For the week of 2/24/20-2/28/20, we focus on the Earnings Distortion Scores for 55 companies.

Our proprietary measure of earnings distortion leverages cutting-edge ML technology featured in Core Earnings: New Data & Evidence. This paper empirically concludes that our adjusted core earnings is superior to:

- “Street Earnings” from Refinitiv’s IBES, owned by Blackstone (BX) and Thomson Reuters (TRI), and

- “Income Before Special Items” from Compustat, owned by S&P Global (SPGI)

The paper also shows that investors with better earnings research have a clear advantage in predicting:

- Future earnings (Section 3.4)

- Future stock prices (Section 4.3)

Our Earnings Distortion Scores[1] empower investors to make smarter investments with superior data as well as defend against management efforts to obfuscate financial performance. The aggregate level of earnings distortion recently reached levels not seen since right before the tech bubble and the financial crisis.

Weekly Earnings Distortion Insights

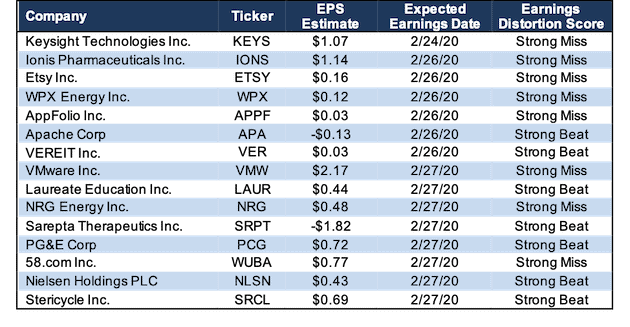

Figure 1 contains the 15 largest (by market cap) companies that earn a “Strong Beat” or “Strong Miss” Earnings Distortion Score and are expected to report the week of February 24, 2020. These stocks are most likely to beat/miss expectations.

Figure 1: Earnings Distortion Scorecard Highlights: Week of 2/24/20-2/28/20

Sources: New Constructs, LLC and company filings

The appendix shows the Earnings Distortion Scores for all the S&P 500 companies, plus those with market caps greater than $10 billion, that are expected to report the week of February 24, 2020.

Details: APA’s Earnings Distortion

Over the trailing twelve months (TTM), Apache Corporation (APA: $28/share) had -$1.2 billion in net earnings distortion that cause earnings to be understated. Notable unusual expenses both hidden and reported in APA’s filings include:

- $511 million in impairments associated with the company redirecting capital from non-core assets 2018 10-K

- $240 million in impairments associated with the sale of Western Anadarko Basin assets 2Q19 10-Q

- $88 million in hidden total restructuring expenses, net - related to unproved leasehold impairments and dry hole expenses 2018 10-K

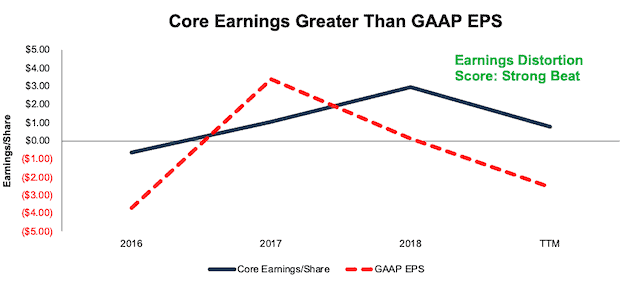

In total, we identified $3.28/share (>100% of reported EPS) in net unusual expenses in APA’s TTM GAAP results. After removing this earnings distortion from GAAP net income, we see that APA’s TTM core earnings of $0.74/share are significantly higher than GAAP EPS of -$2.53, per Figure 2.

With understated earnings, and a “Strong Beat” Earnings Distortion Score, APA is likely to beat consensus expectations. While APA looks like a good bet to beat expectations, we aren’t necessarily optimistic about the company’s long-term prospects. The company earns our Unattractive Risk/Reward Rating due to its low return on invested capital (ROIC) and high expectations for future profit growth baked into the stock price. Accordingly, the stock still looks risky for long-term investors.

Figure 2: APA Core Earnings Vs. GAAP: 2015 – TTM

Sources: New Constructs, LLC and company filings

Figure 1 shows that APA is one of seven companies that earn our “Strong Beat” rating for this week. Eight companies earn our “Strong Miss” rating for this week.

