We’re excited to announce our “DIY ETF” tool, which gives clients the ability to create a custom basket of stocks, ETFs and/or mutual funds weighted according to traditional and proprietary factors.

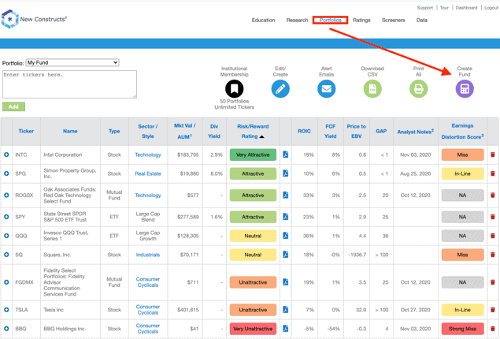

With one click, clients can download a standard order form that brokers can use to create a DIY ETF based on the clients’ customized basket. Access the DIY ETF tool on the Portfolios page, as seen in Figure 1.

Figure 1: New Constructs Website: DIY ETF Tool

Sources: New Constructs, LLC and company filings.

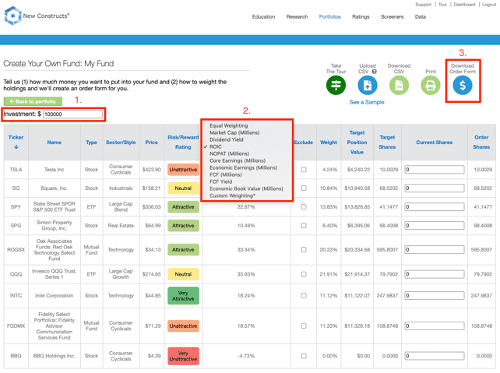

Figure 2 shows where to access key features on the DIY ETF page:

- Enter any investment amount – our system automatically adjusts your order form for the amount of money you wish to allocate.

- Choose the weighting methodology – we offer 10+ factors, including market cap, dividend yield, our proprietary core earnings and return on invested capital (ROIC), and your own custom weightings.

- Download Order Form – get a CSV file with every order needed to create the portfolio on the page. Click here for a sample.

Figure 2: How to Use the DIY ETF Tool

Sources: New Constructs, LLC and company filings.

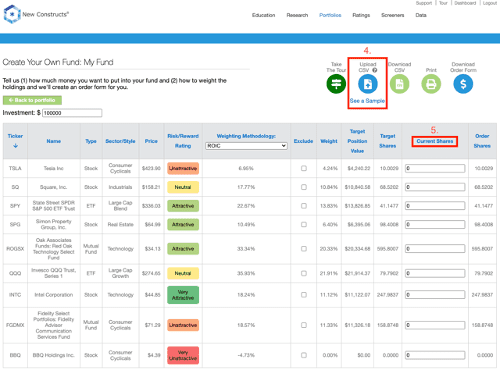

Per Figure 3, clients can also:

4. Upload a CSV of any list of stocks, ETFs and mutual funds along with the shares you own and manage it using the tools on our site. Click here for a sample upload file.

5. Edit current shares – enter the number of shares you already own in any holding and automatically update your order form.

Figure 3: More Features of the DIY ETF Tool

Sources: New Constructs, LLC and company filings.

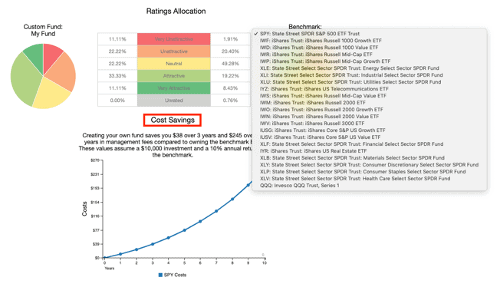

Figure 4 shows how the DIY ETF tool automatically estimates your cost savings compared to investing in your chosen benchmark. To select a benchmark, open the drop-down menu to the right of “Ratings Allocation” table.

Figure 4: How to Use the DIY ETF Tool: Cost Savings Feature

Sources: New Constructs, LLC and company filings.

Please contact us at support@newconstructs.com if you have any questions.

This article originally published on November 11, 2020.

Disclosure: David Trainer, Kyle Guske II, and Matt Shuler receive no compensation to write about any specific stock, style, or theme.

Follow us on Twitter, Facebook, LinkedIn, and StockTwits for real-time alerts on all our research.