This report analyzes[1] market cap, economic book value, and price-to-economic book value (PEBV) ratio for the S&P 500 and each of its sectors.

We analyze other fundamental and valuation metrics for the S&P 500 and its sectors in these reports:

- Core earnings for the S&P 500: S&P 500 Peaks As Earnings Trough

- Core earnings for each S&P 500 sector: Only One S&P 500 Sector’s Core Earnings Improved This Year

- Return on invested capital (ROIC) and its drivers for the S&P 500 and its sectors: No S&P 500 Sector Has a Rising ROIC Through First Half 2020

- Free cash flow (FCF) yield and its drivers for the S&P 500 and its sectors: Two S&P 500 Sectors Have a Rising FCF Yield Through 1H20

These reports leverage cutting-edge technology to provide clients with a cleaner and more comprehensive view of every measure of profits[2]. Investors armed with our research enjoy a differentiated and more informed view of the fundamentals and valuations of companies and sectors.

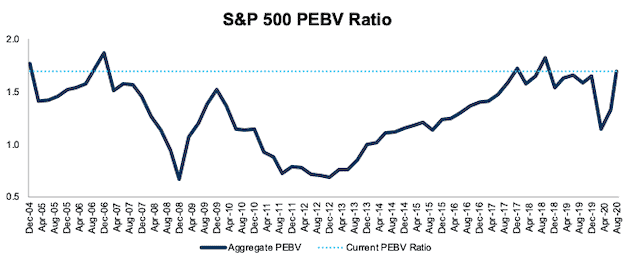

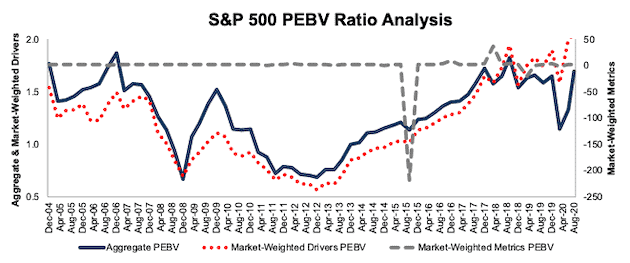

S&P 500 PEBV Ratio Jumps to Highest Level Since September 2018

The PEBV ratio for the S&P 500 rose from 1.1 at the end of 2019 to 1.7 through 2Q20, or its highest level since mid-2018, and one of the highest levels since 2004. See Figure 1. This ratio measures the level of expectations for future profits compared to existing profit. At 1.7, the S&P 500’s valuation implies the profits of the S&P 500 will increase 70% from current levels.

Only one S&P 500 sector trades below its economic book value (excluding Energy, which has a negative economic book value), as we’ll show below.

Figure 1: TTM PEBV Ratio for the S&P 500 From December 2004 – 8/11/20

Sources: New Constructs, LLC and company filings.

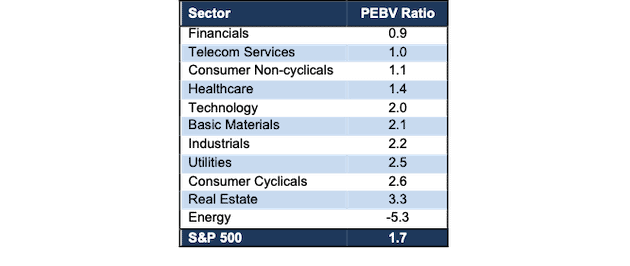

Ranking the S&P 500 Sectors by PEBV Ratio

Figure 2 ranks all 11 S&P 500 sectors by PEBV ratio.

Figure 2: TTM PEBV Ratio as of 8/11/20 by Sector

Sources: New Constructs, LLC and company filings.

With a PEBV of 0.9, investors expect the Financials sector’s profits to decline, permanently, by 10% from current levels. On the flip side, investors expect the Real Estate sector to improve profits more than any other S&P 500 sector.

Details on Each of the S&P 500 Sectors

Figures 3-13 show the PEBV ratio trends for every sector since 2004.

We present the components of PEBV ratio, market cap and economic book value, for the S&P 500 and each S&P 500 sector in Appendix I.

Appendix II provides additional aggregated PEBV ratio analyses that adjust for company size/market cap.

