We closed this position on July 19, 2021. A copy of the associated Position Update report is here.

With looming threats of an economic downturn, and troubles resurfacing in China, many seem to think the best days of this dividend aristocrat are behind it. Investors who can see past the cyclical nature of this industrial business, and the COVID-19 driven disruptions, have the opportunity to add a high-quality firm to their portfolios at an historically cheap price. Caterpillar Inc. (CAT: $117/share) is this week’s Long Idea.

Caterpillar’s History of Profit Growth

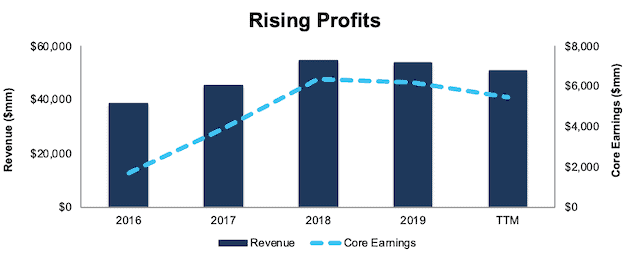

Caterpillar has a strong history of generating consistent profits. Since 2016, Caterpillar has grown revenue by 12% compounded annually and core earnings[1] by 54% compounded annually, per Figure 1. Longer term, Caterpillar has grown core earnings by 22% compounded annually over the past decade and 12% compounded annually over the past two decades. The firm increased its core earnings margin from 4% in 2016 to 11% in the trailing-twelve-month period (TTM).

Figure 1: Core Earnings & Revenue Growth Since 2016

Sources: New Constructs, LLC and company filings.

Caterpillar’s profitability helps the business generate significant free cash flow (FCF). The company generated positive FCF in 15 of the past 20 years and a cumulative $30.2 billion (47% of market cap) over the past five years. Caterpillar’s $7.7 billion in FCF over the TTM period equates to a 10% FCF yield, which is significantly higher than the Industrials sector average of 2%.

Caterpillar’s Balance Sheet Is Ready for Another Down Cycle

As a highly cyclical business, Caterpillar has survived many down cycles over the years. Caterpillar’s strong cash balance positions it to weather another economic downturn, if needed. At the end of 1Q20, the firm had $7.1 billion of cash on hand and available global credit facilities worth $10.5 billion.

Since the end of 1Q20, Caterpillar raised another $2 billion in cash through the issuance of 10- and 30-year bonds, secured an additional $3.9 billion short-term credit facility, and registered for an additional $4.1 billion of commercial paper support programs available in the U.S. and Canada. In total, the firm has access to $27.6 billion in liquidity. Furthermore, the firm has no debt maturities until 2021.

In a worst-case scenario where Caterpillar generates no revenue and incurs expenses of $3.1 billion (1Q20 monthly operating costs) per month, Caterpillar could operate for over eight months with its current cash balance, available credit facilities, and commercial paper before needing additional capital.

While it is unlikely that Caterpillar’s revenue would go to zero, as consensus estimates expect revenue to fall “only” 25% in 2020 and the firm was operating 75% of its production facilities in mid-April, this scenario illustrates the strength of the firm’s cash position. Additionally, Caterpillar is reducing discretionary expenses, suspending salary increases, and reducing production costs to match customer demand, which should lead to lower operating expenses and prolong its available liquidity.

Caterpillar’s Superior Profitability Helps Take Market Share During the Crisis and Grow in the Recovery

COVID-driven disruptions to the demand for industrial machinery may drive some weaker operators out of business for good. However, Caterpillar’s profitability was superior to its competitors before the crisis, and the firm is well-positioned to grow profits when the economy recovers.

