We closed this position on March 5, 2021. A copy of the associated Position Update report is here.

A rising number of individuals are engaged in the DIY crafting movement, driven by the growth of how-to guides and the ease of sharing their creations via social media and e-commerce platforms. This emerging market is too small for giants like Target (TGT) and Walmart (WMT) and too big to be dominated by mom-and-pop stores. Moreover, the hands-on nature of this market has, almost entirely, prevented e-commerce firms like Amazon (AMZN) from capturing any of its growth.

There is one company, however, that is capitalizing on this growing market and making a lot of money while doing so. Meanwhile, most investors do not understand the business or its potential and have left the stock significantly undervalued. The Michaels Companies Inc. (MIK: $19/share) is this week’s Long Idea.

MIK’s’ Impressive Profit Growth

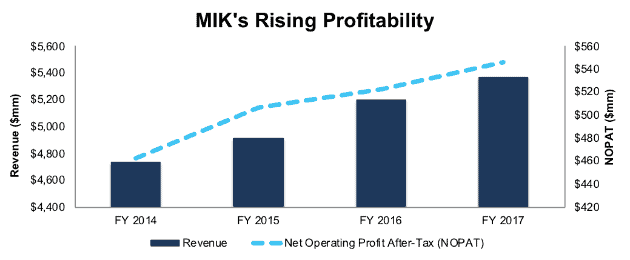

Since 2015, The Michaels Companies has grown revenue by 4% compounded annually and after-tax operating profit (NOPAT) by 6% compounded annually, per Figure 1.

Figure 1: MIK’s Revenue & NOPAT Since 2015 Are on the Rise

Sources: New Constructs, LLC and company filings

NOPAT growth has been fueled by rising NOPAT margins, which have improved from 9.8% in fiscal 2014 to 10.2% in fiscal 2017. As the same time, the company has maintained its invested capital turns, a measure of balance sheet efficiency, steady at 1.8 over each of the past four years.

Rising margins and efficient capital use have allowed MIK to consistently earn a high return on invested capital (ROIC). The company’s ROIC has averaged a top-quintile 19% over the past three years. Further highlighting the strength of MIK’s business, the firm has generated a cumulative $1.1 billion (32% of market cap) in free cash flow (FCF) over the same time.

The Internet Provided a Boost to Michaels

The internet has destroyed the competitive advantage of many specialized retailers as centralized sales platforms created efficiencies of scale that could outprice smaller brick-and-mortars, but it has created opportunity for Michaels. The rise of social sites, such as Pinterest and Instagram, along with craft marketplaces such as Etsy (which we underestimated) made it easier for people to both learn how to craft and share (or even sell) the finished result.

The internet itself cannot easily recreate these personal homemade items. Instead, it provides greater access to the knowledge needed for people to create things themselves. The decentralization of expertise and distribution has expanded the crafting community from a small group of dedicated creators to a wider range of hobbyists.

CEO Chuck Rubin, who took the job in 2013, recognized this knowledge and exposure could be key to building a lasting brick-and-mortar retailer. He focused on maintaining the company’s core customer base while also introducing new products and in-store displays to bring in novice and part-time crafters. The success of this strategy is clear in the company’s financial success.

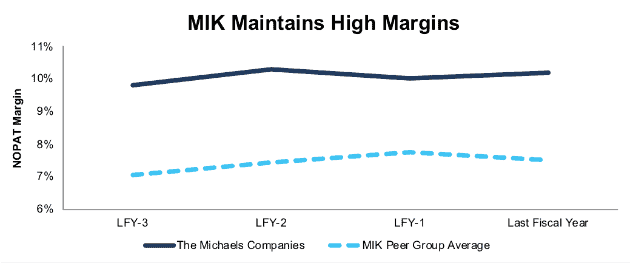

Since 2015, MIK’s NOPAT margins have averaged 10.1% and currently sit at 10.0% over the last twelve months. Meanwhile, the peer average of the 23 specialty retailers we have under coverage is much lower, at 7.0% TTM. Figure 2 shows The Michaels Companies has maintained consistently high margins over the last few years.

Figure 2: MIK Maintains High Margins Relative to Specialty Retail Peers

Sources: New Constructs, LLC and company filings.

Business Model Proves Brick-and-Mortar Can Thrive

In order to succeed, Michael’s must ensure its stores have adequate products to meet consumer needs, while also ensuring they’re not wasting store space or operating unprofitable stores. Essentially, the firm needs to achieve economies of scale (in distribution, logistics, inventory management, etc.) without overreaching and getting stuck with a bunch of excess inventory and/or stores.