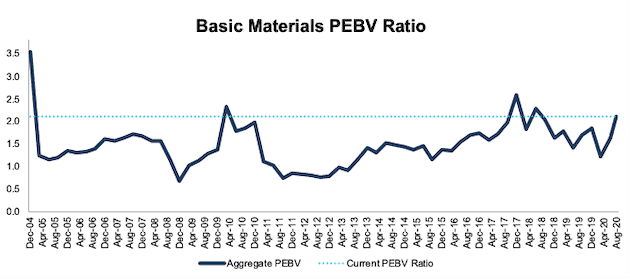

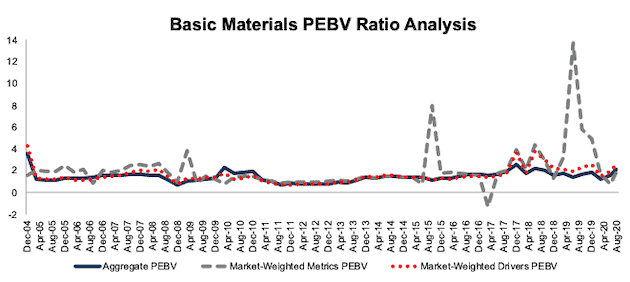

Basic Materials: PEBV Ratio = 2.1

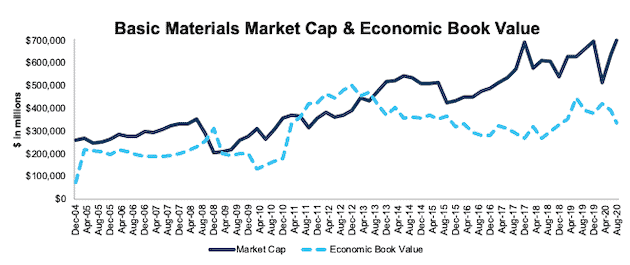

Figure 3 shows the PEBV ratio for the Basic Materials sector has consistently fallen since 2017 even after the market bounce back since March 2020. The Basic Materials sector PEBV ratio is the highest since June 2018 and has rarely been higher since 2004. Since the end of 2019, the sector market cap increased from $693 billion to $701 billion TTM while its economic book value fell from $377 billion to $334 billion over the same time.

Figure 3: Basic Materials PEBV Ratio: December 2004 – 8/11/20

Sources: New Constructs, LLC and company filings.

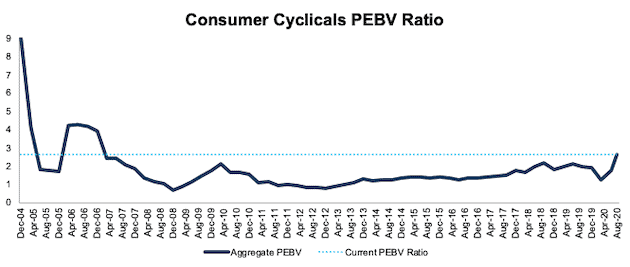

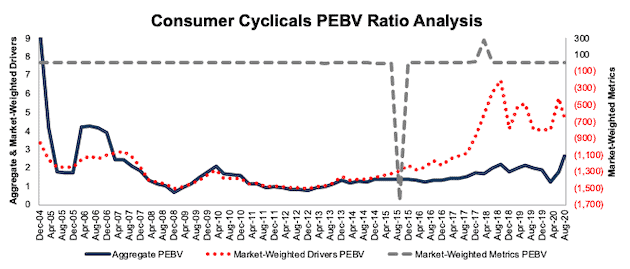

Consumer Cyclicals: PEBV Ratio = 2.6

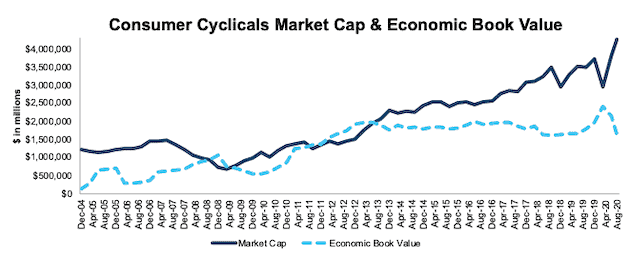

Figure 4 shows the PEBV ratio for the Consumer Cyclicals sector sits at the highest level since December 2006, which suggests investors expect sector profits to normalize after the COVID-19-induced economic downturn. The sector market cap has increased from 3.7 trillion at the end of 2019 to $4.3 trillion TTM while its economic book value fell from $2.0 trillion to $1.6 trillion over the same time.

Figure 4: Consumer Cyclicals PEBV Ratio: December 2004 – 8/11/20

Sources: New Constructs, LLC and company filings.

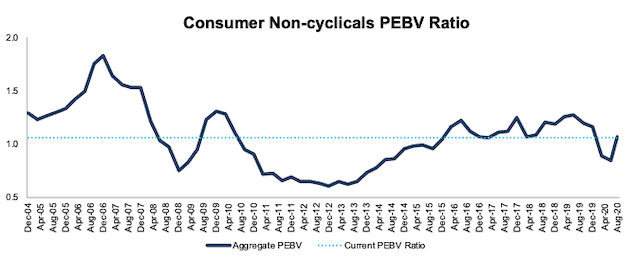

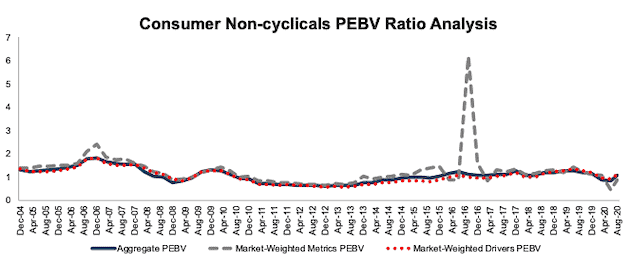

Consumer Non-cyclicals: PEBV Ratio = 1.1

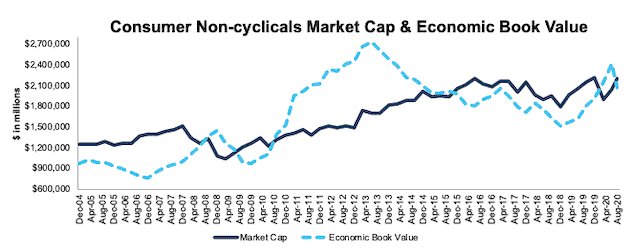

Figure 5 shows the PEBV ratio for the Consumer Non-cyclicals sector is still below recent highs from 2016-2019. The sector market cap is largely stagnant, at $2.2 trillion from the end of 2019 to the TTM. Economic book value increased from $1.9 trillion to $2.1 trillion over the same time, which suggests investors see this sector as somewhat of a safe-haven during uncertain economic times.