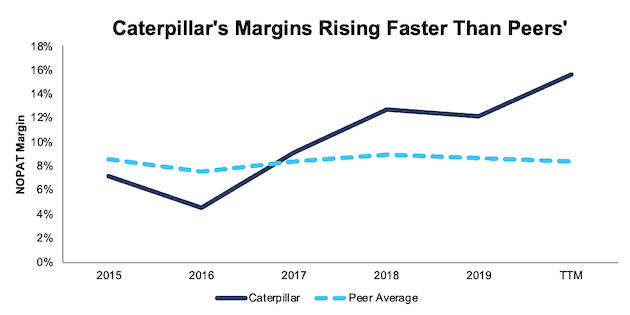

Per Figure 2, Caterpillar’s net operating profit after-tax (NOPAT) margin has improved from 7% in 2015 to 16% TTM. The firm’s current 16% NOPAT margin is much higher than the peer group’s market-cap-weighted average margin of 8%. Caterpillar’s peer group includes Deere & Company (DE), PACCAR Inc. (PCAR), Westinghouse Air Brake Technologies Corp (WAB), The Toro Company (TTC), WABCO Holdings, Inc. (WBC) and 17 additional Heavy Machinery & Vehicles firms under coverage.

Figure 2: NOPAT Margin Vs. Peers

Sources: New Constructs, LLC and company filings.

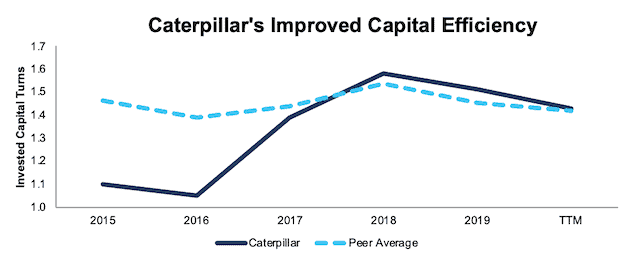

Despite falling in recent years, Caterpillar’s invested capital turns, a measure of balance sheet efficiency, have still improved over the past four years. Per Figure 3, Caterpillar’s invested capital turns have risen from 1.1 in 2015 to 1.4 over the TTM while its peer group’s market-cap-weighted average invested capital turns have fallen from 1.5 to 1.4 over the same time.

Figure 3: Invested Capital Turns Vs. Peers

Sources: New Constructs, LLC and company filings.

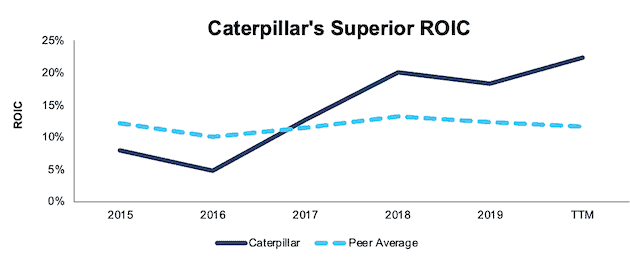

The combination of high and rising margins and improved invested capital turns drive Caterpillar’s leading return on invested capital (ROIC). Per Figure 4, Caterpillar’s ROIC has improved from 8% in 2015 to 22% TTM while the market-cap weighted average of peers has remained largely unchanged at 12% over the same time.

Figure 4: ROIC vs. Peers

Sources: New Constructs, LLC and company filings.

Caterpillar’s financial strength and profitability positions the firm to not just survive the downturn, but to expand its market presence during a recovery. The firm stated in its 1Q20 earnings call that it is prepared for potential M&A activity should “compelling opportunities” arise. Unless you believe that there will be no need for construction and industrial machinery in a post-COVID-19 world, it’s hard to argue against Caterpillar’s ability to survive. And, if it survives, it’s hard to argue that the firm’s superior profitability before the crisis will not translate into market share and profit growth after the crisis.

Demand for Industrial Machinery Is Strong Over the Long Term

While there’s no denying the COVID-19 pandemic will have an adverse effect on Caterpillar’s business (revenue was down 21% year-over-year in 1Q20), the long-term demand for Caterpillar’s products remains strong. Grand View Research, an industry research provider, expects the Global Construction Equipment market to grow from $125 billion in 2019 to $173 billion in 2027, or 4.3% compounded annually.