To that end, management is constantly reviewing locations, opening new stores, closing stores, or even relocating stores when necessary. This process has helped MIK grow comparable store sales in seven of the past eight years.

A testament to the efficiency of Michaels stores (and also consumers’ willingness to spend) can be seen in the growth in average sales per square foot. Since fiscal 2010, average sales per square foot have grown from $205/sq. ft to $224/ sq. ft in fiscal 2017. This improvement was not achieved through a net decrease in store count either. Total stores have actually increased from ~1200 to nearly 1400 since fiscal 2010.

The improved efficiency and growth in comparable store sales is even more impressive considering that Michael’s framing business (16% of revenue) has been in decline for the past three years. Over this time, Framing sales have fallen 2% compounded annually, while Papercrafting, Home Décor & Seasonal, and General Crafts sales have risen 12%, 8%, and 4% compounded annually respectively.

The Michaels Companies is proving that a brick-and-mortar retailer can exist (and grow) in a world where many believe e-commerce will take over.

Bears Case Ignores “High-Touch” Nature of the Industry

Despite its success, bears will still argue that Michael’s cannot withstand the e-commerce threat forever, However, to buy into this argument, one must overlook the nature of the arts & crafts industry, which is heavily “hands-on” when purchasing goods.

First and foremost, the products Michaels sells, such as fabrics, paints, sewing materials, and more, cannot be easily analyzed online. When a crafter is looking to create a purple pillow for instance, they likely want to know exactly what color fabric they’re purchasing, as well as the texture and feel of the material. This experience (and precision) can only be achieved in person. The high-touch nature of these products is intuitive and backed up by consumer research.

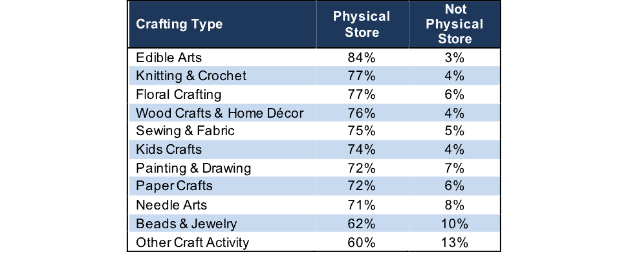

For example, a study conducted by the Association for Creative Industries (AFCI) analyzed purchase location for 11 types of crafting activities. This study found that >70% of consumers purchase supplies exclusively in a physical store for nine of these categories, and for the remaining two, >60% of consumers buy supplies in a physical store. Furthermore, the study found just 3-13% of consumers bought their supplies exclusively outside of a physical store. It seems there are some part of the world where e-commerce will not succeed.

Figure 3: Purchase Location for Crafting Items

Sources: Maritz & AFCI

Bears Must Also Ignore Consumers’ Spending on Crafts

Not only do consumers largely purchase crafts in physical stores, they’re doing so more often and in greater quantities. According to the AFCI, total sales for the creative industry grew to $44 billion in 2016 (the last year the study was done), up from $30.1 billion in 2011, or 8% compounded annually. Additionally, 63% of households in the United States participated in a craft/hobby in the past year, up from 56% in 2010.

Lending further credence to the importance of social media, the study found that those participating in crafting activities are younger than the average American. As Kristen Farrell, marketing and PR manager at AFCI, puts it “seeing creative activities on social media encourages people to build their creative confidence.”

Furthermore, crafters are willing to spend on items they don’t necessarily need right this moment. The AFCI study found that nearly half of crafters purchased what they needed for an existing project and stocked up for future projects in one shopping trip.

While it’s clear that consumers prefer to purchase arts & craft supplies in person, and the industry is growing, bears may still argue that Michael’s faces price competition from other retailers and even manufacturers looking to boost their own margins.

However, as we’ll show below, The Michaels Companies has been taking steps to build its competitive moat over the years to limit its dependence upon other vendors.

MIK is Building its Competitive Moat with Private Brands

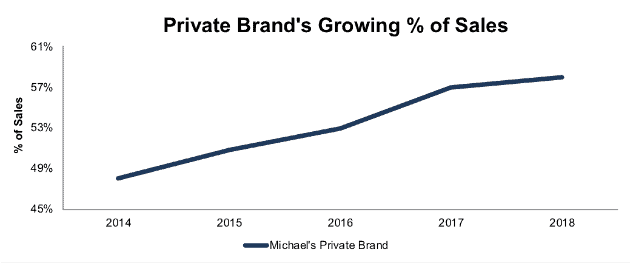

To further combat competition from e-commerce – and larger brick and mortars like Walmart (WMT) – and insulate itself from pricing wars on commoditized goods, The Michaels Companies has focused on growing its private brands, which now represent a majority of its sales. Since 2014, Michael’s private brands have grown from 48% of sales to 58% of sales in 2018, per Figure 4.

