Ever since Netflix (NFLX: $354/share) launched its first original series with House of Cards in 2013, the streaming service has put its original content front and center. Executives cherry pick impressive stats for their originals (without giving access to comprehensive viewing data), and their quarterly reports now regularly feature charts showing the Instagram followers of young actors launched to fame through Netflix originals.

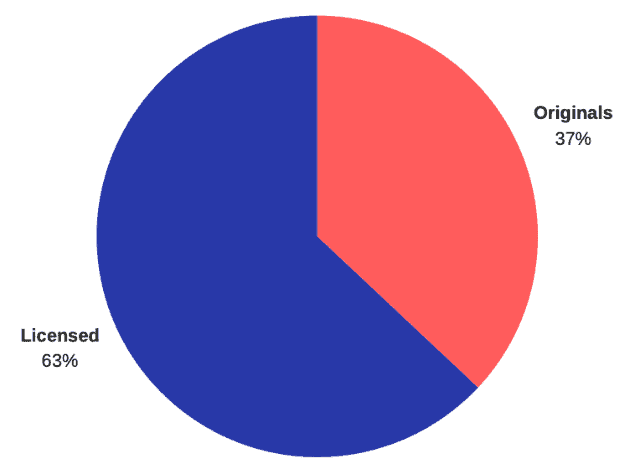

Given all this emphasis on originals, it might come as a surprise that licensed content accounts for nearly 2/3 of viewing hours on Netflix. Despite spending billions of dollars on original content, Netflix still relies heavily on classic shows like The Office, Friends, and Grey’s Anatomy.

Figure 1: Licensed Content Use Dominates Netflix Originals

Source: 7Park Data

As legacy media companies pull these shows to launch their own streaming services, Netflix could lose much of its value to consumers just as the competition heats up.

The Value of Licensed Content

Netflix has been preparing for the loss of its licensed content for years. As the company’s Chief Content Officer, Ted Sarandos, said on the company’s Q4 2018 earnings call:

“Our early investment in doing original content more than six years ago was betting that… there would come a day when the studios and networks may opt not to license us content in favor of maybe creating their own services.”

However, the company’s push into original content hasn’t ended its reliance on licensed content. As Figure 2 shows, licensed TV shows accounted for 3 of the top 4 streaming series on Netflix for November 2018.

Figure 2: Most Streamed Shows on Netflix in the U.S. for November 2018

Source: 7Park Data

Netflix reportedly paid $100 million to keep Friends on its service for 2019, more than triple its previous licensing fee of $30 million. While that’s a hefty price tag, Figure 2 shows just how critical the classic sitcom is to Netflix’s subscriber base. Even though it’s been off the air almost 15 years, it still gets watched more than the vast majority of Netflix’s new releases.

Unfortunately for Netflix, it won’t be able to keep Friends forever. Warner Media – now a part of AT&T (T) – plans to launch a streaming service later this year. Disney (DIS), which owns Grey’s Anatomy, will also launch its streaming service in 2019, while NBC Universal (CMCSA) will likely want to reclaim the rights to The Office when it launches its own service in 2020.

What happens to Netflix when it loses the shows that drive the majority of its viewing hours? Not only do licensed shows account for 63% of viewing hours, as recently as 2017 over 40% of Netflix subscribers in the U.S. almost exclusively watched licensed content. Even if that number has been cut in half over the past year, that still leaves 1 in 5 domestic Netflix subscribers (almost 12 million people) that almost never engage with the roughly 700 original TV shows the company produced last year.

In fact, the sheer number of Netflix originals might be making the licensed content problem even worse. Research suggests that when consumers are presented with an overwhelming array of content, they tend to retreat to the programs that are most familiar to them.

Spending More Money Won’t Make the Licensed Content Problem Go Away

Even though Netflix was early to recognize the risk of media competitors pulling their licensed content, the company now seems reluctant to acknowledge that its original content strategy has not solved the problem. When he acknowledged that Netflix’s original content strategy aimed to help offset the loss of licensed content, Sarandos also said:

“The vast majority of the content that is watched on Netflix are our original content brands.”

As the statistics we cited above show, this answer is simply untrue. Sure enough, CEO Reed Hastings quickly stepped in to correct Sarandos, clarifying:

“In unscripted (i.e. reality TV) now, it’s our first category, where a majority of the viewing is a branded original, in the other categories we’re climbing, not yet at a majority, but on track for it.”

Huge New Content Spending Not Adding Enough Subscribers

Netflix spent $13 billion on content last year, with 85% of new spending earmarked for originals. For that much money, they should be more than just “on track” to have originals be the majority of viewing in every category.

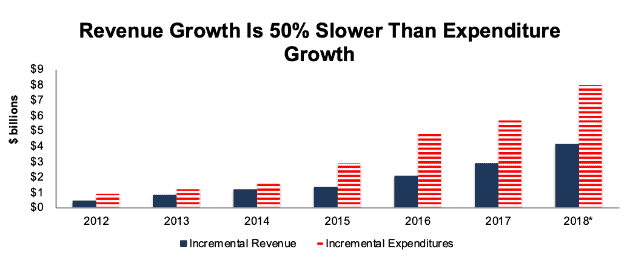

Rather than acknowledge the limitations of their strategy, however, Netflix appears determined to throw more money at the problem. Netflix hasn’t given a specific content budget for 2019, but they expect content costs to continue growing at a similar trajectory, which would put the company on pace to spend $17.5 billion this year. As Figure 3 shows, Netflix’s revenues are not growing fast enough to cover its rising expenses.

Figure 3: Subscriber Growth Is Not Enough to Cover New Content Spending

Sources: New Constructs, LLC and company filings.

As a result of rising content costs, Netflix has been forced to raise its prices, which only serves to make the upcoming streaming services from Disney, Warner Media, and NBC Universal more viable. Over the next year, Netflix will charge customers more while at the same time likely losing some of its most valuable content and facing several formidable new challengers. The company’s subscriber growth is already slowing, and we expect this trifecta of challenges to hurt it even more.

At its current valuation, Netflix can’t afford a further slowdown in subscriber growth. As our reverse DCF model shows, Netflix needs to reach ~500 million subscribers (roughly triple its current count) to justify its valuation. Given the competitive landscape it faces, we don’t think such a scenario is likely.

This article originally published on March 7, 2019.

Disclosure: David Trainer, Sam McBride and Kyle Guske II receive no compensation to write about any specific stock, sector, style, or theme.

Follow us on Twitter, Facebook, LinkedIn, and StockTwits for real-time alerts on all our research.

4 replies to "Loss of Licensed Content Is an Underrated Crisis for Netflix"

Comment removed at user’s request.

Disney’s decision to include entire Disney motion picture library, including those traditionally in “the vault,” in its Disney+ service only it makes it a more formidable competitor https://www.macrumors.com/2019/03/08/disney-streaming-platform-to-host-entire-library/

I don’t know that it will ever be safe to short Netflix. Shorting stocks is an inherently risky activity, and the market has repeatedly demonstrated that it’s willing to look past Netflix’s high costs and negative cash flows. However, the stock is down 17% from its peak, and the combination of new competitors and the loss of licensed content over the next year represents a significant potential catalyst.

Our micro-bubble thesis in action – Disney up 11% and Netflix down 4% after Disney reveals pricing and content plans for Disney+