Furthermore, we believe a recovery is likely over the long-term since the International Monetary Fund (IMF) and nearly every economist in the world believe the global economy will grow strongly in 2021. The IMF estimates the global economy will expand by 5.8%, and the U.S. economy by 4.7%, in 2021. Fitch Ratings projects global GDP growth of 5.1% in 2021, and for “pre-virus levels of GDP” to be reached in mid-2022 in the US and later in Europe. The overall growth in the economy should lead to a rebound in capital expenditures, which present plenty of opportunities for Caterpillar to increase its market share.

Risk in China Can Be Overcome

The COVID-19 pandemic has put a spotlight on already strained relations between the U.S. and China. The widespread support for the Holding Foreign Companies Accountable Act is the latest sign of rising tension between the two countries. For more than 40 years, Caterpillar has been selling its products in China. Last year, Asia/Pacific was Caterpillar’s second largest market, but experienced a 4% decline in sales as the U.S. enacted tariffs in its trade war with China.

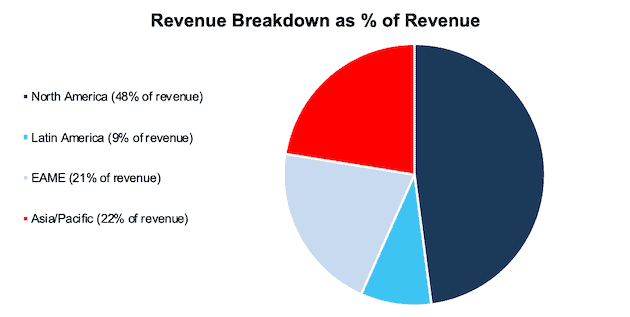

While more difficulty in Asia/Pacific could be on the horizon for the firm, Caterpillar’s exposure to the region, particularly China, is limited. Figure 5 shows that 78% of Caterpillar’s 2019 sales were outside of the Asia/Pacific region.

Figure 5: Caterpillar’s Revenue by Region

Sources: New Constructs, LLC and company filings.

Asia/Pacific includes Australia, China, India, Indonesia, Japan, Singapore, South Korea, and Thailand. China itself accounts for 5% to 10% of Caterpillar’s total sales. While an unlikely scenario, if geopolitical relations deteriorated to the point that Caterpillar lost all of its business in China, we would expect 90% of the firm’s total revenue source to remain intact.

Furthermore, a complete shutdown of operations in China would likely occur amidst a large-scale exit of foreign operations from China, which could actually be beneficial for Caterpillar. The firm would likely see some of its lost revenue in China offset by additional demand for its products and services as other businesses around the world would increase their capital expenditures as a result of relocating operations away from China.

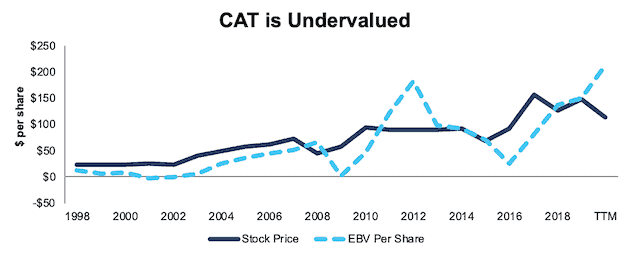

CAT Trades at Cheapest Level Since 2012

After falling 19% YTD to $117/share and adjusting for the debt issuance since the close of the first quarter noted above, CAT now trades at its cheapest PEBV ratio (0.6) since 2012. This ratio means the market expects Caterpillar’s NOPAT to permanently decline by 40%. This expectation seems overly pessimistic over the long term.

Caterpillar’s current economic book value, or no-growth value, after accounting for its additional debt, is $209/share – a 79% upside to the current price.

Figure 6: Stock Price vs. Economic Book Value (EBV)

Sources: New Constructs, LLC and company filings.

CAT’s Current Price Implies No Economic Recovery

Below, we use our reverse DCF model to quantify the cash flow expectations baked into Caterpillar’s current stock price. Then, we analyze the implied value of the stock based on different assumptions about COVID-19’s impact on the economy and Caterpillar’s future growth in cash flows.

