We published an update on this Long Idea on May 5, 2021. A copy of the associated Earnings Update report is here.

In May 2017, we featured this large-cap biotech stock due to its industry leading position, strong cash flow, and faster growth than traditional pharma. Best of all, the stock’s valuation provided significant upside.

Since then, the stock has more than doubled the performance of the S&P 500 (up 17% vs. S&P up 7%) and helped us earn the #1 ranking for Healthcare stock pickers on SumZero. Now, the stock looks expensive by traditional metrics, but our cash flow adjustments reveal that it’s still cheap. Value investing may be tougher, but this stock was and is an excellent value investment. Amgen (AMGN: $190/share) is this week’s Long Idea.

AMGN’s Economic Earnings Remain Strong

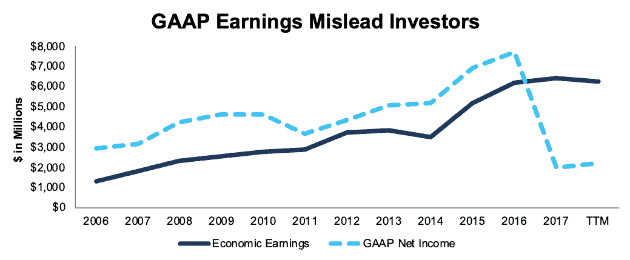

AMGN has been a profitable and fast-growing company for years, based on any metric. From 2006 to 2016, the company grew GAAP earnings by 10% compounded annually. AMGN’s economic earnings – the true cash flows of the business – grew at an even more impressive 17% compounded annually over that same time.

As Figure 1 shows, however, GAAP earnings declined sharply in 2017 even as economic earnings remained strong.

Figure 1: AMGN GAAP vs. Economic Earnings Since 2006

Sources: New Constructs, LLC and company filings

GAAP earnings significantly understate the company’s true profitability for 2017 and the trailing twelve months (TTM) period due to a number of non-recurring expenses. Most notably, the company incurred a $6.1 billion (26% of revenue) charge due to the new tax law. In addition, AMGN faced $634 million (3% of revenue) in non-recurring expenses due to restructuring, damage to one of its facilities from Hurricane Maria, and write-downs.

GAAP earnings per share are down 71% TTM. Meanwhile, even though economic earnings are slightly lower TTM than they were in 2017, economic earnings per share are still up 11% year-over-year.

Capital Discipline Rewards Investors

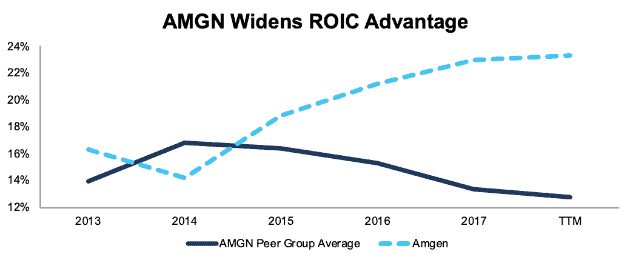

Income statement adjustments explain most of the difference between AMGN’s GAAP net income and economic earnings, but we also need to look at the balance sheet to get the full picture. AMGN has consistently grown net operating profit after tax (NOPAT) for decades, but over the past few years the company has managed this feat while also reducing its invested capital.

Since 2013 – after AMGN completed its $9.5 billion acquisition of Onyx – the company has grown NOPAT from $5.8 billion to $9 billion TTM (a 55% increase), while decreasing its invested capital from $47.8 billion in 2013 to $37.7 billion TTM (a 21% decrease). That decrease in invested capital represents $10 billion (8% of market cap) in cash freed up to return to shareholders.

The combination of rising NOPAT and declining invested capital means that AMGN’s return on invested capital (ROIC) has risen from 16% in 2013 to 23% TTM. As Figure 2 shows, AMGN’s rising ROIC stands in contrast to the peer group in its proxy statement, which has seen ROIC fall since 2013.

Figure 2: AMGN’s ROIC Vs. Peers

Sources: New Constructs, LLC and company filings

Corporate Governance Drives ROIC Advantage

It’s no accident that AMGN has outperformed peers in terms of ROIC over the past three years. That outperformance stems from a deliberate decision by the company to prioritize efficient capital allocation and transform itself from a growth-focused company to an efficient, cash generating machine.

When AMGN’s compensation committee designed its long-term bonus program for 2017-2019, the company used EPS growth, operating margin, and non-GAAP expense as the target metrics for the first two years. However, in 2019, non-GAAP expense will be replaced with ROIC in order to “support our transformation strategic priority to deliver an efficient, disciplined business model.”

This focus on improving ROIC will align the interests of executives and shareholders and ensure prudent stewardship of capital. ROIC is the primary driver of valuation.[1] There is also a strong correlation between improving ROIC and increasing shareholder value, a fact highlighted in our recent article “CEO’s That Focus on ROIC Outperform.”