Figure 4: Michael’s Private Brands Strengthen Business

Sources: New Constructs, LLC and company filings

This shift in sales is important, as it differentiates The Michaels Companies from traditional competitors, such as Hobby Lobby or Jo-Ann, as well as online retailers like Amazon (AMZN).

Improving ROIC Correlated with Creating Shareholder Value

Numerous case studies show that getting ROIC right is an important part of making smart investments. Ernst & Young recently published a white paper that proves the material superiority of our forensic accounting research and measure of ROIC. The technology that enables this research is featured by Harvard Business School.

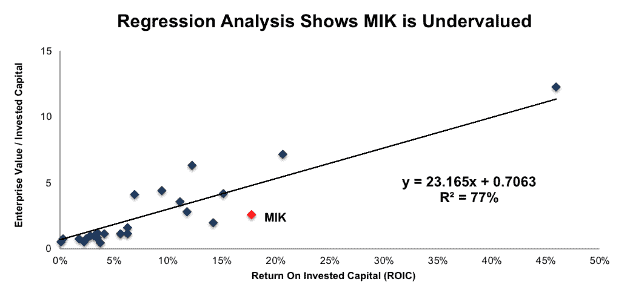

Per Figure 5, ROIC explains 77% of the difference in valuation for the 23 specialty retailers under coverage. MIK’s stock trades at a significant discount to peers as shown by its position below the trend line in Figure 5. MIK’s enterprise value per invested capital (a cleaner version of price to book) of 2.5 implies that the market expects its ROIC to decline to below 7%.

Figure 5: ROIC Explains 77% Of Valuation for Specialty Retailers

Sources: New Constructs, LLC and company filings

If the stock were to trade at parity with its peer group, it would be worth $57/share – an impressive 205% upside to the current stock price. Given the firm’s high margins and consistent margins, one would think the stock would garner a premium valuation. Below we’ll use our DCF model to quantify just how high shares could rise assuming conservative profit growth.

MIK Is Priced for Permanent Profit Decline

Despite the strong fundamentals and macro tailwinds, MIK is cheap, whether analyzed through traditional valuation metrics or the expectations already baked into the stock price. It its current price of $19/share, MIK has a P/E ratio of 9.9, which is well below the Consumer Cyclicals sector average of 22.5.

When we analyze the cash flow expectations baked into the stock price, we get similar findings. At its current price of $19/share, MIK has a price-to-economic book value (PEBV) ratio of 0.6. This ratio means the market expects MIK’s NOPAT to permanently decline by 40%.

This expectation seems rather pessimistic given that MIK has grown NOPAT by 6% compounded annually over the past four years. Furthermore, management expects full year EPS to grow anywhere from 1% to 7%, not fall.

Such pessimistic expectations create large upside potential. If we assume that MIK’s NOPAT margins stagnate (at 10%), and it can only grow NOPAT by 1% compounded annually over the next five years, the stock is worth $32/share today – a 68% upside. See the math behind this dynamic DCF scenario.

Given the positive impact of the recently enacted tax legislation (details below), this margin scenario should prove conservative, and the potential upside for the stock could be even greater.

Tax Reform Will Help Boosts Margins

MIK stands to benefit from tax reform more than most companies as it paid a cash tax rate of 35% in 2018, which is higher than the median S&P 500 company at 28%. If MIK can reduce its cash tax rate to the new statutory rate of 21%, it can generate 21% more NOPAT and increase its NOPAT margin from 10% to 12%. In addition to boosting margins, tax savings also provide additional capital for The Michaels Companies. Management noted it plans to invest some of the tax savings to convert certain stores to a new layout, bring e-commerce fulfillment in-house, strengthen their data analytics, and further enhance the customer experience.

Earnings Beat Could Send Shares Soaring

MIK recently dropped 19% in the three days following its most recent quarterly earnings, despite beating both top and bottom line expectations. This volatility around earnings is nothing new and could present a catalyst to send shares higher. Even better, consensus 2018 EPS expectations have fallen from $2.58/share in January to $2.28/share. Meanwhile, management expects 2018 EPS to fall within $2.19-$2.32/share. This lowered expectation provides greater opportunity for MIK to impress investors (and beat expectations) not already willing to buy into the business’ strong fundamentals.