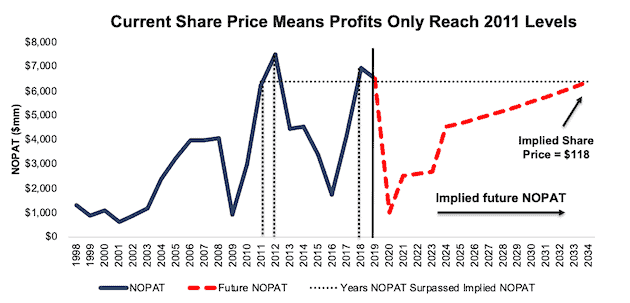

Scenario 1: Using historical revenue declines, historical margins, and average historical GDP growth rates, we can model the worst-case scenario already implied by Caterpillar’s current stock price. In this scenario, we assume:

- NOPAT margins fall to 3% (all-time company low, 2009) in 2020 and increase to 7% (all-time company average) in 2021 to 2023 and 12% (2019 level) each year thereafter

- Revenue falls 37% (vs. consensus -25% and in line with 2009 year-over-year decline) in 2020 and does not grow in 2021 (vs. consensus 8.5% in 2021)

- Sales begin growing again in 2022, but only at 3.5% a year (vs. consensus 7.9% in 2022), which equals the average global GDP growth rate since 1961 and is below Caterpillar’s revenue CAGR over the past two decades (5%)

In this scenario, where Caterpillar’s NOPAT declines 1% compounded annually over the next 15 years (and falls 84% YoY in 2020), the stock is worth $118/share today – nearly equal to the current stock price. This scenario accounts for the debt issuance after the end of 1Q20 noted earlier. We conservatively assume this capital will be used to cover operating expenses and do not treat it as excess cash. See the math behind this reverse DCF scenario.

For reference, Caterpillar’s NOPAT declined by 78% from 2008 to 2009 before exceeding its 2008 NOPAT level by 52% in 2011, or just three years later.

Figure 7 compares Caterpillar’s implied future NOPAT to the firm’s historical NOPAT in this scenario. This worst-case scenario implies Caterpillar’s NOPAT 15 years from now will be 2% below its 2019 NOPAT. In other words, this scenario implies that 15 years after the COVID-19 pandemic, Caterpillar’s profits will have only recovered to ~2011 levels. In any scenario better than this one, CAT holds significant upside potential, as we’ll show below.

Figure 7: Current Valuation Implies Severe, Long-Term Decline in Profits: Scenario 1

Sources: New Constructs, LLC and company filings.

Scenario 2: Long-term View Could Be Very Profitable

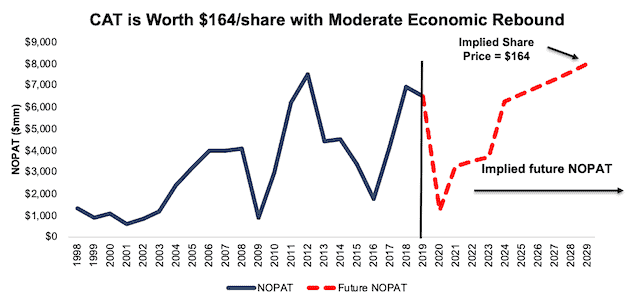

If we assume, as does the IMF and nearly every economist in the world, that the global economy rebounds and returns to growth starting in 2021, CAT is undervalued.

In this scenario, we assume:

- NOPAT margins fall to 3% (all-time company low, 2009) in 2020 and increase to 7% (all-time company average) in 2021 to 2023 and 12% (2019 level) each year thereafter

- Revenue falls 24.6% (consensus estimate) in 2020

- Revenue grows at 8.5% in 2021 and 7.9% in 2022 (consensus estimates) and 5% per year thereafter, which equals Caterpillar’s revenue CAGR over the past two decades

In this scenario, Caterpillar’s NOPAT only grows by 2% compounded annually over the next decade (and falls 81% YoY in 2020) and the stock is worth $164/share today – a 40% upside to the current price. This scenario also accounts for the debt issuance after the end of 1Q20 noted earlier. We conservatively assume this capital will be used to cover operating expenses and do not treat it as excess cash. See the math behind this reverse DCF scenario.

