One of the best “win-win” combinations in today’s world is Weight Watcher International’s (WTW) stock.

First, it is a winner because it helps people become healthier. They have a proven and well-recognized method for helping folks drop unwanted weight. And last, I checked, the target audience for such a service is growing rather quickly.

According to the Center For Disease Control (CDC)’s website, 35.7% of US adults were obese in 2009-2010. Also on the CDC website:

“No state has met the nation’s Healthy People 2010 goal to lower obesity prevalence to 15%. The number of states with an obesity prevalence of 30% or more has increased to 12 states in 2010. In 2009, nine states had obesity rates of 30% or more. In 2000, no state had an obesity prevalence of 30% or more.” (Source: CDC website)

As obesity has become our nation’s top health problem, WTW is positioned to create value for investors while helping people improve their health.

As detailed in “Biggest Winner of Affordable Care Act: Weight Watchers”, United Health Group (UNH) is already incorporating Weight Watchers into their anti-obesity programs. The article also points out that

- “it costs 50% more to cover medical costs for someone who is obese versus someone who is at a healthy weight” and

- obesity is the leading cost of healthcare

Consequently, I think it is safe to say that more insurers will follow UNH’s lead and make Weight Watchers part of their health care services. Probably not all insurers will go with Weight Watchers, but chances are more than good that a least a few will choose them to help keep costs down. WTW is very well-positioned to win contracts with other insurers given their experience with UNH and the scalability of their business.

Weight Watcher’s is not just for the obese. It also serves the needs of those looking to improve their image by shaving off a few pounds. WTW’s advertising includes many famous celebrities who have benefited from their product. This marketing strategy enables Weight Watchers to appeal to higher-end consumers. In an economy where consumers, of almost all spending levels, are looking to cut costs, many might turn to Weight Watchers as a lower-cost alternative to plastic surgery or liposuction.

By catering to such a wide range of potential customers, WTW’s target audience includes nearly everyone who is not already thin. That is a lot of people.

Second: WTW is a winner for investors because the valuation is cheap. The stock price is giving WTW no credit for being able to grow its business. At about $50/share the stock price implies the company will not grow its profits beyond their 2011 level. In other words, the market is pricing 0% profit growth for WTW for the rest of its corporate life.

That positions the stock with significant upside.

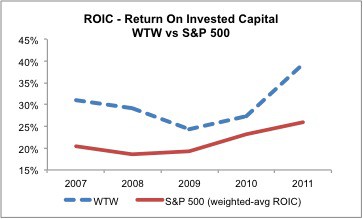

This story gets better as few investors realize the high returns on invested capital (ROIC) achieved by this company. It’s ROIC rivals that of some of my favorite tech companies like Google (GOOG) and Lam Research (LRCX). I like to think of WTW as almost like a software company. They have recipes for food (like code) that they can distribute to a nearly infinite number of customers with very low marginal costs. True, preparing and delivering a meal is more costly than copying code from one computer to the next, but not that much more. And WTW’s ROIC shows that it can prepare and deliver meals quite efficiently.

A high ROIC also translates into faster profit growth for a given level of revenue growth than lower ROIC companies. In addition, WTW’s business model can scale more easily than more capital-intensive businesses.

Figure 1 shows that WTW’s ROIC has been consistently higher than that of the market-weighted average of the current S&P 500 companies over the past 5 years. In 2011, WTW’s ROIC rose much more than the S&P 500’s ROIC. That is an impressive achievement.

The combination of large growth potential, a cheap valuation and a highly-scalable make WTW a great investment opportunity.

My rating on the stock is Very Attractive. It also made my Most Attractive Stocks list for July. Click here for more details on my WTW rating and my top-rated ETFs and funds that hold WTW.

Disclosure: I am long WTW, GOOG and LRCX. I receive no compensation to write about any specific stock, sector or theme.