Figure 5: Consumer Non-cyclicals PEBV Ratio: December 2004 – 8/11/20

Sources: New Constructs, LLC and company filings.

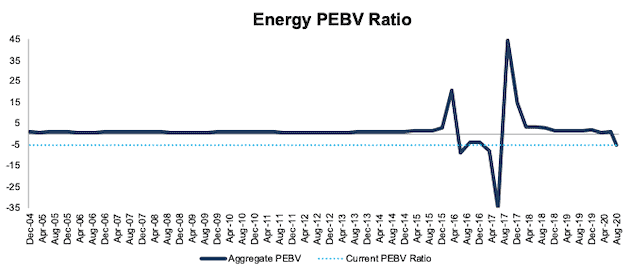

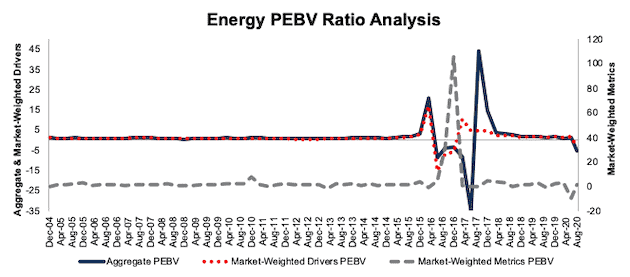

Energy: PEBV Ratio = -5.3

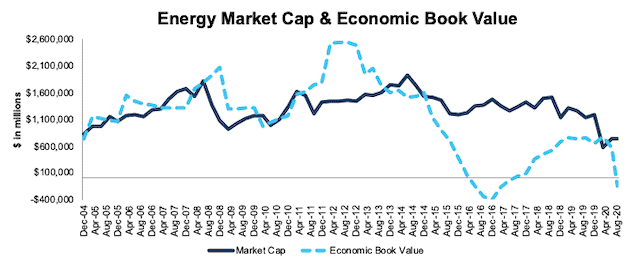

Figure 6 shows the COVID-19 impact on the Energy sector’s valuation which results in a negative PEBV for the first time since mid-2017. The Energy sector market cap fell from $1.2 trillion at the end of 2019 to $742 billion TTM while economic book value fell from $642 billion to -$139 billion over the same time. The large change in 2017 is driven by a large improvement in economic book value as oil prices, and therefore Energy firms’ profits, recovered from the precipitous fall in 2014-2016.

Figure 6: Energy PEBV Ratio: December 2004 – 8/11/20

Sources: New Constructs, LLC and company filings.

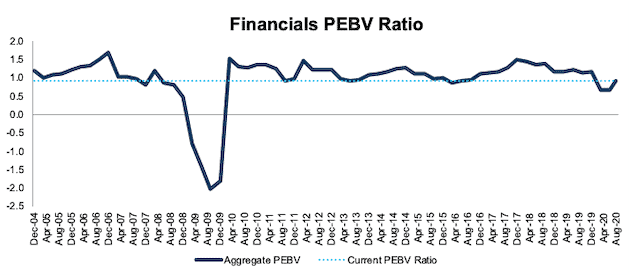

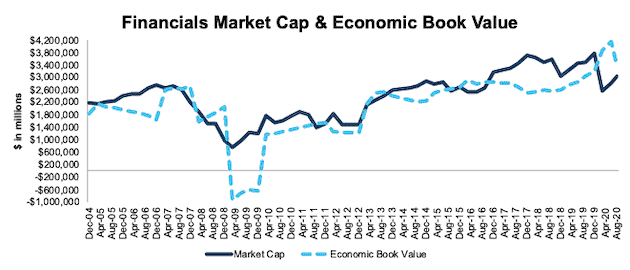

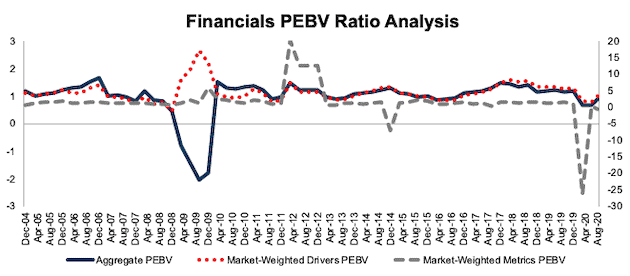

Financials: PEBV Ratio = 0.9

Figure 7 shows PEBV ratio for the Financials sector has been stable except for the Financial Crisis and has mostly been higher than it is now. The Financials sector market cap fell from $3.8 trillion at the end of 2019 to $3.1 trillion TTM while its economic book value increased from $3.2 trillion to $3.4 trillion over the same time.

