We published an update on this Long Idea on May 19, 2021. A copy of the associated Earnings Update report is here.

This week, we focus on a firm that is well-positioned to thrive in the increasingly competitive video streaming market. Though it is currently rated Unattractive in our model, largely due to transitory COVID-19-related disruptions, micro-bubble winner The Walt Disney Company (DIS: $189/share) is this week’s Long Idea, which we pair with Neutral-rated micro-bubble loser Netflix Inc. (NFLX: $535/share).

We first made Disney a Long Idea in January 2017 and a Micro-Bubble winner in August 2018. While the stock has underperformed the S&P 500 by 3% since our first article, it is up 65% (vs. S&P +38%) since our August 2018 report. Today, Disney’s stock remains undervalued as its business recovers from the pandemic and enters the next phase of growth. DIS continues to present quality risk/reward given Disney’s:

- unmatched ability to create and monetize original content

- growth in streaming is outpacing expectations

- ability to generate profit if streaming margins approach zero

- live content is a key differentiator

- parks and cruises will rebound beyond pre-covid levels

- cheap valuation and large upside for DIS if profits reach 2018 levels

Another Door Into the Magic Kingdom

Unlike Netflix, Disney’s profitability is not dependent on streaming because the firm is, rather uniquely, positioned to monetize content across many business segments. While the firm believes its streaming business will be profitable by 2024, profits are not the point for Disney’s streaming business. We think of Disney’s streaming offerings as another entry point into the magic kingdom’s content monetization platform.

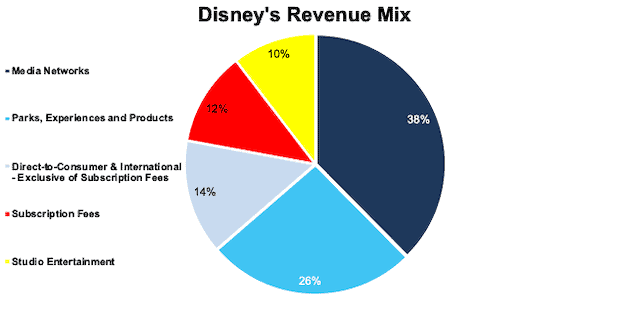

Figure 1 shows subscription fees from streaming services account for only 12% of the firm’s revenue in 2020.

Figure 1: Disney’s Revenue by Segment in Fiscal 2020

Sources: New Constructs, LLC and company filings.

Disney Is Growing Market Share While Netflix Isn’t

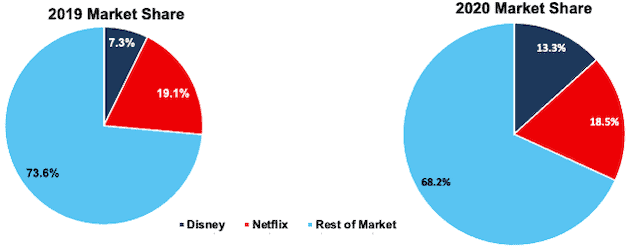

At the end of fiscal 1Q21, Disney had more than 146 million subscribers across its Disney+, Hulu, and ESPN+ platforms. In just 16 months from its launch date, Disney+ reached 100 million subscribers, a feat that took Netflix 10 years to accomplish. For reference, Netflix currently has 204 million paid subscribers, or just 40% more than Disney’s subscribers across all platforms. Rapid user growth means Disney has improved its share of global online video subscriptions from 7% in calendar 2019 to 13% in calendar 2020.

Figure 2: Disney’s & Netflix’s Share of Global Online Video Subscriptions

Sources: New Constructs, LLC and company filings.

Motion Pictures Association’s 2020 THEME Report

Netflix Can’t Match Disney’s Content Budget Forever

Losing popular content to Disney, Warner Bros, Paramount, and NBC (because they now have their own streaming services) forced Netflix to shift to creating its own original content. This strategy is not cheap, and Netflix’s original content budget rose from $2.4 billion in 2013 to $19 billion in 2021. Despite all this spending, Netflix still relies heavily on content it licenses from other creators. In fact, its three most streamed series in 2020 were all licensed.

The big problem with Netflix’s strategic shift to create its own content is that it is too expensive to sustain for a business that can monetize through just one channel. On the other hand, the magic kingdom’s content monetization platform has a long history of generating huge cash flows (see Figure 5) from original content.

Disney announced plans to launch 100 film and television projects and increase its original content budget to $14-$16 billion per year by 2024. Can Netflix keep up? We don't think Netflix’s mono-channel streaming business has the staying power to keep up with Disney’s original content spending, not to mention the original content spending of all the many other video content producers (see Figure 4).

Netflix Must Become Disney, Not the Other Way Around

On the one hand, Netflix lacks Disney’s ability to monetize content through merchandise sales, theme parks, cruises, and licensing to consumer products. On the other hand, Disney has proven it can distribute content through a streaming channel.

