Check out this week’s Danger Zone interview with Chuck Jaffe of Money Life.

Passive investing is an increasingly crowded trade as investors blindly pour money into ETFs that hold many of the same stocks. Passive strategies grew in popularity on the premise that active managers very rarely outperform indices and, therefore, investing in mutual funds cost more than it was worth.

We agree with that premise, but we also believe that the risk/reward advantage of passive vs. active investing is not infinite. If every investor only engages in passive strategies, then large active management opportunities would emerge. We believe that passive investing has become a sufficiently crowded trade that indexers will see lower returns than fundamentally rigorous active investors over the next few years, at least. Passive investors are in the Danger Zone.

How Crowded Is Passive Investing?

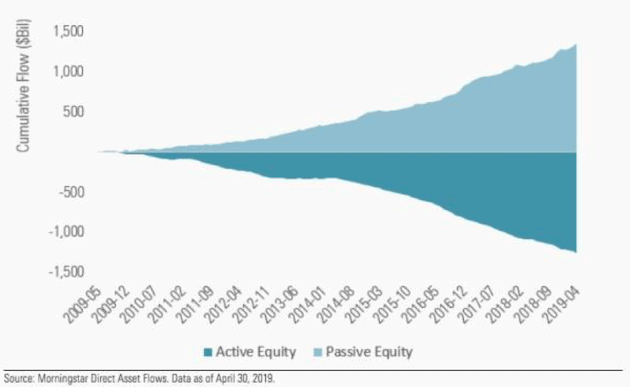

According to Morningstar, “active U.S. equity funds have had outflows in every year since 2006 with roughly equivalent inflows into passive funds during that time”. Figure 1 shows the cumulative inflows and outflows of active and passive equity funds since mid-2009. This trend continued through the end of 2019, when active-managed funds experienced $204 billion of outflows while passive funds attracted $163 billion of inflows.

Figure 1: Cumulative Flows for Active Vs. Passive Equity Funds

Sources: Morningstar Direct Asset Flows

Easier access to ETFs and passive investing is a boon for small investors, primarily from a cost savings perspective. However, when too many investors rely on passive strategies, market efficiency suffers and opportunities for active managers emerge.

Dangers in Overcrowded Trades

Five members of the Federal Reserve recently raised concerns about crowded trades and ETFs blindly allocating to the largest stocks in an index. In their paper, “The Shift From Active to Passive Investing: Potential Risks to Financial Stability?”, the authors found that passive funds may be contributing to index-inclusion effects, including increased correlation of returns among index constituents. Specifically, they noted that “if index-inclusion effects (particularly price distortions) do become more significant over time, they may slow the shift to passive investing by increasing the profitability of active investing strategies that exploit these distortions.”

Whether the original 2010 Flash Crash, the 2014 bond market flash crash, the flash crash of 2015, the “tech wreck” in 2017, or the fastest 30% drop in history, there are abundant signs that the stock market behaves differently in the age of ETFs and rapid trading of passive investments. A key question for passive investors is whether the current race to the bottom for management fees eventually runs headlong into the old adage “you get what you pay for.”

In July 2019, Bank of America also warned about the dangers of too many funds buying the same stocks, regardless of price. Bank of America studied the top 50 stock holdings between mutual funds and hedge funds and found the overlap was close to record highs. The study found that cheap stocks were being ignored, with the “value” stocks being 20% under owned by managers chasing benchmark returns.

Passive Investing Compounds Overcrowding

At its most basic level, the purpose of the stock market is to efficiently allocate capital to the most deserving companies, i.e. ones that generate the most after-tax profit (NOPAT) per dollar of invested capital, or the highest return on invested capital (ROIC). Passive index investing disrupts this process.

Instead of allocating only to quality companies, investors are putting money into the same strategies, and most of that money is flowing to the largest, most popular stocks because they have the largest weights in the indices.

For example, the seven largest ETFs under coverage, State Street SPDR S&P 500 ETF (SPY), iShares Core S&P 500 ETF (IVV), Vanguard Total Stock Market Index Fund (VTI), Vanguard 500 Index Fund (VOO), Invesco QQQ Trust (QQQ), iShares Russell 1000 Growth ETF (IWF), and Vanguard Growth Index Fund (VUG) each count the same five stocks as their top holdings. Combined, these funds have over $908 billion in assets, and despite different investment style categorizations, investors in each are buying the same five stocks.