For comparison, Caterpillar has grown NOPAT by 8% compounded annually over the past five years and 10% compounded annually over the past two decades. It’s not often investors get the opportunity to buy an industry leader at such a discounted price.

Figure 8 compares the stock’s implied future NOPAT to the firm’s historical NOPAT in scenario 2. This moderate scenario implies that a decade from now, Caterpillar’s NOPAT will be just 7% above 2012 levels and 23% above 2019 levels. If the firm’s profits return to these levels in less than 10 years, CAT has even more upside potential.

Figure 8: Implied Profits Assuming Moderate Recovery: Scenario 2

Sources: New Constructs, LLC and company filings.

Sustainable Competitive Advantages Will Drive Shareholder Value Creation

Here’s a summary of why we think the moat around Caterpillar’s business will enable it to continue to generate higher NOPAT than the current market valuation implies. The following competitive advantages help Caterpillar survive the downturn and return to growth as the economy grows again:

- Strong balance sheet to survive the dip

- Leading manufacturer of highly specialized machinery with longstanding customer relationships

- 90% of the firm’s sales are generated outside of China

- Superior profitability to its peer group

What Noise Traders Miss with Caterpillar

These days, fewer investors focus on finding quality capital allocators with shareholder friendly corporate governance. Instead, due to the proliferation of noise traders, the focus is on short-term technical trading trends while high-quality fundamental research is overlooked. Here’s a quick summary of what noise traders are missing:

- Consistent profit growth over the past two decades

- Long-term demand for heavy machinery is strong

- Valuation implies the economy never recovers

3.5% Yield with Potential for More

Caterpillar has paid dividends every year since 1933 and was one of the stocks featured in our Safest Dividend Yields report in April due to its attractive dividend yield, relatively low debt, and strong cash flows. Over the past five years, the firm has generated more in free cash flow ($30.2 billion) than it has paid out in dividends ($9.5 billion), which equates to an average $4.1 billion surplus each year. It’s latest quarterly dividend, when annualized, equals $4.12/share or a 3.5% dividend yield.

Firms with cash flows greater than dividend payments have a higher likelihood to maintain and grow dividends. While many companies are cutting their dividends during the current economic downturn, Caterpillar has been through many downturns since 1933 and noted in its most recent earnings call that it is “committed to returning substantially our free cash flow to shareholders through the cycles.”

In addition to dividends, Caterpillar historically returned capital to shareholders through share repurchases. Caterpillar temporarily suspended its share repurchases but stated that the firm may resume share repurchases in the future at any time.

Caterpillar has repurchased $9.9 billion worth of shares since 2015 (16% of current market cap). Prior to the suspension, Caterpillar had an additional $4.9 billion remaining under its current authorization. Should the firm resume share repurchases, the yield for investors will increase.

A Consensus Beat or Signs of Recovery Could Send Shares Higher

According to Zacks, consensus estimates at the end of January pegged Caterpillar’s 2020 EPS at $9.54/share. Jump forward to May 19, and consensus estimates for Caterpillar’s 2020 EPS have fallen to $4.99/share.

Though the COVID shutdowns are crushing near-term profits, these lowered expectations provide a great opportunity for a strong business, such as Caterpillar, to beat consensus, if not this quarter, then maybe the next. Though our current Earnings Distortion Score for Caterpillar is “In-Line”, the firm beat EPS estimates in eight of the past 12 quarters, and doing so again, in the midst of such market turmoil, could send shares higher.

Additionally, any signs of a recovery in the global economy would send shares higher.

Executive Compensation Could Be Improved but Raises No Red Flags

No matter the macro environment, investors should look for companies with executive compensation plans that directly align executives’ interests with shareholders’ interests. Quality corporate governance holds executives accountable to shareholders by incentivizing them to allocate capital prudently.

In fiscal 2019, 68% to 70% of executive compensation was linked to long-term incentives in the form of performance-based restricted stock units and stock options. While Caterpillar does not directly link executive pay to ROIC, it does link ~70% of each NEO’s annual cash incentive to Enterprise Operating Profit and Enterprise Operating Profit After Capital Charge (OPACC) performance. Caterpillar defines OPACC as Machinery, Energy & Transportation operating profit less the capital charge, and is similar to our economic earnings calculation.