In addition to monetizing content, another key factor in this competition is who can produce the best content, and Disney beats Netflix on this front, too. Last year, Disney had five of the top 20 (more than any other studio) and two of the top three most watched at home titles according to the Motion Picture Association. Disney also had seven of the 10 top streaming films in the U.S.

Disney Already Has Scale Advantages

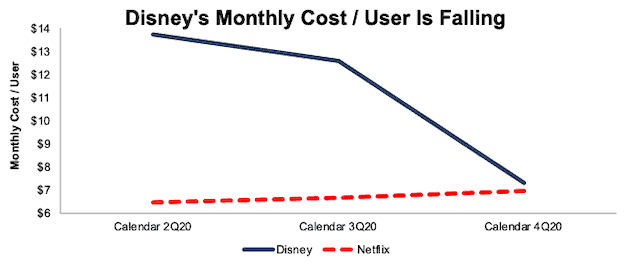

Disney’s cost of streaming revenue has rapidly declined over the past year. Disney’s monthly cost of streaming revenue per paid subscriber[1] fell from $13.72 in calendar 2Q20 to $7.29 in calendar 4Q20. Meanwhile, Netflix’s monthly cost of streaming revenue per paid subscriber grew from $6.46 in calendar 2Q20 to $6.96 in calendar 4Q20.

In other words, in short time, Disney’s cost of streaming per user has nearly matched Netflix’s, per Figure 3.

Figure 3: Disney vs. Netflix: Monthly Cost of Streaming / User

Sources: New Constructs, LLC and company filings.

Disney Growing in a Splintered Market

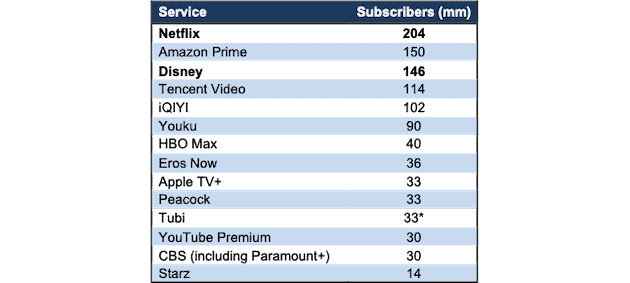

The streaming market, which was once dominated by only a few players, is quickly splintering, and Disney has arrived to take market share. At least 14 streaming services now have at least 10 million subscribers. Market entrants with existing profitable businesses (i.e. Disney, Amazon [AMZN], YouTube [GOOGL], Apple [AAPL], Paramount [VIAC] and Warner Bros.[T]) can now add low-cost streaming in addition to their many other offerings. Figure 4 is a non-exhaustive list of some of the competition in the global online streaming market.

Figure 4: Competitors in the Online Streaming Market

Sources: New Constructs, LLC and company filings.

*Monthly Active Users (MAUs). As a free service, Tubi reports MAUs instead of numbers of subscribers.

Disney Will Grow Profits and Take Market Share in a Commoditized Market

The flood of new market entrants will lead to the continued commoditization of the online streaming industry. Disney, with its ability to monetize content at scale, is perfectly positioned to profitably compete in a lower-margin streaming market and force out smaller services which are unable compete at lower margins. Since Disney is not solely dependent on streaming to sustain its business, it can afford to operate its streaming services at a loss for an extended period of time and still leverage streaming as another customer acquisition gateway into other businesses that the firm monetizes, such as merchandise, parks, and cruises.

Live Content Drives Further Demand for Disney

Netflix promotes its spending on original content, while live content is conspicuously absent from its library. However, Disney and other streaming competitors have decades of experience of monetizing live content.

Recently, the NFL announced its new distribution rights deal which includes agreements with Amazon, CBS, Disney, Fox, and NBC. Disney secured ESPN’s distribution of Monday Night Football (cable’s most-watched series) for the next 11 years. Additionally, Disney’s ABC purchased the rights to air two Super Bowls which the network has not done since 2006. Disney is also picking up six more regular season games and a playoff game each season. This recent deal should attract plenty of eyeballs to Disney’s platforms. In the final six weeks of the 2020 season, the average Monday Night Football game averaged nearly 13 million viewers and Super Bowl LV drew ~92 million viewers.

Disney is pursuing live content outside of football, too. The NHL recently announced a seven year deal that will bring hockey games to ESPN for the first time since 2005.

Beyond the domestic live sports, Disney’s growth in the Indian market in 2020 highlights the impact live content can have on a streaming service. With exclusive rights to the country’s widely popular IPL cricket league, Disney+Hotstar added 10 million subscribers in fiscal 1Q21 and now has 28 million subscribers.

