This report is one of a series on the adjustments we make to GAAP data so we can measure shareholder value accurately. This report focuses on an adjustment we make to our calculation of economic book value and our discounted cash flow model.

We’ve already broken down the adjustments we make to NOPAT and invested capital. Many of the adjustments in this third and final section deal with how adjustments to those two metrics affect how we calculate the present value of future cash flows. Some adjustments represent senior claims to equity holders that reduce shareholder value while others are assets that we expect to be accretive to shareholder value.

Adjusting GAAP data to measure shareholder value should be part of every investor’s diligence process. Performing detailed analysis of footnotes and the MD&A is part of fulfilling fiduciary responsibility.

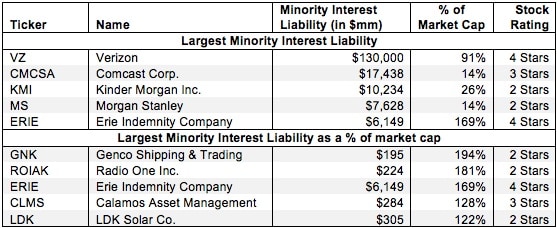

Minority interests (or non-controlling interests) are a significant but non-controlling ownership of a company's voting shares. The portion of the parent company's income attributed to the minority interests is subtracted from reported profits, i.e. the minority interest expense. The parent company's balance sheet will also show a liability for the minority interest.

We subtract the fair value of the minority interest liability from shareholder value in our DCF model as the minority interest shareholders have the rights to that portion of the cash flows. Without careful research, investors would never know that these minority interest liabilities distort GAAP numbers.