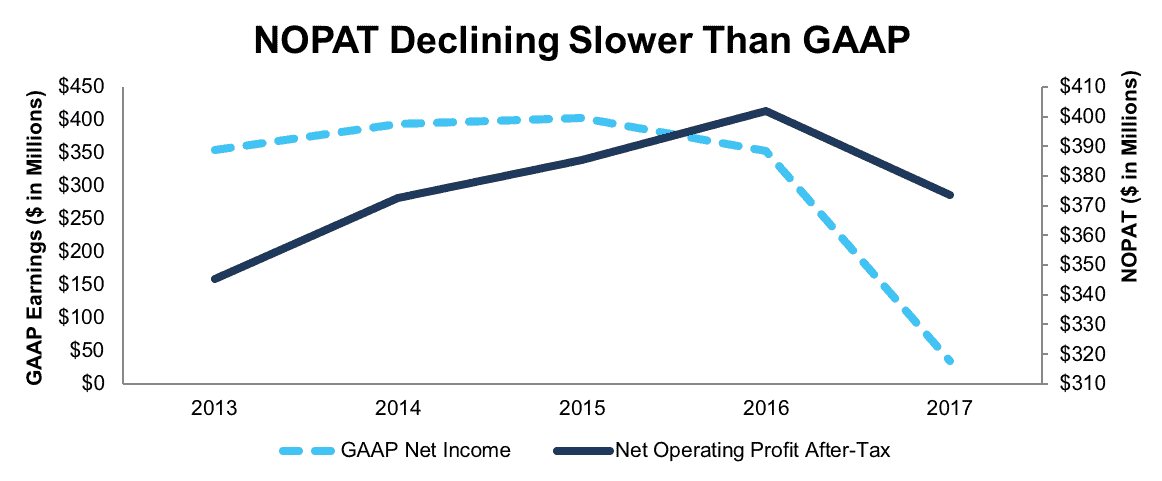

Investors that only look at accounting earnings would likely be confused by Sycamore’s interest in GameStop, which has seen its GAAP net income decline from a peak of $403 million in 2016 to just $4 million over the past twelve months. The company’s stock price declined by ~50% over that same time. Meanwhile, after-tax operating profit (NOPAT) has been much steadier. See Figure 1.

Figure 1: GME’s NOPAT & GAAP Net Income Since 2013

Sources: New Constructs, LLC and company filings

Much of the GAAP net income decline in 2017 was driven by $390 million in asset write-downs related to the Technology Brands segment, which owns and operates AT&T branded wireless retail stores. A non-operating tax expense of $42 million related to the new tax law also contributed to this decline.

After adjusting for these non-operating items, we see that the business is declining, but that profits aren’t falling off a cliff the way that GAAP earnings suggest. This disconnect creates the value opportunity that appears to have piqued Sycamore’s interest.

Fundamentals Still Compare Well to Peers

GameStop faces undeniable challenges. Its core business model of selling new and used video games and consoles has been squeezed by online retail, mobile gaming, and the rise of digital downloads. These disruptions have led to an undeniable decline in the company’s profitability.