Disney Will Monetize 21st Century Fox As Well

Disney has a long history of making acquisitions that create shareholder value. After acquisitions of Pixar, Marvel, and LucasFilms, Disney drove its return-on-invested capital (ROIC) to all-time highs of 14% in fiscal 2018. While Disney’s ROIC fell from its pre 21st Century Fox acquisition level of 14% in 2018 to just 1% TTM, we expect the Fox acquisition to create shareholder value in the long term given Disney’s success with previous acquisitions.

Disney immediately benefits from 21st Century Fox’s content library, which makes its streaming platform more competitive. Beyond the content library, Disney is working at unlocking value with 21st Century’s struggling film production business. Disney plans to profitably restructure 21st Century Fox by applying its tried-and-true template of focusing Fox’s production on its high-quality franchises. While this disciplined approach to production may take time, we expect Disney to derive long-term profit growth from this acquisition.

Parks and Cruises Will Rebound

The pandemic in 2020 dramatically disrupted Disney’s parks and cruises business. Revenue fell from $26.2 billion in fiscal 2019 to just $16.5 billion in fiscal 2020. It seems the worst may be over for the segment, though. With favorable declines in COVID-19 cases worldwide and the rollout of vaccinations, many of the firm’s operations are planning to reopen. Shanghai Disneyland, Tokyo Disney, and Hong Kong Disneyland are now open and Disneyland reopens April 30, 2021.

Walt Disney World reopened in July 2020 and saw a significant rise in demand in calendar 4Q20, nearly reaching full capacity in park passes over Thanksgiving. If Disney World is a leading indicator, then other more recently opened parks could see a quick uptick in demand as well.

Resumption of the firm’s cruise business will be delayed longer. However, Disney expects cruises to resume in fall 2021. Over the long-term, Disney’s parks and cruises are an extremely profitable business that we expect to rebound beyond pre-pandemic profit levels.

Disney’s Strong Cash Flows Showcase its Monetization Capabilities

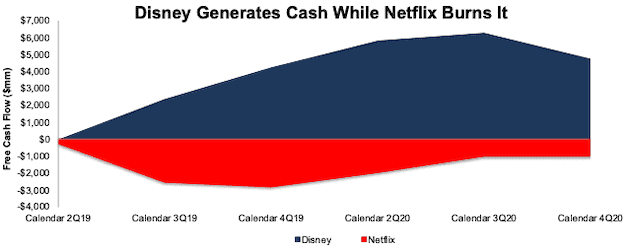

Given the competitive advantages above, it should come as no surprise that Disney generates significant free cash flow (FCF). Since calendar 2Q20, Disney has returned to cash flow positive after its $71 billion acquisition of 21st Century Fox and generated a cumulative $4.7 billion in FCF over the past seven quarters. On the other hand, Netflix has burned $1 billion in FCF over the same time.

Figure 5: Disney vs. Netflix: Cumulative Free Cash Flow Since Calendar 2Q19

Sources: New Constructs, LLC and company filings.

Disney’s Current Price Implies Margins Only Recover to Pre-Pandemic Levels

We use our reverse discounted cash flow (DCF) model to highlight the disconnect in the future revenue and profit growth expectations baked into Disney’s and Netflix’s current stock prices.

To justify Disney’s current price of $189/share, we assume:

- net operating profit after-tax (NOPAT) margin improves to 11% in 2021 (average of 2019 and 2020) as parks reopen and cruises resume

- NOPAT margin improves to 15% in 2022 (equal to 2019), and reaches 18% in 2023 (equal to its pre-acquisition five-year average, compared to 3% TTM) and each year thereafter through 2031

- revenue grows 11% compounded annually from 2021-2025 (equal to consensus revenue estimates) and 3.5% each year thereafter through 2031

In this scenario, Disney’s NOPAT grows 5% compounded annually in the 13 years following its pre-acquisition fiscal 2018 NOPAT. For reference, Disney grew NOPAT by 11% compounded annually in the 13-year period preceding the 21st Century Fox acquisition. See the math behind this reverse DCF scenario.

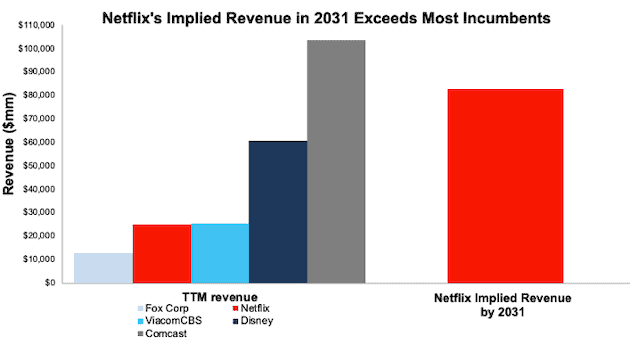

Netflix Must Generate More Revenue Than Fox Corp, ViacomCBS & Disney

On the other hand, expectations for Netflix’s future cash flows are much higher. To justify Netflix’s current stock price of $535/share, the company must:

- maintain its 2020 NOPAT margin of 16% (vs. five-year average of 9%)

- grow revenue 17% compounded annually from 2021-2023 (equal to consensus revenue estimates) and 10% each year thereafter through 2031

In this scenario, Netflix’s implied revenue in 2031 of $82.7 billion is 231% larger than its 2020 revenue, 118% larger than the combined TTM revenue of Fox Corp (FOXA) and ViacomCBS (VIAC), and 36% above Disney’s TTM revenue. See the math behind this reverse DCF scenario.