While we applaud Caterpillar for significantly linking executive compensation to a measure that accounts for changes to the balance sheet, we would still prefer the firm use an accurate ROIC calculation, as there is a strong correlation between improving ROIC and increasing shareholder value. Having accurate values for NOPAT and invested capital ensures investors have an apples-to-apples metric for measuring corporate performance and holds management accountable for every dollar invested into the company.

Despite not using ROIC when measuring performance, Caterpillar’s plan has not compensated executives while destroying shareholder value. Caterpillar has grown economic earnings by 17% compounded annually over the past five years and the same CAGR since 1998, the earliest year in our model.

Insider Trading and Short Interest Trends

Over the past three months, insiders have bought a total of 12 thousand shares and sold 3 thousand shares for a net effect of 9 thousand shares purchased. These purchases represent less than 1% of shares outstanding.

There are currently 8.6 million shares sold short, which equates to 2% of shares outstanding and less than 2 days to cover. Short interest is down 16% from the prior month. The lack of short interest indicates that the market is not willing to bet against this stock’s chances to rebound.

Critical Details Found in Financial Filings by Our Robo-Analyst Technology

As investors focus more on fundamental research, research automation technology is needed to analyze all the critical financial details in financial filings as shown in the Harvard Business School and MIT Sloan paper, "Core Earnings: New Data and Evidence”.

Below are specifics on the adjustments we make based on Robo-Analyst findings in Caterpillar’s 2019 10-K:

Income Statement: we made $1.9 billion of adjustments, with a net effect of removing $419 million in non-operating expenses (<1% of revenue). You can see all the adjustments made to Caterpillar’s income statement here.

Balance Sheet: we made $12.9 billion of adjustments to calculate invested capital with a net increase of $469 million. One of the largest adjustments was $2.6 billion in asset write-downs. This adjustment represented 7% of reported net assets. You can see all the adjustments made to Caterpillar's balance sheet here.

Valuation: we made $21.5 billion of adjustments with a net effect of decreasing shareholder value by $14.1 billion. Apart from total debt, the most notable adjustment to shareholder value was $5.6 billion in underfunded pensions. This adjustment represents 9% of Caterpillar’s market cap. See all adjustments to Caterpillar’s valuation here.

Attractive Funds That Hold CAT

The following funds receive our Attractive-or-better rating and allocate significantly to Caterpillar Inc.:

- Advisors Quantified Common Ground Fund (QCGDX) – 5.5% allocation and Attractive rating

- Stock Dividend Fund, Inc. (SDIVX) – 4.7% allocation and Very Attractive rating

- Invesco Dow Jones Industrial Average Dividend ETF (DJD) – 4.1% allocation and Very Attractive rating

- AIG Focused Dividend Strategy Fund (FDSBX) – 3.9% allocation and Very Attractive rating

- Pioneer Disciplined Value Fund (CVFYX) – 3.7% allocation and Attractive rating

- Invesco Comstock Select Fund (CGRWX) – 3.7% allocation and Attractive rating

- Cutler Equity Fund (CALEX) – 3.6% allocation and Attractive rating

- State Street SPDR Dow Jones Industrial Average ETF Trust (DIA) – 3.6% and Very Attractive rating

- Madison Dividend Income Fund (BHBFX) – 3.5% and Attractive rating

This article originally published on May 27, 2020.

Disclosure: David Trainer, Kyle Guske II, and Matt Shuler receive no compensation to write about any specific stock, style, or theme.

Follow us on Twitter, Facebook, LinkedIn, and StockTwits for real-time alerts on all our research.

[1] Our core earnings are a superior measure of profits, as demonstrated in In Core Earnings: New Data & Evidence a paper by professors at Harvard Business School (HBS) & MIT Sloan. The paper empirically shows that our data is superior to “Income Before Special Items” from Compustat, owned by S&P Global (SPGI).