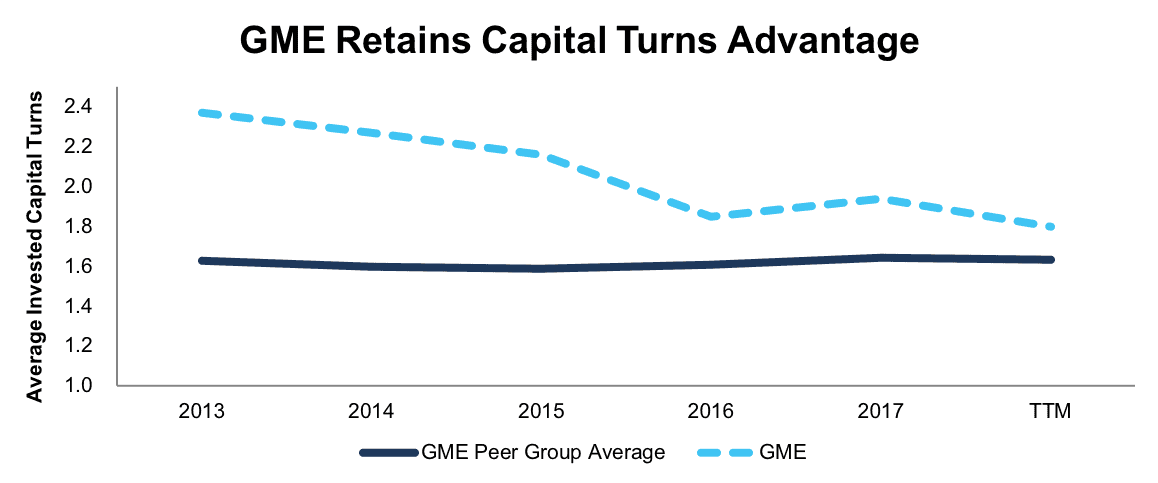

Despite these challenges, GameStop still compares reasonably well to other specialty retailers. Its 8% return on invested capital (ROIC) is right at the median for the peer group listed in its proxy statement. Figure 2 shows that, even after a significant decline, it still earns more revenue per dollar invested in its business (invested capital turns) than its peers.

Figure 2: GME Capital Turns Vs. Peers Since 2013

Sources: New Constructs, LLC and company filings

GameStop has historically been such a profitable business that it still compares favorably to its peers even with its recent struggles.

Core Business Decline Should Be Gradual

We expect the pressures on the company’s core games and console sales to continue to mount, but the decline should be gradual rather than sudden. The company’s ecosystem and the limitations of digital storage continue to provide it with a competitive advantage in the near term.

We saw GameStop’s ecosystem advantage play out with the launch of the Nintendo Switch in March of 2017, which became the fastest selling console in history and helped boost the company’s new hardware sales by 28% last year. Despite the ease of buying the Switch online or through a major retailer such as Target (TGT) or Walmart (WMT), many customers continued to buy it at GameStop.

The next generation of the Xbox (MSFT) and PlayStation (SNE) consoles – expected soon – should provide a similar boost.

Many customers remain loyal to GameStop through different console generations because they can sell their used games, equipment, and phones to the company in exchange for store credit. Many Wii and WiiU owners traded in their games and consoles to offset the purchase of the Switch, an offer that other retailers can’t match.

This ecosystem may eventually face disruption. There are startups experimenting with allowing gamers to buy and resell digital downloads, but so far there’s no scalable solution for console games.

Meanwhile, the sheer size of digital game files continues to give physical games an advantage. Currently, both the Xbox One and PS4 can only store about 12 games at a time, while some individual Switch games take up more space than its hard drive can hold.

Improvements in compression, storage capacity, and streaming bandwidth may overcome this hurdle in the long-term, but for now physical games maintain clear advantages in storage, ability to resell and portability (ability to play the game at your buddy’s house).

