Uber’s (UBER) stock fell 12% after it missed expectations on bookings, revenue, and users when it reported earnings on August 8. The stock has continued to decline and recently hit an all-time low of $34/share, 25% below its IPO price of $45/share.

Uber’s slowing growth and mounting losses reaffirm our belief that this stock has no viable path to justifying its valuation. Even after the stock’s post-IPO decline, it remains significantly overvalued.

Numbers Don’t Back Up Growth Story

We’re not going to talk about Uber’s losses here, even though the amount of money the company loses (its operating cash flow was -$1.6 billion through Q2) is astonishing. Everyone knows Uber loses money. At this point, the amount of money you’re able to lose seems to be a point of pride in Silicon Valley.

Instead, let’s talk about the story Uber wants to highlight for investors. According to Uber, they are still in the early stages of capturing what they estimate to be a $12 trillion (yes, that’s trillion with a “T”) total addressable market that includes personal mobility, food delivery, and freight shipping. For context, the World Bank estimates that global GDP was ~$80 trillion in 2017. Uber is saying they think they can capture 15% of global economic activity.

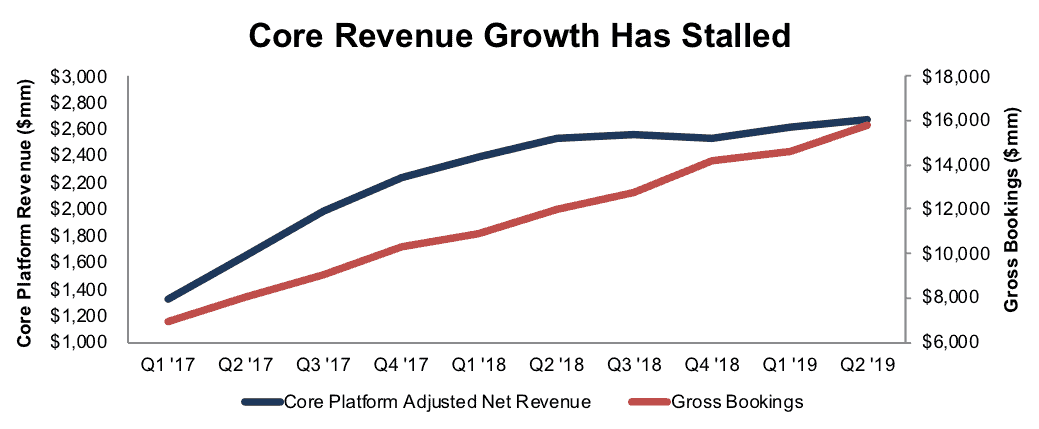

If that goal was remotely feasible, and Uber was at less than 1% of its total addressable market, you’d expect the company’s revenue growth to be rapidly accelerating. Instead, Uber’s revenue growth rate declined from 106% in 2017 to 42% in 2018, and it declined even further to just 14% year-over-year in Q2. Even that number overstates Uber’s growth, as it doesn’t account for the extra incentives given to drivers. Uber’s Core Platform Adjusted Net Revenue, which strips out driver incentives, grew by just 39% in 2018, and by just 7% YoY in Q2.

Figure 1: UBER Adjusted Net Revenue and Gross Bookings: Q1 ’17 – Q2 ‘19

Sources: New Constructs, LLC and company filings

Uber’s Gross Bookings – the total amount of money spent by users on the platform – is also experiencing slower growth. Gross bookings increased by 31% YoY in Q2, down from its 49% growth rate a year ago.

Uber’s slowing growth rate for Gross Bookings – and its even slower growth rate for Adjusted Net Revenue – shows the key problem with Uber’s theory of world domination: as Uber tries to protect and expand its market share around the world, it’s giving up a larger share of revenue to drivers and restaurants, a trend we expect to continue unabated.

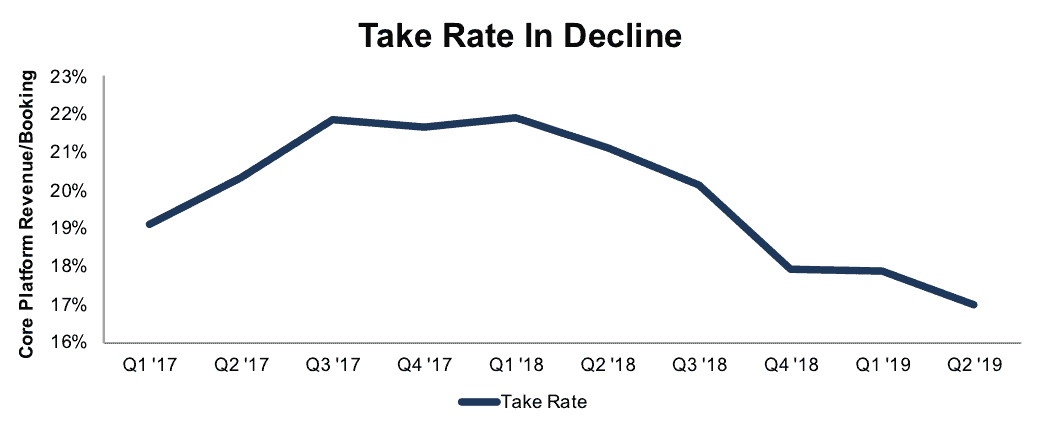

Alarming Decline in “Take Rate” Will Continue

Uber’s Take Rate, the percentage of Gross Bookings it captures as Core Platform Adjusted Net Revenue, has been in steady decline throughout 2018. Figure 2 shows that the company’s take rate declined from 22% in Q1 2018 to 17% in the most recent quarter.