Drug Pipeline Remains Strong

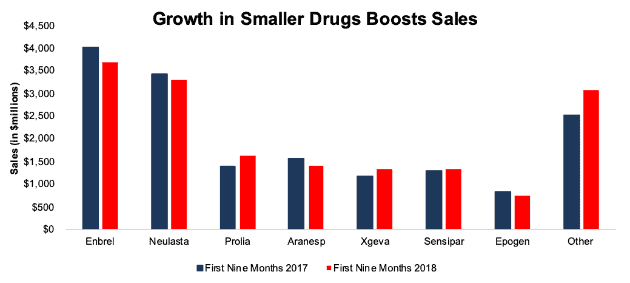

In our original article, we addressed the potential bear case of slowing sales for AMGN’s largest drug, the arthritis treatment Enbrel. As it turns out, bears were correct to be worried about Enbrel. Sales for the drug are down 8% year over year through the first nine months of 2018. However, overall drug sales are still up 2% year over year.

As Figure 3 shows, several of AMGN’s smaller drugs have risen to offset the decline of Enbrel.

Figure 3: Year-Over-Year Sales of AMGN’s Drugs

Sources: New Constructs, LLC and company filings

Osteoperosis treatments Prolia and Xgeva grew sales by 17% and 12%, while the collection of smaller drugs under the “Other” label are up 22%. Standouts from this group include the cancer treatment Bincyto (up 29%) and the cholesterol drug Repatha (up 77%).

Offsetting Price Declines with Volume

The high growth of Repatha is especially notable since AMGN announced in October that it was cutting the price of the cholesterol medication by 60%. AMGN’s executives weren’t satisfied with the drug’s growth and viewed the price cut as a way to expand the drug’s reach and make its copay more affordable for Medicare patients.

Pricing pressure remains the most significant risk for any company in the biotech/pharmaceutical industry. Competition from generics and the ever-present threat of government regulations put the high industry margins (which typically range from 30-40%) at risk.

Amgen’s superior profitability gives it more flexibility compared to its peers if prices decrease further. The company can afford to lower its prices by a greater amount in order to maintain market share, as evidenced by its move with Repatha.

More broadly, Amgen has taken concrete steps to be able to compete in a more price-driven world by developing a portfolio of 10 biosimilars – near-copies of existing products – that could have an addressable market of up to $65 billion.

No matter what happens with drug prices, demand will continue to rise. The 65+ population in the U.S. is projected to grow from ~50 million today to 78 million in 2035, and seniors will soon outnumber children. AMGN’s price cuts and investments in biosimilars should enable it to serve a larger portion of this demand and expand its market share to offset potential pricing pressure.

Traditional Value Metrics Mislead Investors

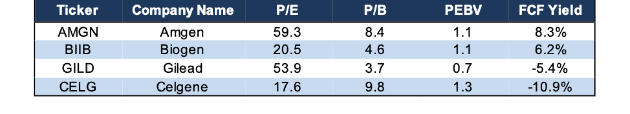

We’ve recently written about how price to earnings (P/E) and price to book (P/B) ratios mislead investors because they rely on flawed GAAP numbers. These ratios are especially misleading for AMGN. As discussed above, non-recurring expenses significantly distort its reported earnings. The company’s accounting book value is similarly misleading, as the most valuable asset for any biotech is its intellectual property, which is only carried on the balance sheet if it comes through an acquisition.

When we look at AMGN through the lens of price to economic book value (PEBV) – which compares the market’s valuation of the business to its zero-growth value – and free cash flow yield, we get a much different picture.

Figure 4 compares AMGN to its three largest biotech peers: Gilead (GILD), Biogen (BIIB), and Celgene (CELG). It shows that AMGN has the highest P/E and the second-highest P/B of the group, but it has the second-lowest PEBV and the best free cash flow yield.

Figure 4: AMGN’s Valuation Compared to Peers

Sources: New Constructs, LLC and company filings.

When we wrote our original article, AMGN was cheap by both our metrics and traditional metrics, as it had a P/E of 14.3 and a P/B of 3.6. Even though the traditional metrics now look worse, a close examination of the cash flows shows that AMGN is still a value.

Cheap Valuation Creates Potential Upside

At its current valuation of ~$190/share, AMGN has a PEBV of 1.1. This ratio implies that the market expects the company’s NOPAT to grow by no more than 10% for the remainder of its corporate life. For a company that grew NOPAT by 14% compounded annually between 2002-2017, such a low expectation seems overly pessimistic.

Even in the worst-case scenario where pricing pressure drops AMGN’s NOPAT margin from 39% down to 24% – in-line with a generic drug producer like Mylan (MYL) – the company can still justify its valuation by growing revenue by 9% compounded annually for a decade. See the math behind this dynamic DCF scenario.

9% compounded annual revenue growth is ambitious, but not unrealistic for a company that is expanding product lines and taking market share in an already growing industry. AMGN’s cheap valuation means that even if bears’ worst fears about drug prices come true, the downside is limited.