New Revenue Streams Offset Decline

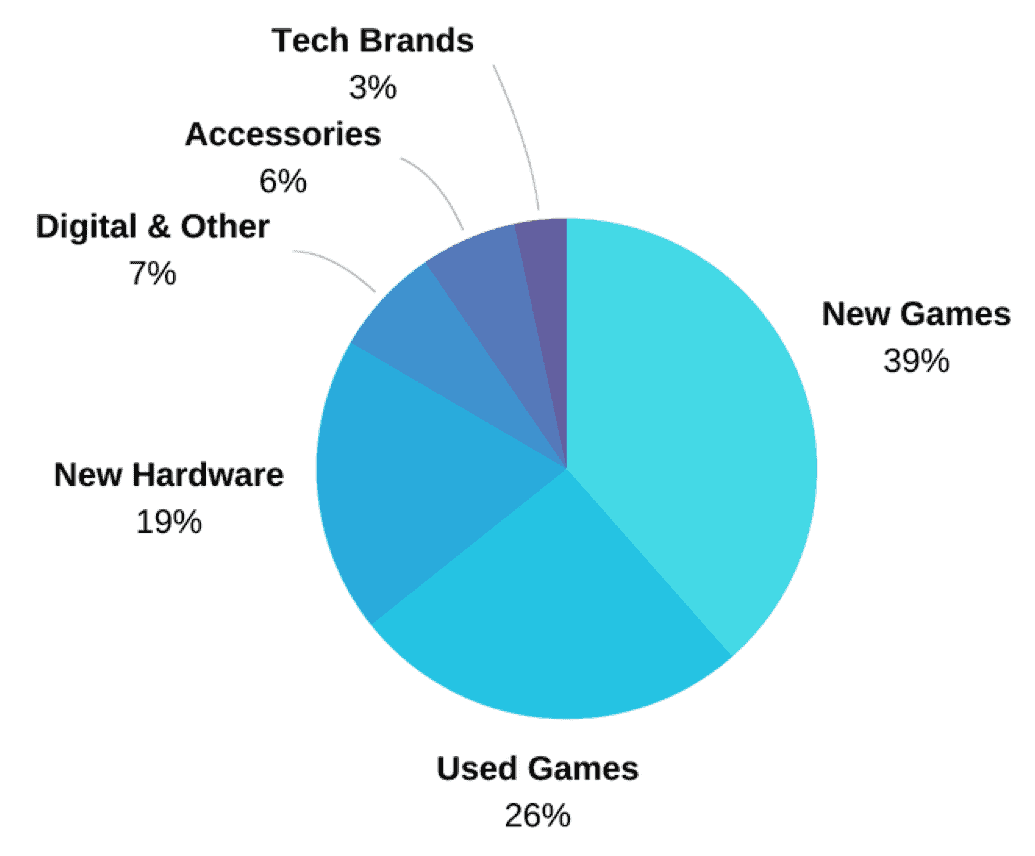

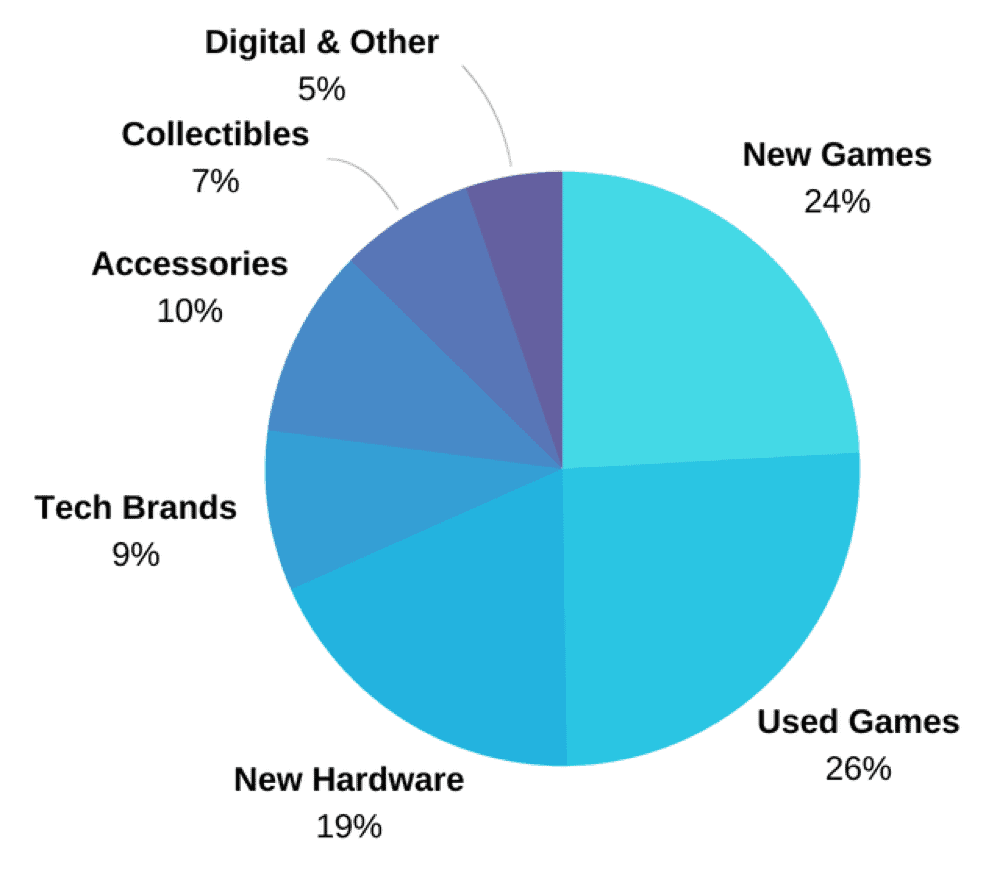

While GameStop’s core business declines, the company has successfully expanded its offerings to diversify its revenue. Figures 3 and 4 compare the company’s revenue by product category in 2014 vs. Q1 2018.

Figure 3: Revenue by Product Category: 2014

Sources: New Constructs, LLC and company filings

Figure 3 shows that product categories outside of games and consoles accounted for just 16% of revenue in 2014. In the most recent quarter, that share nearly doubled to 31%, as shown in Figure 4.

Figure 4: Revenue by Product Category: Q1 2018

Sources: New Constructs, LLC and company filings

The company’s Collectibles and Accessories sales grew respectively by 24% and 13% year over year in Q1. GameStop has had significant success devoting more space in its stores to collectible items such as t-shirts, toys, and gadgets. It has also devoted more attention to sales of accessories like headsets as the growing popularity of “Battle Royale” games such as Fortnite have increased demand for these products.

The accessories business could be a significant growth category for the company as virtual reality (VR) gaming goes increasingly mainstream. The VR market is expected to grow by ~50% annually over the next several years and be worth ~$50 billion by 2025.

GameStop already sells VR headsets, and the company should be well-equipped to profit from the growth in this category. While it’s easy to buy games or consoles online, most customers will want to try out VR devices and accessories before buying them, which means having a brick and mortar space to demo the equipment is a valuable advantage.

Esports represents another opportunity for GameStop to drive traffic to its stores. The company has already partnered with game developers to host tournaments, and its stores are a logical space for smaller events. It’s easy to envision a future where GameStop locations thrive as Esports venues and showrooms for VR, with games and consoles taking up a much smaller amount of space than they do today.

Meanwhile, the Technology Brands segment, which owns and operates ~1,300 AT&T licensed retail locations along with a handful of Simply Mac stores, has been fairly dysfunctional over the past year. Changes in the compensation structure from AT&T (T) led to a double-digit decline in revenues and slimming profit margins, along with the write-downs mentioned above.

It appears that GameStop overpaid for this business, but that doesn’t mean it’s worthless. If the company can stabilize its relationship with AT&T, the Technology Brands segment can provide ~10% of revenue that is not impacted by video game sales and earns a fairly high margin. In addition, this segment enables GameStop to easily profit from the phones it accepts for trade in credits.