How to Make Money with Earnings Distortion Data

“Trading strategies that exploit {adjustments provided by New Constructs} produce abnormal returns of 7-to-10% per year.” – Page 1 in Core Earnings: New Data & Evidence

In Section 4.3, professors from HBS & MIT Sloan present a long/short strategy that holds the stocks with the most understated EPS and shorts the stocks with the most overstated earnings.

This strategy produced abnormal returns of 7-to-10% a year. Click here for more details on our data offerings.

We Provide 100% Audit-ability & Transparency

Clients can audit all of the unusual items used in our calculations in the Marked-Up Filings section of each of our Company Valuation models. We are 100% transparent about what goes into our research because we want investors to trust our work and see how much goes into building the best earnings quality and valuation models.

This article originally published on February 17, 2020.

Disclosure: David Trainer, Kyle Guske II, and Matt Shuler receive no compensation to write about any specific stock, sector, style, or theme.

Follow us on Twitter, Facebook, LinkedIn, and StockTwits for real-time alerts on all our research.

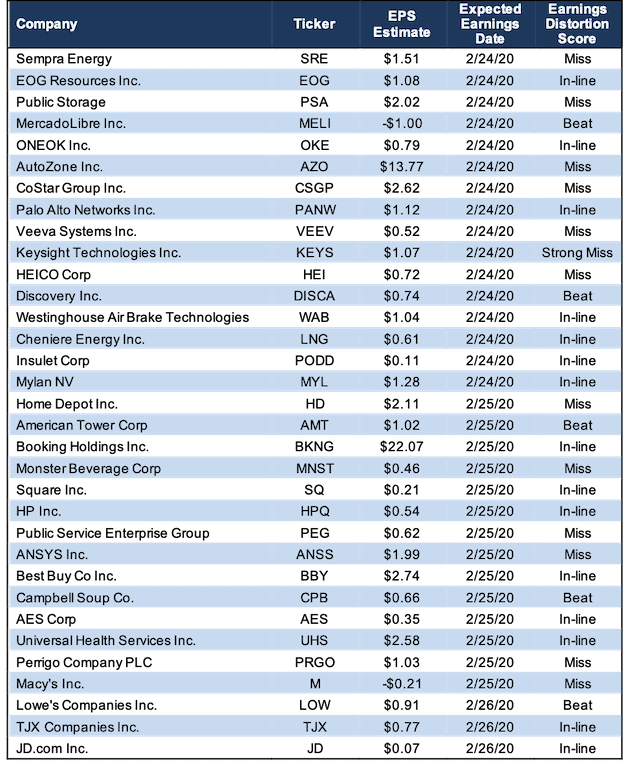

Appendix: All Major Companies Expected to Report February 24-28

Figure 3 shows all the S&P 500 companies, plus those with market caps greater than $10 billion, that are expected to report the week of February 24, 2020.

Figure 3: Earnings Distortion Scorecard: Week of 2/24/20-2/28/20

Sources: New Constructs, LLC and company filings

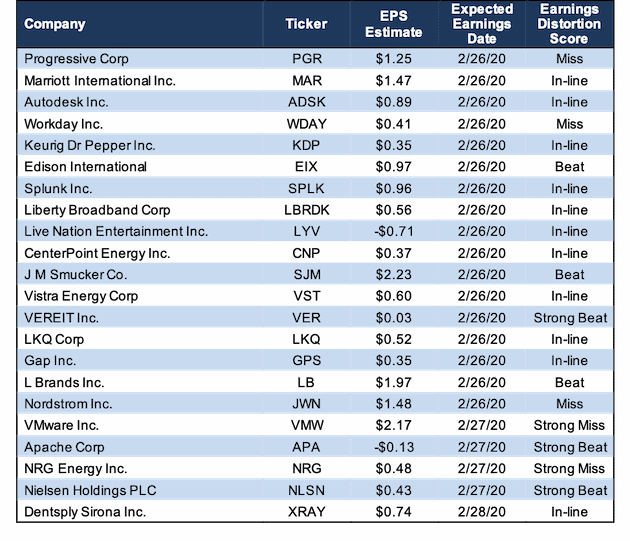

Figure 3: Earnings Distortion Scorecard: Week of 2/24/20-2/28/20 (continued)

Sources: New Constructs, LLC and company filings

[1] Note that Earnings Distortion scores are also available to clients of our website.