Figure 7: Financials PEBV Ratio: December 2004 – 8/11/20

Sources: New Constructs, LLC and company filings.

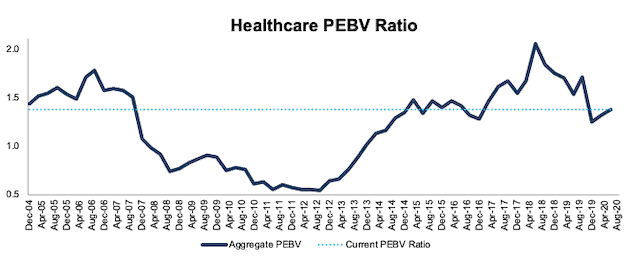

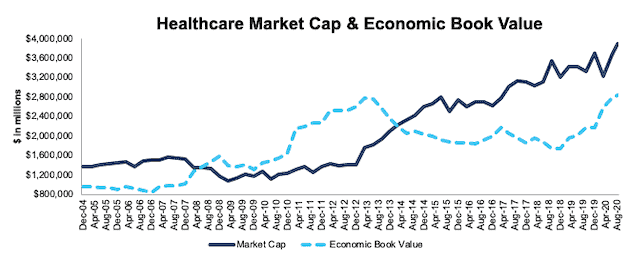

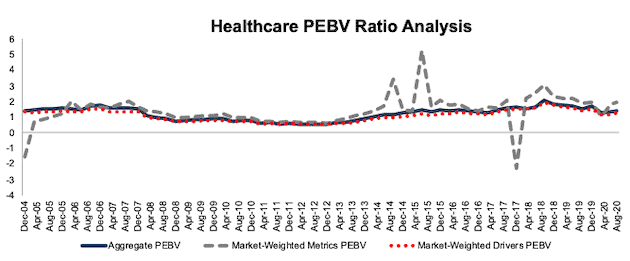

Healthcare: PEBV Ratio = 1.4

Figure 8 shows PEBV ratio for the Healthcare sector is near its lowest level since March 2017 (excluding March 2020). Figure 8 also shows how cheap the Healthcare sector was during and after the Financial Crisis, trading below its economic book value from mid-2008 until March 2014. The Healthcare sector market cap has increased from $3.7 trillion at the end of 2019 to $3.9 trillion TTM while economic book value improved from $2.2 trillion to $2.8 trillion over the same time.

Figure 8: Healthcare PEBV Ratio: December 2004 – 8/11/20

Sources: New Constructs, LLC and company filings.

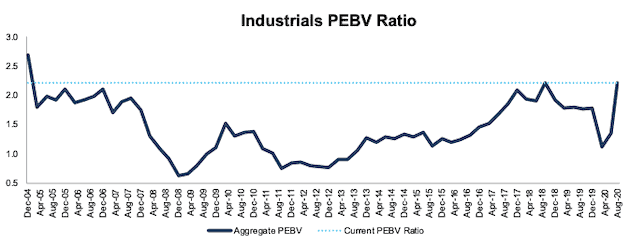

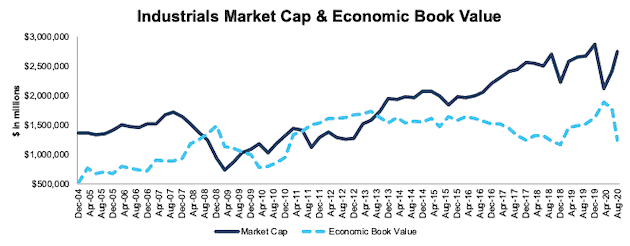

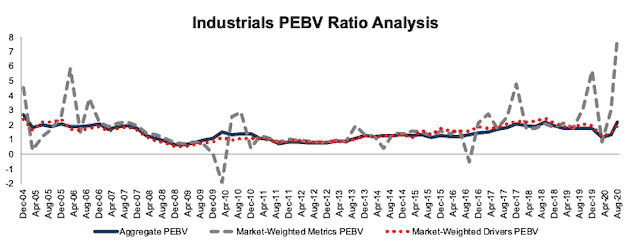

Industrials: PEBV Ratio = 2.2

Figure 9 shows the PEBV ratio for the Industrials sector has increased significantly since the end of 2019, has rarely traded higher since 2004, and shows that investors expect the sector’s profitability to rebound in a big way. The Industrials sector market cap fell from $2.9 trillion at the end of 2019 to $2.7 trillion TTM while economic book value declined from $1.6 trillion to $1.2 trillion over the same time.

Figure 9: Industrials PEBV Ratio: December 2004 – 8/11/20

Sources: New Constructs, LLC and company filings.