Blockbuster Comparison Doesn’t Hold Water

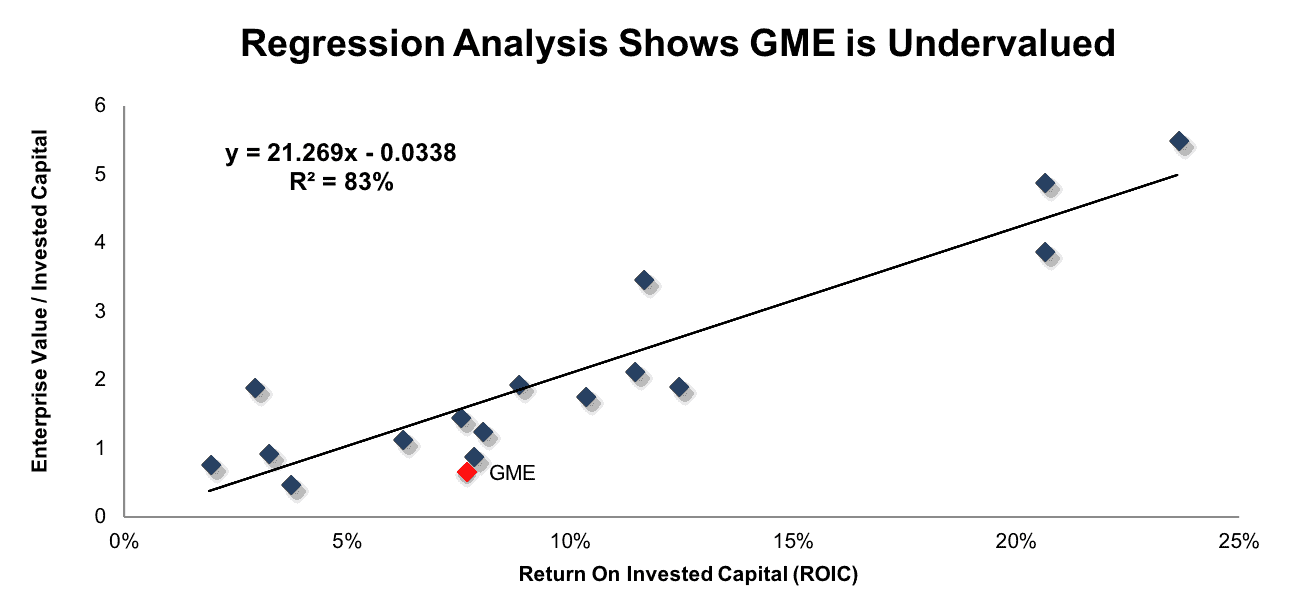

The bear case against GameStop has focused on comparing the company to other specialty retailers that have gone out of business due to technological disruption: companies such as Blockbuster, Circuit City, Borders, and RadioShack. Figure 5 shows that the comparison doesn’t hold water for most of these companies, as GameStop is more profitable than they ever were.

Figure 5: Peak ROIC for GameStop Vs. High-Profile Retail Bankruptcies

Borders, Circuit City and Blockbuster were not particularly profitable companies in the first place, which left them helpless to fight off competition and technological disruption. These companies were also significantly more indebted than GameStop is today, with an average of ~$3 billion in total debt compared to $1.6 billion for GameStop.

Add in the fact that these companies were never able to diversify their revenue streams outside of their core business, and it becomes clear that calling GameStop the next Blockbuster, Borders, or Circuity City doesn’t really make sense.

GameStop Is Not the Next RadioShack

The best comp for GameStop in Figure 5 is RadioShack, which was similarly profitable and had a comparable level of debt (~$1.2 billion) prior to its collapse.

However, there are still significant differences between the two companies that explain why GameStop’s business will not face that sudden deterioration and liquidity crunch that doomed RadioShack.

Most notably, GameStop hasn’t destroyed its brand in the same way RadioShack did prior to its collapse. RadioShack’s decision to sell cell phones in its stores – along with years of underinvestment – created a horrible customer experience. Employees that hadn’t been trained to understand the products they sold were constantly tied up in paperwork signing new customers up for mobile plans, which left other customers waiting ages for help.

In 2011, the Temkin Group, a consulting firm that surveys 10,000 U.S. consumers annually, gave RadioShack a customer experience rating of 57%, 17 points below the industry average. The company’s reputation was so bad that it rebranded itself as “The Shack”.

RadioShack was trying to achieve the same goal as GameStop – diversify its revenue away from its legacy business – but instead it ended up hurting the existing business while failing to properly establish the new revenue stream.

Notably, RadioShack is survived by competitor (and recent Long Idea) Best Buy (BBY), which worked hard to optimize the customer experience in its stores. The success of Best Buy shows that RadioShack’s demise wasn’t the inevitable result of market forces, it was the consequence of poor management decisions.

