One of the biggest misconceptions in the investing world is that the merit of an acquisition should be judged by whether or not it is “earnings accretive”. The impact of an acquisition on a company’s accounting earnings is not indicative of its economic value to shareholders.

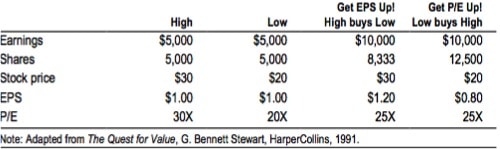

“To illustrate the point, we turn to the so-called ‘high-low fallacy.’ This simple exercise shows the impact of combining two ‘businesses’—one with a high price/earnings multiple (P/E) and one with a low P/E—in a stock-for-stock deal. Assuming no acquisition premium or synergy between the operations, it can be demonstrated that management can either increase earnings—High buys Low—or increase the P/E—Low buys High.[1]”

Here is the webinar and copy of the excel file that shows the math and proves this assertion.

Figure 1 clearly demonstrates the simple math behind how acquisitions can be accretive without any consideration whatsoever to the economic impact of a deal.

Figure 1: The High-Low Fallacy

Sources: Credit Suisse First Boston, Frontiers of Finance, “Let’s Make a Deal”, Michael Mauboussin, page 7

The take-away for investors is: do not be fooled by the misleading increase in BHI’s reported earnings. The economics of the business have taken a turn for the worse, and, eventually, the stock price will drop to reflect that decline.

In fact, the stock price decline could be rather severe given the unrealistically high future cash flow expectation reflected in its valuation.

1 Response to "The High-Low Fallacy: Don’t Believe the Merger Hype"

[…] discussed the High-Low Fallacy on this blog before. The fact that an acquisition is “earnings accretive” does not make it […]