Figure 2: UBER Take Rate: Q1 ’17 – Q2 ‘19

Sources: New Constructs, LLC and company filings

Uber’s declining Take Rate over the past year and a half stands in stark contrast to 2017, when its Take Rate increased from 19% to 22% over the course of the year.

It’s not hard to see what caused this reversal. Uber’s attempt to squeeze drivers in 2017, along with a series of PR disasters that led to the #DeleteUber campaign, drove both riders and drivers to other platforms, like Lyft. According to data firm Second Measure, Uber’s share of the U.S. rideshare market declined from 82% at the beginning of 2017 to 71% at the end of the year.

The U.S. rideshare market is not the only market where Ube is losing share. Internationally, the company has been forced to throw in the towel in China, Russia, and Southeast Asia in recent years. Meanwhile, Uber Eats is losing share to DoorDash domestically.

Uber’s added incentives for riders and drivers have helped stem the market share losses – its domestic market share declined by a smaller amount, from 71% to 67%, in 2018. Despite its efforts to improve its image, Uber’s brand still has a worse reputation than Lyft with consumers, and its drivers recently went on strike in Los Angeles. It’s no surprise that Uber drivers are upset, as one recent study suggests they only earn ~$9/hour after accounting for all costs involved.

In light of these ongoing struggles, one line from Uber’s latest 10-Q stood out. On page 63, Uber writes:

“As we aim to reduce Driver incentives to improve our financial performance, we expect Driver dissatisfaction will generally increase.”

Uber can’t achieve profitability without squeezing drivers, but if it tries to squeeze drivers it will lose market share. With wages rising at the fastest pace in a decade – and growing even faster for low earners – it seems likely that Uber’s take rate will continue to decline.

Companies like Bolt in Europe have shown that it’s possible to operate a ridesharing app profitably, but you can’t do so while simultaneously trying to achieve a dominant market share worldwide. Uber can be a huge company, or it can be a profitable company, but it can’t be both.

Uber Has No Competitive Advantages

Uber’s declining market share and take rate highlight the core problem the company faces: it has no real competitive advantage that will allow it to earn a sustainably high return on invested capital (ROIC). Uber bulls would dispute this claim. They’ll argue that the company’s scale gives it a network effect that will lead to a long-term competitive advantage.

Uber even makes this claim explicitly, writing on Page 152 of its S-1:

“Our strategy is to create the largest network in each market so that we can have the greatest liquidity network effect, which we believe leads to a margin advantage.”

Uber believes that as it grows its user base, it gains a competitive advantage over its rivals. Riders want to use a platform with lots of drivers, which minimizes wait times, and drivers want to use a platform with lots of riders so they have consistent fares. In theory, by achieving the largest scale, Uber’s network should represent a sustainable competitive advantage over its rivals.

In practice, Uber is losing billions of dollars of a year and its market share is declining. The company’s fundamentals certainly don’t back up the idea that it has any real competitive advantage. There are two key reasons why network effects don’t make much of a difference in the ridesharing space:

- Low Switching Costs: It is easy for both drivers and riders to use multiple ridesharing apps. Roughly 70% of drivers work for both Uber and Lyft, and smaller services such as Juno have easily grown by piggybacking off that network. The only switching cost involved for users of these platforms is the time it takes to close one app and open another. Switching cost are inconsequential for drivers too, especially for new rideshare apps that can use driver ratings from Lyft and Uber as a lower-cost way to screen drivers.

- No Scale Effects: The bulk of Lyft and Uber use comes within a single city. In fact, Uber discloses that 24% of its bookings comes from just five cities: New York, San Francisco, LA, London, and Sao Paolo. The localized nature of the ridesharing industry means that competitors can make inroads by focusing on a single city. If a startup can attract enough riders and drivers in a single city, it doesn’t matter if Uber has a superior network worldwide.