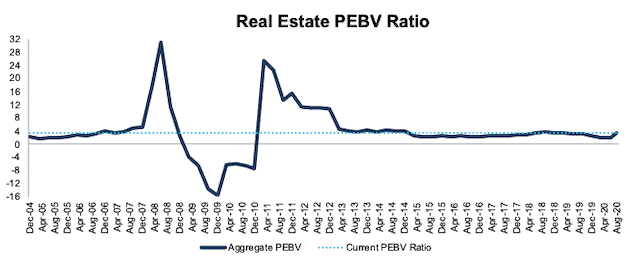

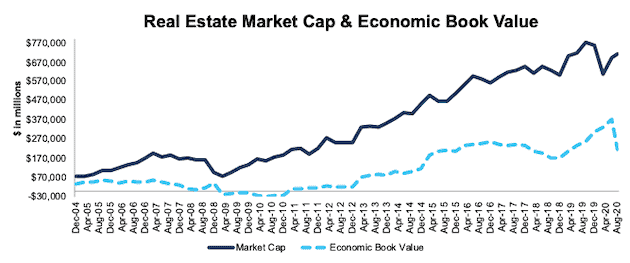

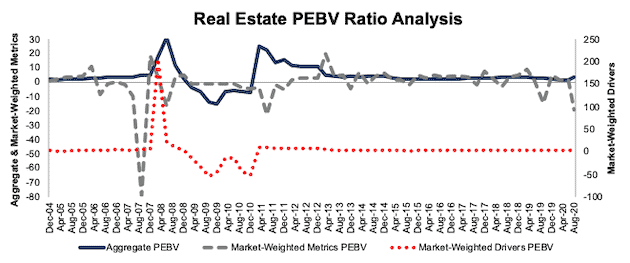

Real Estate: PEBV Ratio = 3.3

Figure 10 shows the PEBV ratio for the Real Estate sector is relatively stagnant save for the run up and crash around the Financial Crisis. The current sector PEBV is the highest since March 2019. The Real Estate sector market cap fell from $759 billion at the end of 2019 to $715 billion TTM and the economic book value fell from $309 billion to $216 billion over the same time.

Figure 10: Real Estate PEBV Ratio: December 2004 – 8/11/20

Sources: New Constructs, LLC and company filings.

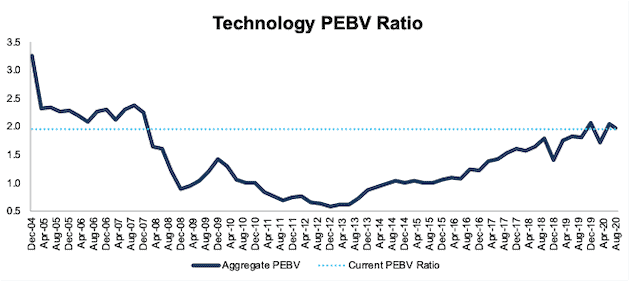

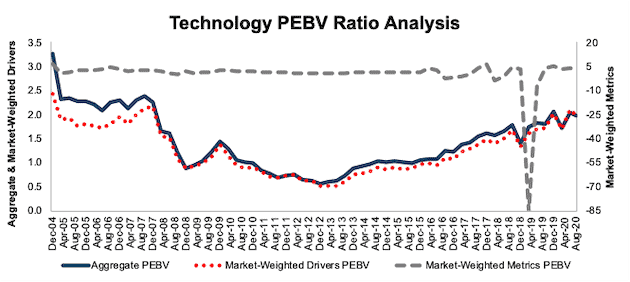

Technology: PEBV Ratio = 2.0

Figure 11 shows the current PEBV ratio for the Technology sector sits at levels last seen at the end of 2019, and prior to that, December 2007. The Technology sector market cap increased from $8.0 trillion at the end of 2019 to $9.6 trillion TTM and economic book value improved from $3.9 trillion to $4.9 trillion over the same time.

Figure 11: Technology PEBV Ratio: December 2004 – 8/11/20

Sources: New Constructs, LLC and company filings.

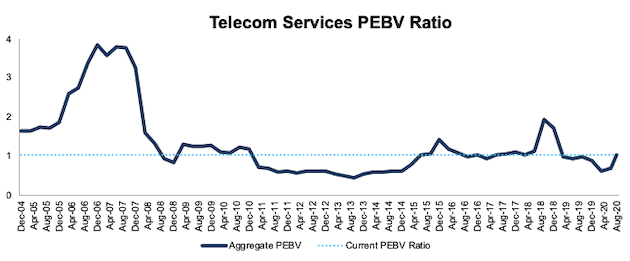

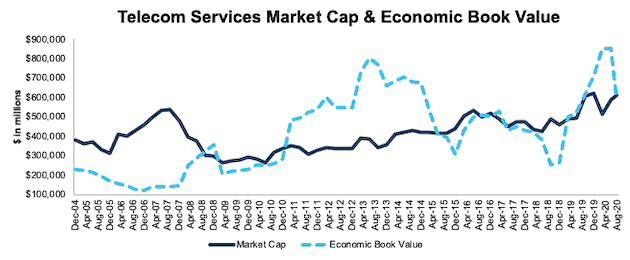

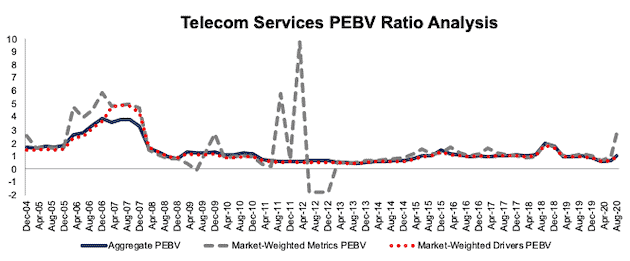

Telecom Services: PEBV Ratio = 1.0

Figure 12 shows the PEBV ratio for the Telecom Services sector has spiked in 2020, but the sector’s valuation remains equal to its economic book value. The sector market cap fell from $621 billion at the end of 2019 to $610 billion TTM while economic book value declined from $708 billion to $590 billion over the same time.