Such an earnings beat can have a dramatic impact on the stock, as we’ve seen in the past.

- Stock jumped 13% following fiscal 3Q17 earnings

- Stock jumped 12% following fiscal 2Q17 earnings

In the meantime, investors receive a significant yield via share repurchases, as we’ll show below.

Share Repurchases Could Offer 9.5% Yield

The Michaels Companies does not pay a dividend, but instead returns capital to shareholders through share repurchases. In June 2017, the Board of Directors authorized MIK to repurchase up to $500 million. This repurchase authorization has no expiration and currently has $350 million remaining. In the last two years, MIK has repurchased $401 million and $250 million under its programs. Were the company to repurchase at the average rate of the last two years, it would repurchase $326 million, or 9.5% of the current market cap.

MIK could also be looking to increase share repurchases given that management believes the company’s stock is undervalued. On the 1Q18 conference call CEO Chuck Ruin noted that “they believe their valuation is dramatically low and its laughable how low its gone.”

Executive Compensation Plan Could be Improved but Hasn’t Led to Value Destruction

Executives receive annual bonuses that are tied to a company wide incentive goal of earnings before interest and taxes (EBIT). Each executive also has individual performance goals, which include cash flow, “improvement of operational excellence”, sales, new marketing campaign deployment, and more. Long-term equity compensation is granted through options and restricted stock units. While it’s a positive that MIK does not include misleading non-GAAP metrics in its executive compensation plan, that doesn’t mean there isn’t room for improvement.

MIK should tie performance compensation to improvement in ROIC, as there is a strong correlation between improving ROIC and increasing shareholder value[1]. Tying exec comp to ROIC also ensures that executives’ interests are properly aligned with shareholders’ interests.

However, despite using different metrics, MIK’s current plan has not led to executives getting paid while destroying shareholder value. The company has improved economic earnings, the true cash flows of the business, from $335 million in 2015 to $391 million in 2018, or 5% compounded annually.

Insider Trading is Minimal While Short Interest Shows Pessimistic Expectations

Insider activity has been minimal over the past 12 months, with six thousand shares purchased and 280 thousand shares sold for a net effect of 274 thousand shares sold. These sales represent less than 1% of shares outstanding.

There are currently 12.1 million shares sold short, which equates to 7% of shares outstanding and 2.6 days to cover. Short interest has increased 2% from the prior month but is down 24% from its 52-week high. Continued improvement in The Michaels Companies fundamentals could bring about a minor short squeeze and send shares higher.

Critical Details Found in Financial Filings By Our Robo-Analyst Technology

As investors focus more on fundamental research, research automation technology is needed to analyze all the critical financial details in financial filings. Below are specifics on the adjustments we make based on Robo-Analyst[2] findings in The Michaels Companies 2018 10-K:

Income Statement: we made $304 million of adjustments, with a net effect of removing $157 million in non-operating expense (3% of revenue). We removed $74 million in non-operating income and $230 million in non-operating expenses. You can see all the adjustments made to MIK’s income statement here.

Balance Sheet: we made $2.2 billion of adjustments to calculate invested capital with a net increase of $1.6 billion. The most notable adjustment was $1.8 billion in operating leases. This adjustment represented 138% of reported net assets. You can see all the adjustments made to MIK’s balance sheet here.

Valuation: we made $4.8 billion of adjustments with a net effect of decreasing shareholder value by $4.4 billion. Apart from $4.6 billion in total debt, which includes the $1.8 billion in operating leases noted above, the largest adjustment to shareholder value was $154 million in excess cash. The excess cash adjustment represents 4% of MIK’s market cap.

Attractive Funds That Hold MIK

The following funds receive our Attractive-or-better rating and allocate significantly to The Michaels Companies.

- ICON Consumer Discretionary Fund (ICCCX) – 2.0% allocation and Very Attractive rating.

- MFS Blended Research Mid Cap Equity Fund (BMSDX) – 1.2 allocation and Attractive rating.

This article originally published on June 27, 2018.

Disclosure: David Trainer, Kyle Guske II, and Sam McBride receive no compensation to write about any specific stock, style, or theme.

Follow us on Twitter, Facebook, LinkedIn, and StockTwits for real-time alerts on all our research.

[1] Ernst & Young’s recent white paper “Getting ROIC Right” proves the superiority of our holdings research and analytics.

[2] Harvard Business School features the powerful impact of our research automation technology in the case New Constructs: Disrupting Fundamental Analysis with Robo-Analysts.