By comparison, GameStop has maintained its brand value reasonably well. It currently earns a customer experience rating of 69%, 6 points below the industry average. That’s not great, but it’s not nearly as bad a position as RadioShack was in right before its profitability cratered.

There are several other distinctions that also suggest GameStop is not about to follow in the path of RadioShack and be driven into bankruptcy in the next few years, including:

- Location: A large portion of RadioShack’s locations were in shopping malls, especially after it expanded into cell phone kiosks. As a result, the drastic decline in mall traffic nationwide hit the company hard. By comparison, just 10% of GameStop’s U.S. stores are located in shopping malls according to the company’s Q4 2017 earnings call.

- Shorter Lease Life: Both companies finance their stores through off-balance sheet debt in the form of operating leases, but GameStop has comparatively fewer long-term lease commitments than RadioShack did before its profitability declined. 68% of GameStop’s operating lease obligations are due in the next two years, compared to just 60% for RadioShack in 2010. This shorter lease life gives GameStop more flexibility to close underperforming stores.

- Sellable Assets: In the event GameStop’s business does face a rapid decline, it has more assets it can partition off and sell to pay its debts. These include the Technology Brands segment, ThinkGeek.com, the Game Informer Magazine, and its international operations in Canada, Australia, and Europe.

On the surface, GameStop today may look like RadioShack in 2010, but further investigation reveals significant differences.

GME Is Undervalued Compared to Peers

Numerous case studies show that getting ROIC right is an important part of making smart investments. Ernst & Young recently published a white paper that proves the material superiority of our forensic accounting research and measure of ROIC. The technology that enables this research was featured in Harvard Business School.

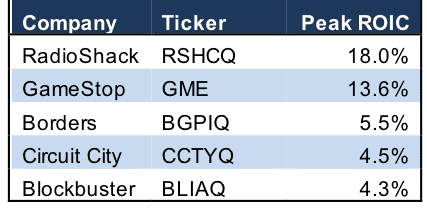

Per Figure 6, ROIC explains 83% of the difference in valuation for the 17 stocks in GME’s listed peer group. GME is the most undervalued company among its peers based on its position below the trendline.

Figure 6: ROIC Explains 83% of Valuation for Specialty Retailers

Sources: New Constructs, LLC and company filings

GME’s enterprise value per invested capital (which is a cleaner version of price to book) implies that the market expects the company’s ROIC to decline from 8% to 3%.

If the stock were to trade at parity with its peers, it would be worth $62 per share, almost four times the current stock price. GME should be valued at a discount based on the unique challenges it faces, but we don’t think it should be priced this far below its peer group. This steep discount helps to explain why Sycamore Partners and other private equity firms might be interested in an acquisition.

DCF Valuation Reveals Significant Upside

Even after a 10% spike on the news of a potential takeover, GME is still priced as if it will go out of business. Specifically, its $15.50/share valuation implies that its NOPAT margin will be cut in half and its revenue will decline by 10% compounded annually for 10 years until the company liquidates the remainder of its assets. See the math behind this dynamic DCF scenario here.

Such pessimistic expectations baked into the stock price create large potential upside. If we assume (as we did in the prior scenario) that margins get cut in half and the firm experiences 10% compounded annual declines in revenue for 10 year, but that GME will be able to survive and maintain flat cash flows after that, the stock is worth $17.50/share, an 11% upside from the current price. See the math behind this dynamic DCF scenario here.

If GME can offset the declining revenue from its core business through a shift to collectibles and VR accessories, the upside becomes much more significant. In this scenario, we still cut margins in half due to the decline in the high margin used games business and use consensus analyst forecasts for revenue in years 1 and 2, but we assume revenues are flat for the next three years and return to 3% annual growth in years 5-10. If Sycamore Partners believes GameStop can achieve this level of performance, they should be willing to pay ~$22/share for GME, a 38% premium to the current stock price. See the math behind this dynamic DCF scenario here.

Even this last scenario assumes NOPAT declines by 5% compounded annually over the next decade. The expectations baked into the current valuation of the stock are so low that even a slightly positive improvement in the financial future of this firm will translate into big gains for the stock.