It should come as no surprise then, in early January, these five stocks, Apple (AAPL), Microsoft (MSFT), Alphabet (GOOGL), Amazon (AMZN), and Facebook (FB) composed 18% of the total market cap of the S&P 500. AAPL and MSFT alone accounted for nearly 15% of the S&P 500’s rise in 2019.

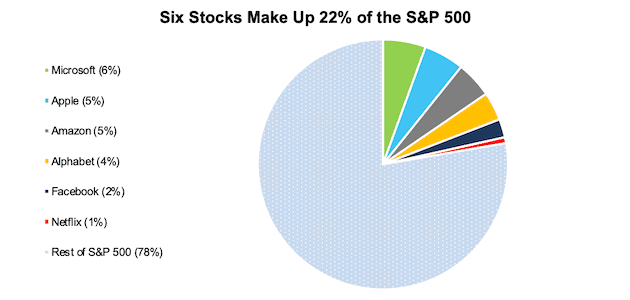

Overexposure to these prominent tech stocks (and Netflix (NFLX)) has only increased during the COVID-19 induced bear market. As of May 6, 2020, the FANG stocks, plus AAPL and MSFT, make up 22% of the S&P 500’s market cap, per Figure 2. In other words, six stocks make up nearly a quarter of the entire S&P 500’s capitalization.

Figure 2: FANG Plus Microsoft and Apple’s Dominance of the S&P 500

Sources: New Constructs, LLC and Company Filings

Passive Strategies Are Blind to Relative Value

When an index fund or ETF receives inflows, the fund essentially has no choice but to invest in stocks based on their index allocation at that moment, without any consideration of fundamentals, valuation, or anything else.

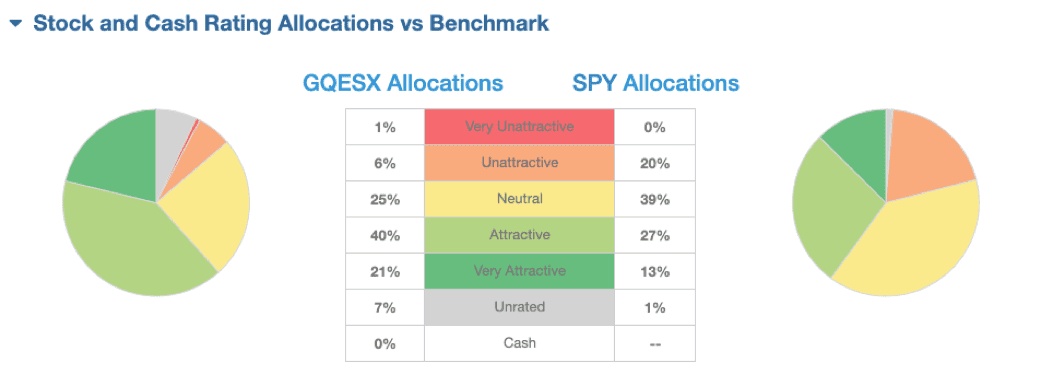

It should be intuitive that all 500 stocks in an ETF, such as State Street SPDR S&P 500 ETF (SPY) are not attractive “buys” at the moment the ETF is purchased. Many such stocks are overvalued and pose a risk to your portfolio. In fact, our research shows that SPY allocates 20% of its assets to Unattractive-or-worse rated stocks.

Meanwhile, our top-rated Large Cap Blend mutual fund, GMO Quality Fund (GQLOX, GQEFX, GQESX, GQETX, GQLIX), which benchmarks to the S&P 500, has much higher-quality holdings. By holding only 44 stocks, GMO Quality Fund allocates just 7% of assets to Unattractive-or-worse stocks and an impressive 61% of assets to Attractive-or-better stocks (compared to 40% for SPY), per Figure 3. Such superior holdings help a fund like GMO Quality Fund justify its fees relative to its cheaper benchmark.