Figure 12: Telecom Services PEBV Ratio: December 2004 – 8/11/20

Sources: New Constructs, LLC and company filings.

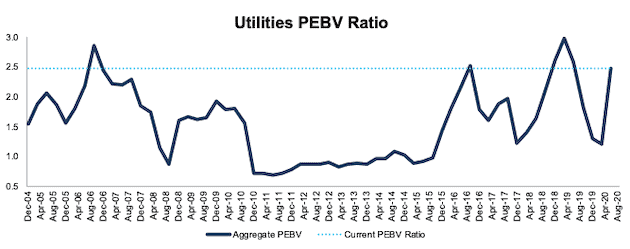

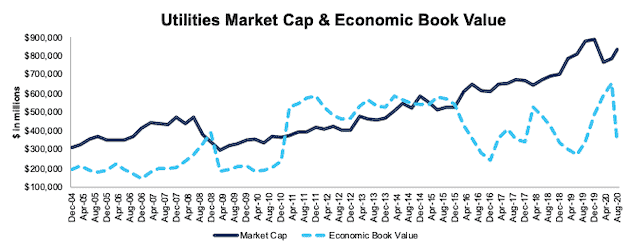

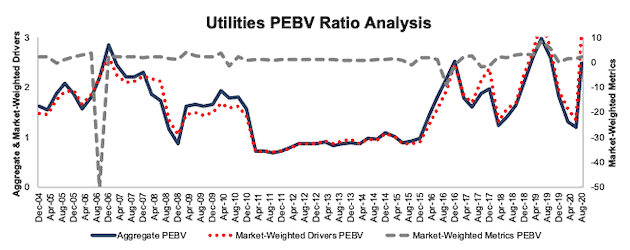

Utilities: PEBV Ratio = 2.5

Figure 13 shows the volatile nature of the PEBV ratio for the Utilities sector. The sector’s current PEBV ratio has only been surpassed in four periods, December 2006, March 2019, June 2019, and September 2019. The Utilities sector market cap fell from $888 billion at the end of 2019 to $837 billion TTM and economic book value fell from $489 billion to $338 billion over the same time.

Figure 13: Utilities PEBV Ratio: December 2004 – 8/11/20

Sources: New Constructs, LLC and company filings.

This article originally published on October 6, 2020.

Disclosure: David Trainer, Kyle Guske II, and Matt Shuler receive no compensation to write about any specific stock, style, or theme.

Follow us on Twitter, Facebook, LinkedIn, and StockTwits for real-time alerts on all our research.

Appendix I: S&P 500: Market Cap & Economic Book Value Since 2004

This appendix shows the two drivers used to calculate PEBV ratio – market cap and economic book value (EBV) – for the S&P 500 and each S&P 500 sector going back to December 2004. We sum the individual S&P 500 constituent values for market cap and economic book value. We call this approach the “Aggregate” methodology, and it matches S&P Global’s (SPGI) methodology for these calculations. More methodology details in Appendix II.

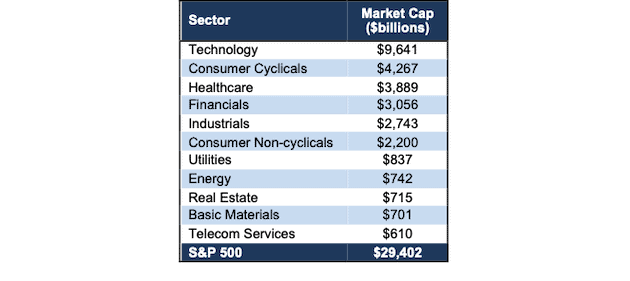

Figure 15 ranks all 11 sectors by TTM market cap. It shows the Technology sector’s potentially outsized impact on the S&P 500, with a market cap more than double the size of the next closest sector, Consumer Cyclicals.

Figure 15: Market Cap by Sector – TTM as of 8/11/20

Sources: New Constructs, LLC and company filings.

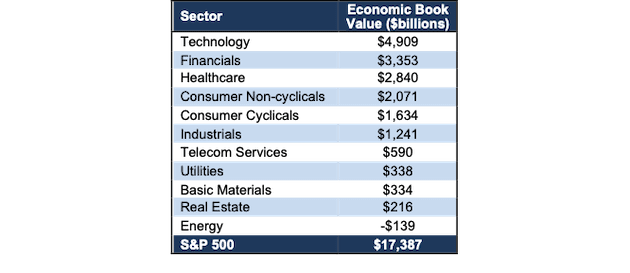

Figure 16 ranks all 11 sectors by TTM economic book value. it shows that the Technology sector also has the highest economic book value – though it’s not nearly double the EBV of the next closest sector.