GameStop’s economic book value, the value of the company if NOPAT simply stays flat, is over $52/share, more than triple the current stock price.

Management Transition Creates Strategic Opportunity

GameStop has undergone significant management upheaval so far in 2018. Former CEO Paul Raines resigned in January due to medical issues, and Michael Mauler took his place. However, Mauler lasted just three months before resigning due to personal issues, so board member and former Microsoft executive Shane Kim is now serving as interim CEO.

This management upheaval is a challenge for GameStop, but it’s also an opportunity for Sycamore or any other private equity firm that may be interested. Any buyer knows they won’t have to deal with an entrenched management team that might resist a new strategic direction.

A private equity buyer could also improve GameStop’s value by implementing superior executive compensation practices. Currently, 50-60% of executive compensation comes in the form of bonuses tied to both operating earnings as a whole and specifically earnings from non-video games products.

The goal of diversifying the company’s revenue stream is a good one, but the company could use superior metrics to structure these incentives. To ensure that management is creating value for shareholders, we’d like to see bonuses tied to ROIC instead. There is a strong correlation between improving ROIC and increasing shareholder value,[1] and tying exec comp to ROIC ensures that executives’ interests are properly aligned with shareholders’ interests.

10% Dividend Yield Leaves a Margin of Safety

Some investors might be wary of buying into GME due to concerns that the rumored acquisition won’t materialize, but the stock’s high dividend yield means investors get paid handsomely to wait. GME pays a $0.38/share quarterly dividend, which annualizes to a 9.7% dividend yield.

That dividend looks sustainable, as it amounts to just half of GME’s 19.6% free cash flow yield over the trailing twelve months. Even if GME’s NOPAT does decline significantly, closing down stores and selling off underperforming assets should free up enough capital to sustain the dividend for several years to come.

Insider Trading Is Minimal While Short Interest Remains High

Insider activity has been minimal over the past three months with 155 thousand shares purchased and 68 thousand shares sold for a net effect of 88 thousand shares purchased. These purchases represent less than 1% of shares outstanding.

There are currently 44 million shares sold short, which equates to 45% of the float and nine days to cover. Any positive developments in the acquisition talks could lead to a short squeeze that sends shares higher.

Critical Details Found in Financial Filings By Our Robo-Analyst Technology

As investors focus more on fundamental research, research automation technology is needed to analyze all the critical financial details in financial filings. Below are specifics on the adjustments we make based on Robo-Analyst[2] findings in GameStop’s 2017 10-K:

Income Statement: we made $1.4 billion of adjustments, with a net effect of removing $339 million in non-operating expense (4% of revenue). We removed $554 million in non-operating income and $894 million in non-operating expenses. You can see all the adjustments made to GME’s income statement here.

Balance Sheet: we made $2.8 billion of adjustments to calculate invested capital with a net increase of $1.5 billion. The most notable adjustment was $800 million in operating leases. This adjustment represented 27% of reported net assets. You can see all the adjustments made to GME’s balance sheet here.

Valuation: we made $2.1 billion of adjustments with a net effect of decreasing shareholder value by $1.3 billion. Despite the decrease in shareholder value, GME remains undervalued.

Attractive Funds That Hold GME

The following fund receives our Attractive-or-better rating and allocates significantly to GameStop

- Northern Lights KCM Macro Trends Fund (KCMIX) – 2% allocation and Attractive rating.

This article originally published on June 20, 2018.

Disclosure: David Trainer, Kyle Guske II, and Sam McBride receive no compensation to write about any specific stock, style, or theme.

Follow us on Twitter, Facebook, LinkedIn, and StockTwits for real-time alerts on all our research.

[1] Ernst & Young’s recent white paper “Getting ROIC Right” proves the link between an accurate calculation of ROIC and shareholder value.

[2] Harvard Business School features the powerful impact of our research automation technology in the case New Constructs: Disrupting Fundamental Analysis with Robo-Analysts.