Valuation Is Almost Impossible to Justify

Even after its disappointing IPO and the subsequent decline in the stock price, Uber remains significantly overvalued with a market cap of $58 billion. In addition, it has several liabilities, both hidden and on the balance sheet that inflate its valuation further, including:

- $6.5 billion in total debt, which includes $2 billion in operating lease liabilities (Uber’s reported operating lease liability on the balance sheet understates its real liability due to its unusually high discount rate of 7.2%)

- $1 billion in deferred tax liabilities

- $1 billion in outstanding employee stock option liabilities

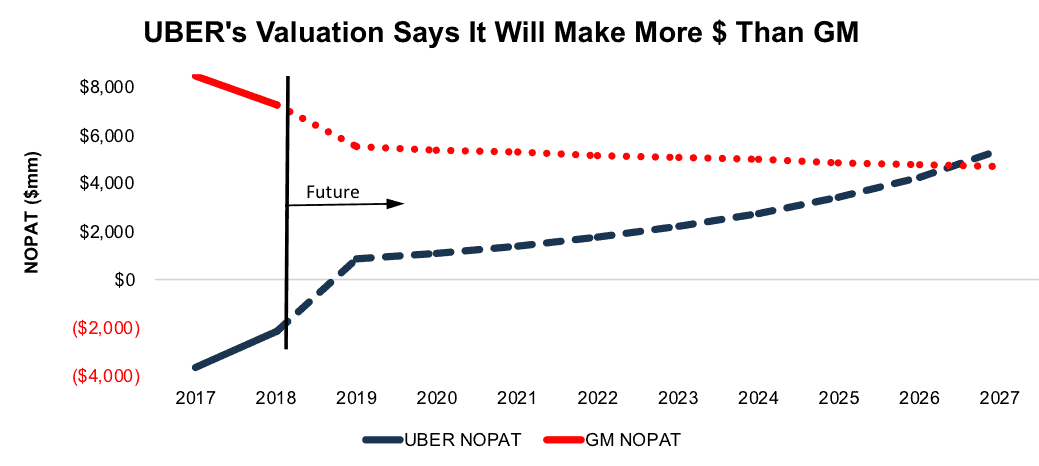

Including these liabilities, Uber has an enterprise value of ~$70 billion. The company’s slowing growth and huge losses can’t justify this valuation, so Uber has tried to tout the promise of self-driving cars instead. However, there’s no reason to believe they have an advantage and chance of making money in this industry, either. In fact, analysis from Navigant shows Uber lagging far behind leaders such as GM Cruise (GM) and Waymo (GOOGL) in the self-driving space.

The most reasonable path we see to profitability for Uber is a scenario where the company manages to create duopolies/oligopolies with competitors in its various markets, a la the airline industry after consolidation.

If we assume Uber can earn airline-like pretax margins of 8 (current pre-tax margins are -24%), the company must grow revenue by 25% compounded annually for the next 9 years to justify its valuation. See the math behind this dynamic DCF scenario.

In this scenario, Uber would earn $84 billion in revenue in 2027. At its Q2 take rate, that equates to over $490 billion in gross bookings. Meanwhile, Goldman Sachs estimates that the total size of the global ridesharing industry will be just $285 billion in 2030.

Figure 3 compares the historical and future NOPAT for Uber and GM. It shows that even though GM earned $7 billion in NOPAT last year and UBER lost $3 billion, the market expects Uber to be the more profitable company by 2027. Note that this performance is what is already baked into the stock price. To buy Uber at $34/share, investors are betting that Uber will exceed the already-high expectations in the current price. We find it hard to make that bet.

Figure 3: UBER vs. GM: Actual and Market-Implied NOPAT

Sources: New Constructs, LLC and company filings

As with Lyft, we think the ceiling on Uber’s valuation is the amount of capital it took to build out its platform. The company’s prospects for profitability on its own are slim, so its best chance is to partner with/be acquired by a larger company like Alphabet that develops its own self-driving technology. In this scenario, the acquiring company asks the inevitable “build or buy” question: should we pay $70 billion for Uber or spend $22 billion, what Uber spent to get to where it is today?

There are many good arguments that one could build the equivalent of Uber’s network with a lot less capital. Look no farther than Bolt in Europe, which has only spent $100 million (and is actually making money) to build a user base larger than Lyft’s.

The bottom line: it is hard to justify paying anything more than $22 billion for Uber, a 65% downside to the current market valuation.

Critical Details Found in Financial Filings by Our Robo-Analyst Technology

As investors focus more on fundamental research, research automation technology is needed to analyze all the critical financial details in financial filings. Below are specifics on the adjustments we make based on Robo-Analyst[1] findings in Uber’s S-1:

Income Statement: we made $8 billion of adjustments, with a net effect of removing $3.1 billion in non-operating income (27% of revenue). Our biggest adjustment was the removal of a $3.2 billion gain on sale of the company’s Southeast Asia business. You can see all the adjustments made to UBER’s income statement here.

Balance Sheet: we made $10 billion of adjustments to calculate invested capital with a net decrease of $1.9 billion. You can see all the adjustments made to UBER’s balance sheet here.

Valuation: we made $12.4 billion of adjustments with a net effect of decreasing shareholder value by $11.7 billion. You can see all the adjustments made to UBER’s valuation here.

This article originally published on August 14, 2019.

Disclosure: David Trainer, Kyle Guske II, and Sam McBride receive no compensation to write about any specific stock, style, or theme.

Follow us on Twitter, Facebook, LinkedIn, and StockTwits for real-time alerts on all our research.

[1] Harvard Business School Features the powerful impact of research automation in the case study New Constructs: Disrupting Fundamental Analysis with Robo-Analysts.