Figure 16: Economic Book Value by Sector – TTM as of 8/11/20

Sources: New Constructs, LLC and company filings.

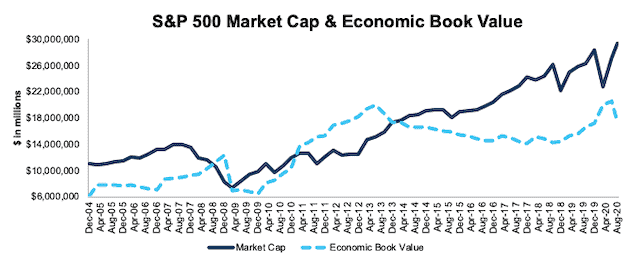

Figures 17-28 compare the market cap and economic book value trends for the S&P 500 and every sector since 2004.

Note the much more prolonged price downturn during the Financial Crisis compared to the rapid recovery after the COVID-19-induced market crash.

Figure 17: S&P 500 Market Cap & Economic Book Value: December 2004 – 8/11/20

Sources: New Constructs, LLC and company filings.

Figure 18: Basic Materials Market Cap & Economic Book Value: December 2004 – 8/11/20

Sources: New Constructs, LLC and company filings.

Figure 19: Consumer Cyclicals Market Cap & Economic Book Value: December 2004 – 8/11/20

Sources: New Constructs, LLC and company filings.

Figure 20: Consumer Non-cyclicals Market Cap & Economic Book Value: December 2004 – 8/11/20

Sources: New Constructs, LLC and company filings.

Figure 21: Energy Market Cap & Economic Book Value: December 2004 – 8/11/20

Sources: New Constructs, LLC and company filings.

Figure 22: Financials Market Cap & Economic Book Value: December 2004 – 8/11/20

Sources: New Constructs, LLC and company filings.

Figure 23: Healthcare Market Cap & Economic Book Value: December 2004 – 8/11/20

Sources: New Constructs, LLC and company filings.

Figure 24: Industrials Market Cap & Economic Book Value: December 2004 – 8/11/20

Sources: New Constructs, LLC and company filings.

Figure 25: Real Estate Market Cap & Economic Book Value: December 2004 – 8/11/20

Sources: New Constructs, LLC and company filings.

Figure 26: Technology Market Cap & Economic Book Value: December 2004 – 8/11/20

Sources: New Constructs, LLC and company filings.

Figure 27: Telecom Services Market Cap & Economic Book Value: December 2004 – 8/11/20

Sources: New Constructs, LLC and company filings.

Figure 28: Utilities Market Cap & Economic Book Value: December 2004 – 8/11/20

Sources: New Constructs, LLC and company filings.

Appendix II: Analyzing PEBV Ratio with Different Weighting Methodologies

We derive the metrics above by summing the individual S&P 500 constituent values for market cap and economic book value to calculate PEBV ratio. We call this approach the “Aggregate” methodology.

The Aggregate methodology provides a straightforward look at the entire sector, regardless of firm size or index weighting, and matches how S&P Global (SPGI) calculates metrics for the S&P 500.

For additional perspective, we compare the Aggregate method for PEBV ratio with two other market-weighted methodologies. These market-weighted methodologies add more value for ratios that do not include market values, e.g. ROIC and its drivers, but we include them here, nonetheless, for comparison:

- Market-weighted metrics – calculated by market-cap-weighting the PEBV ratio for the individual companies in each sector in each period. Details:

- Company weight equals the company’s market cap divided by the market cap of the S&P 500 or its sector

- We multiply each company’s PEBV ratio by its weight

- S&P 500/Sector PEBV equals the sum of the weighted PEBV ratios for all the companies in the S&P 500/sector

- Market-weighted drivers – calculated by market-cap-weighting the market cap and economic book value for the individual companies in each sector in each period. Details:

- Company weight equals the company’s market cap divided by the market cap of the S&P 500 or its sector

- We multiply each company’s market cap and economic book value by its weight

- We sum the weighted market cap and weighted economic book value for each company

- S&P 500/Sector PEBV ratio equals weighted market cap divided by weighted economic book value

Each methodology has its pros and cons, as outlined below:

Aggregate method

Pros:

- A straightforward look at the entire S&P 500/sector, regardless of company size or weighting in any indices.

- Matches how S&P Global calculates metrics for the S&P 500.

Cons:

- Vulnerable to impact of companies entering/exiting the group of companies, which could unduly affect aggregate values. Also susceptible to outliers in any one period.

Market-weighted metrics method

Pros:

- Accounts for a firm’s market cap relative to the S&P 500/sector and weights its metrics accordingly.

Cons:

- Vulnerable to outlier results from a single company disproportionately impacting the overall PEBV ratio, as we’ll show below.

Market-weighted drivers method

Pros:

- Accounts for a firm’s market cap relative to the S&P 500/sector and weights its size and economic book value accordingly.

- Mitigates the disproportionate impact of outlier results from one company on the overall results.

Cons:

- More susceptible to large swings in market cap or economic book value period over period, particularly from firms with a large weighting in the S&P 500/Sector.