However, it seems unlikely that such a dramatic decrease in margins is on the horizon. Innovation remains key to improving healthcare outcomes, and that means companies should expect to earn a premium for developing innovative new treatments.

If AMGN’s NOPAT margin declines from 39% to 36% (where it was in 2015), and the company grows revenue at 4.5% compounded annually for the next decade (in-line with projected industry growth), the stock is worth $226/share today, a 21% upside from the current price. See the math behind this dynamic DCF scenario.

What Noise Traders Miss with AMGN

In general, markets aren’t good at identifying quality capital allocation that creates value and shareholder friendly corporate governance. Instead, due to the proliferation of noise traders, markets are great at amplifying volatility, and therefore risk, in popular momentum stocks, while high-quality unconflicted & comprehensive fundamental research is overlooked. Here’s a quick summary for noise traders when analyzing AMGN:

- Transformation from a growth-driven business to a company focused on efficiency and capital allocation, as evidenced by its executive compensation plan.

- Undervalued stock price – AMGN’s P/E and P/B ratios look high relative to its peers, but these ratios are misleading.

- Strong drug pipeline to offset decline in top products.

Volume Gains Could Boost Shares

Due to the large amount of media attention given to the price cut for Repatha, that drug’s performance could have an outsized impact on near-term results. If the drug can reach enough new patients to offset the impact of the price cut, that would send a bullish signal to long-term investors and push shares higher.

In addition, the results of AMGN’s biosimilar investments could have a big impact on shares in 2019. We highlighted biosimilars as a potential long-term catalyst in our original article, and now they should start to have a tangible impact on results. The company launched its first two products – Kanjiti and Amgevita – in Europe in 2018, with eight others set to come in the near future. Strong growth from this new business line could provide earnings beats and stock price appreciation in 2019.

Share Repurchases Plus Dividends Could Provide Upwards of 16% Yield

AMGN has increased its dividend in each of the past seven years. It’s annualized dividend has grown from $1.88/share in 2013 to an announced $5.80/share in 2019, or 21% compounded annually. The current dividend provides a 2.8% yield. This impressive track record of growth, combined with the company’s strong free cash flow, earns it a spot in our Dividend Growth Model Portfolio.

In addition to dividends, AMGN returns capital to shareholders through share repurchases. Over the past year, AMGN has bought back $16.5 billion (13.6% of market cap) worth of shares. The company’s new commitment to capital discipline means returning more capital to shareholders rather than overinvesting in unprofitable projects. The company’s continued growth and investments in biosimilars shows it can grow the business while returning such a large amount of money to shareholders.

Combined with the dividend, AMGN’s buybacks give the stock an impressive 16% yield.

Insider Trading and Short Interest Trends

There is little insight to be gained from recent insider trading trends, as they have been minimal. Over the past 12 months, 131 thousand shares have been sold and 211 thousand have been purchased. These purchases represent less than 1% of shares outstanding.

Short interest trends are similarly minimal. There are currently 10 million shares sold short, which equates to 2% of shares outstanding and four days to cover. Short interest has stayed relatively consistent over the past year.

Critical Details Found in Financial Filings by Our Robo-Analyst Technology

As investors focus more on fundamental research, research automation technology is needed to analyze all the critical financial details in financial filings. Below are specifics on the adjustments we make based on Robo-Analyst[2] findings in Amgen’s fiscal 2017 10-K:

Income Statement: we made $7.1 billion of adjustments, with a net effect of removing $6.9 billion in non-operating expense (30% of revenue). We removed $110 million in non-operating income and $7 billion in non-operating expenses. You can see all the adjustments made to AMGN’s income statement here.

Balance Sheet: we made $48.4 billion of adjustments to calculate invested capital with a net decrease of $34.3 billion. The most notable adjustment was $41.4 billion in excess cash. This adjustment represented 58% of reported net assets. You can see all the adjustments made to AMGN’s balance sheet here.

Valuation: we made $81.9 billion of adjustments with a net effect of decreasing shareholder value by $850 million.

Attractive Funds That Hold AMGN

The following funds receive our Attractive-or-better rating and allocate significantly to AMGN.

- Live Oak Health Sciences Fund (LOGSX) – 7.7% allocation and Very Attractive rating.

- White Oak Select Growth Fund (WOGSX) – 6.5% allocation and Attractive rating

- Smead Value Fund (SVFFX) – 6.3% allocation and Very Attractive rating

- Invesco Dynamic Pharmaceuticals ETF (PJP) – 5.3% allocation and Very Attractive rating

This article originally published on December 19, 2018.

Disclosure: David Trainer, Kyle Guske II, and Sam McBride receive no compensation to write about any specific stock, style, or theme.

Follow us on Twitter, Facebook, LinkedIn, and StockTwits for real-time alerts on all our research.

[1] Ernst & Young’s recent white paper “Getting ROIC Right” proves the superiority of our holdings research and analytics.

[2] Harvard Business School features the powerful impact of our research automation technology in the case New Constructs: Disrupting Fundamental Analysis with Robo-Analysts.