Figure 3: Disparities in Holdings Quality Between Passive and Active Strategies

Sources: New Constructs, LLC and Company Filings

Indices are Richly Valued

We think it’s prudent to consider whether broad over-valuation is an unintended consequence of large, uninterrupted inflows into ETFs and other passive index products.

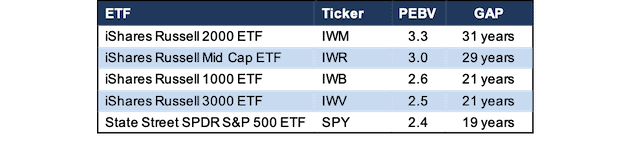

Figure 4 uses four iShares ETFs and SPY to compare the Large Cap, Mid Cap, and Small Cap segments of the market to the total market. Per Figure 4, the price-to-economic book value (PEBV) ratio, which measures the markets expectations for future profit growth, for each ETF is greater than 2.4. In other words, the market expects the profits of each of these ETFs’ holdings to more than double, and in some cases, triple.

Figure 4: Popular Passive ETFs Are Fully Valued

Sources: New Constructs, LLC and Company Filings

In addition, the average market-implied growth appreciation period (GAP) ranges from 19-31 years. Put another way, the holdings in each of these ETFs must grow profits at forecasted rates for up to 31 years simply to justify current stock prices. For comparison, GMO Quality Fund’s (highlighted above in Figure 3) holdings have a PEBV ratio of just 1.5 and a GAP of 9 years.

It might make sense to pay, on average, two or three times the economic book value for higher quality businesses such as Apple or Facebook. However, it makes less sense to pay a premium for lower-quality holdings such as Twitter (TWTR), Corteva (CTVA), or Occidental Petroleum (OXY), each of which earns our Unattractive-or-worse rating.

Instead of blindly allocating to all stocks through a passive strategy, those looking to generate above market returns should be more selective in their investing process.

Only Way Out of the Danger Zone: Due Diligence

Passive investors are playing a numbers game. By allocating capital as broadly as possible, they attempt to participate in all winners while minimizing exposure to sure-to-happen losers. We maintain that diversification is no substitute for diligence.

In volatile and uncertain times like the current market, accurate fundamental analysis is of paramount importance. Stocks that don’t make up a significant portion of an index can get overlooked because less passive money is flowing blindly to them. The current market environment presents an excellent opportunity for active managers to generate alpha over passive funds.

To start, active investors should find stocks trading as if the COVID-driven economic decline will last forever and invest in those that will emerge more profitable than their valuations suggest.

We’ve recently featured seven such stocks, each high-quality businesses, whose valuations meaningfully overstate the impact of COVID-19 on their future cash flows. All of these firms have a strong history of profit growth, ample liquidity to survive the crisis, competitive advantages to thrive when the economy rebounds, and stock prices that trade at historic discounts.

- SYSCO Corporation (SYY)

- Simon Property Group (SPG)

- Darden Restaurants (DRI)

- D.R. Horton (DHI)

- Cracker Barrel Old Country Store (CBRL)

- Southwest Airlines (LUV)

- Omnicom Group (OMC)

Too Much Passive Investing Creates Greater Risk

We first put “passive investors” in the Danger Zone in December 2013 for not recognizing they are making active management decisions while skipping out on the due diligence of knowing what they own. We showed how it is practically impossible to make a “passive” choice given the sheer number of index fund options in almost every market segment. Additionally, there are wide holdings differences between funds that, according to their names, appear to be tracking the same thing.

Furthermore, we pointed out passive investing was a hidden trigger for another (flash) crash in July 2017, as significant inflows to passive investing strategies posed risks for the market. By allocating capital as broadly as possible, passive investors attempt to participate in all winners while minimizing exposure to losers.

However, when an investment process makes no effort to differentiate winners from losers, and instead blindly allocates based on index weights, there is no diligence, no intelligent capital allocation, and eventually, no efficient market.

This article originally published on May 11, 2020.

Disclosure: David Trainer owns SYY, SPG, and DHI. David Trainer, Kyle Guske II, and Matt Shuler receive no compensation to write about any specific stock, sector, style, or theme.

Follow us on Twitter, Facebook, LinkedIn, and StockTwits for real-time alerts on all our research.