Figures 29-40 compare these three methods for calculating S&P 500 and sector PEBV ratio. We provide some high-level commentary on why certain sectors show some interesting results. Clients can contact us for access to the underlying data to study the results in more detail.

In Figure 29, the sharp decline in the market-weighted metrics PEBV for the S&P 500 in 2015, along with the sharp increase in 2018, are driven largely by volatility in Amazon’s (AMZN) economic book value. The first instance was caused by a sharp decline in the firm’s net operating profit after-tax (NOPAT), coupled with an increase in weighted average cost of capital (WACC), which resulted in a negative economic book value and negative 16,606 PEBV. The second instance, in 2018, was caused by the significant increase in debt after the firm’s acquisition of Whole Foods, which caused economic book value to fall precipitously and PEBV to rise to nearly 1,228.

This analysis highlights the outsized sensitivity of the market-weighted metrics methodology to outlier results from a single company with a large market cap, such as Amazon.

Figure 29: S&P 500 PEBV Ratio Methodologies Compared: December 2004 – 8/11/20

Sources: New Constructs, LLC and company filings.

Figure 30: Basic Materials PEBV Ratio Methodologies Compared: December 2004 – 8/11/20

Sources: New Constructs, LLC and company filings.

In Figure 31, Amazon drives the sharp decline in the market-weighted metrics PEBV for the Consumer Cyclicals Sector in 2015 along with the sharp increase in 2018, as noted for S&P 500 above. The impacts are even larger on the sector-level results, as Amazon represented 10% of the sector in 2015 and 23% in 2018.

Figure 31: Consumer Cyclicals PEBV Ratio Methodologies Compared: December 2004 – 8/11/20

Sources: New Constructs, LLC and company filings.

In Figure 32, the sharp increase in the market-weighted metrics PEBV for the Consumer Non-cyclicals sector in 2016, is driven by Kraft Heinz (KHC). The merger between Kraft and Heinz caused the combined firms’ economic book value to improve from -$15 billion in June 2016 to $1 billion in September 2016, which resulted in PEBV rising from negative 7 to positive 98 over the same time. Given KHC’s 5% weight in the sector this large change in PEBV had an outsized impact on the sector’s market-weighted metrics PEBV.

Figure 32: Consumer Non-cyclicals PEBV Ratio Methodologies Compared: December 2004 – 8/11/20

Sources: New Constructs, LLC and company filings.

In Figure 33, the sharp increase in the market-weighted metrics PEBV for the Energy sector in 2016, is driven largely by Exxon Mobil (XOM), which at the time, made up 25% of the sector’s market cap. As a result of crashing oil prices, XOM’s NOPAT more than halved in 2015 and 2016 was still 41% below 2014. The significant decline in profitability caused an equally large drop in XOM’s economic book value and resulted in XOM’s PEBV increasing from 14 in June 2016 to 425 in December 2016. Given its large weighting in the sector, this increase had an outsized impact on the sector’s market-weighted metrics PEBV during this time.

Figure 33: Energy PEBV Ratio Methodologies Compared: December 2004 – 8/11/20

Sources: New Constructs, LLC and company filings.

In Figure 34, the sharp decrease in the market-weighted metrics PEBV for the Financials sector in 2019, is driven largely by Fiserv (FISV) and its $22 billion acquisition of First Data. The acquisition significantly increased Fiserv’s total debt, which resulted in a negative economic book value and PEBV that created a drag on the entire sector.

Figure 34: Financials PEBV Ratio Methodologies Compared: December 2004 – 8/11/20

Sources: New Constructs, LLC and company filings.

Figure 35: Healthcare PEBV Ratio Methodologies Compared: December 2004 – 8/11/20

Sources: New Constructs, LLC and company filings.

Figure 36: Industrials PEBV Ratio Methodologies Compared: December 2004 – 8/11/20

Sources: New Constructs, LLC and company filings.

Figure 37: Real Estate PEBV Ratio Methodologies Compared: December 2004 – 8/11/20

Sources: New Constructs, LLC and company filings.

In Figure 38, the sharp decrease in the market-weighted metrics PEBV in 2019, is driven largely by Netflix’s (NFLX) rising total debt, which caused a significant drop in the firm’s economic book value from one quarter to the next. A subsequent rise in NOPAT drove the ratio back to positive territory.

Figure 38: Technology PEBV Ratio Methodologies Compared: December 2004 – 8/11/20

Sources: New Constructs, LLC and company filings.

Figure 39: Telecom Services PEBV Ratio Methodologies Compared: December 2004 – 8/11/20

Sources: New Constructs, LLC and company filings.

Figure 40: Utilities PEBV Ratio Methodologies Compared: December 2004 – 8/11/20

Sources: New Constructs, LLC and company filings.

[1] We calculate these metrics based on S&P Global’s (SPGI) methodology, which sums the individual S&P 500 constituent values for market cap and economic book value before using them to calculate the metrics. We call this the “Aggregate” methodology. Get more details in Appendix I and II.

[2] For 3rd-party reviews on the benefits of adjusted Core Earnings, historically and prospectively, across all stocks, click here and here.