Figure 6 compares Netflix’s implied revenue in 2031 with the TTM revenue of other content production firms.

Figure 6: Netflix’s 2020 Revenue and Implied Revenue vs. Incumbents

Sources: New Constructs, LLC and company filings.

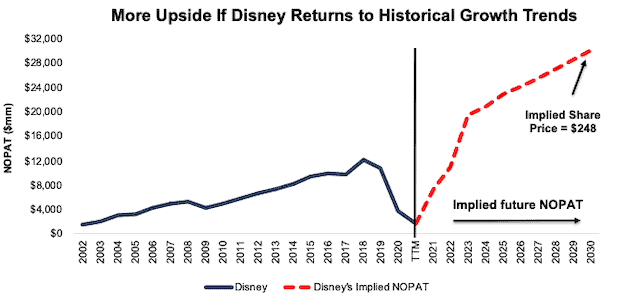

DIS Has 31% Upside if Revenue Grows at Consensus Estimates

DIS has considerable upside potential even if it only grows at expected rates. If we assume Disney’s:

- net operating profit after-tax (NOPAT) margin improves to 11% in 2021 (average of 2019 and 2020) as parks reopen and cruises resume

- NOPAT margin improves to 15% in 2022 (equal to 2019), and reaches 20% in 2023 (equal to 2018) and each year thereafter through 2030

- revenue grows 11% compounded annually from 2021-2025 (equal to consensus revenue estimates) and 5.7% (equal to its five-year pre-acquisition revenue CAGR) each year thereafter until 2030, then

the stock is worth $248/share today – a 31% upside to the current stock price. See the math behind this reverse DCF scenario. Figure 7 compares Disney’s historical NOPAT with the implied NOPAT in this scenario.

Figure 7: See Through the Dip – DCF Scenario 2: Historical vs. Implied NOPAT

Sources: New Constructs, LLC and company filings.

Keep These Winners & Sell These Losers

There are micro-bubbles in other industries, too. Figure 8 shows all of our micro-bubble winners and losers along with our original Disney vs. Netflix micro-bubble report.

Figure 8: Micro-Bubble Winners & Micro-Bubble Stocks

| Micro-Bubble Winners | Micro-Bubble Losers | Report Date |

| The Walt Disney Company (DIS) | Netflix (NFLX) | 3/24/21 |

| JPMorgan Chase (JPM) | No one specific loser | 3/10/21 |

| Not one specific winner | Spotify Technology (SPOT) | 3/1/21 |

| General Motors Co (GM) | Tesla Inc (TSLA) | 2/18/21 |

| Kellogg Company (K) | Beyond Meat Inc. (BYND) | 2/16/21 |

| Hyatt Hotels Corp (H) | Airbnb, Inc. (ABNB) | 2/10/21 |

| Williams-Sonoma Inc. (WSM) | Wayfair, Inc. (W) | 2/3/21 |

| Sysco Corporation (SYY) | DoorDash, Inc. (DASH) | 1/27/21 |

| Alphabet, Inc. (GOOGL) | GoDaddy Inc (GDDY) | 9/26/18 |

| Microsoft Corporation (MSFT) | Dropbox Inc. (DBX) | 9/26/18 |

| Oracle Corporation (ORCL) | Salesforce.com Inc. (CRM) | 8/16/18 |

| Walmart, Inc. (WMT) | Amazon.com Inc. (AMZN) | 8/16/18 |

Sources: New Constructs, LLC and company filings.

This article originally published on March 24, 2021.

Disclosure: David Trainer, Kyle Guske II, and Matt Shuler receive no compensation to write about any specific stock, style, or theme.

Follow us on Twitter, Facebook, LinkedIn, and StockTwits for real-time alerts on all our research.

[1]Monthly cost of streaming revenue per subscriber for Disney and Netflix is calculated as the total cost of revenue in the reported period divided by the number of months in the reported period and the average number of subscribers in the reported period. Disney’s cost of streaming revenue equals the firm’s programming and production costs and other operating expense from its filings. Netflix’s cost of streaming revenue is taken from its filings’ cost of revenue, which includes “expenses associated with the acquisition, licensing and production of content…”