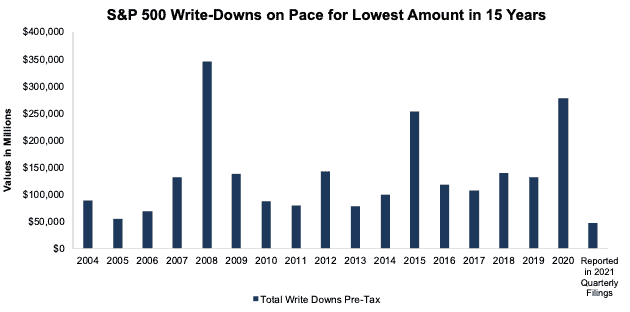

Write-downs for S&P 500 companies through the first nine months of 2021 remain on pace for the lowest levels seen in 15 years. Low write-downs continue a trend we first saw through the first half of 2021 in our report Write-Downs Near 15-Year Lows Post 2020 “Kitchen Sink”. We see a similar trend continue in Small Cap and All Cap companies.

In this report, we’ll look at the write-down trends across the S&P 500, NC 1500 (our proxy for Small Cap companies), and the NC 2000 (our proxy for All Cap companies).

This report leverages more reliable fundamental data[1] that overcomes flaws with legacy fundamental datasets to provide a more informed view of the fundamentals of companies and a new source of alpha.

S&P 500 Through First Nine Months of 2021: Write-Downs Are 77% Lower Year-Over-Year (YoY)

The total value of pre-tax[2] write-downs for the S&P 500 through the first nine months of 2021 is $46.6 billion, or just 17% of the total write-downs in 2020. Our analysis shows write-downs tend to spike (“kitchen sink” effect) when stock markets and economic growth sink, as they did during the financial crisis of 2008, the economic turbulence in 2015, and the pandemic-driven disruptions in 2020.

Figure 1: S&P 500: Total Write-Downs Pre-Tax: 2004[3] through First Nine Months of 2021

Sources: New Constructs, LLC, and company filings

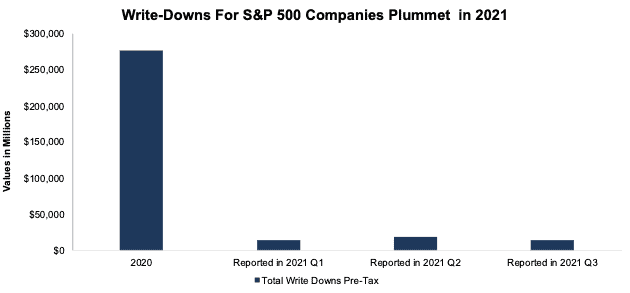

S&P 500 First Nine Months of 2021: Write-Downs by Quarter

In 1Q21, S&P 500 companies disclosed $14.2 billion in pre-tax write-downs. In 2Q21, we found another $18.2 billion in pre-tax write-downs for the S&P 500. In 3Q21, S&P 500 companies disclosed $14.3 billion in pre-tax write-downs, 49% less than 3Q20 and just 5% of the total for 2020. See Figure 2.

Figure 2: S&P 500: Write-Downs in 2020 vs 1Q21, 2Q21, and 3Q21

Sources: New Constructs, LLC, and company filings

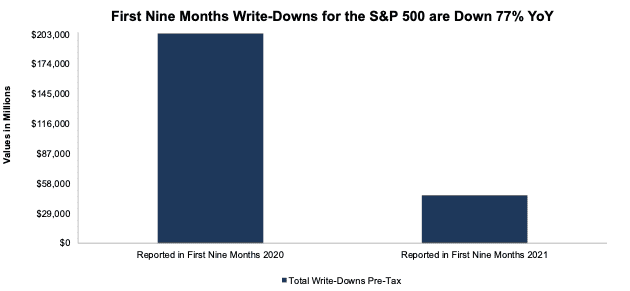

S&P 500: Write-Downs In First Nine Months of 2021 vs. First Nine Months of 2020

Pre-tax write-downs in the first nine months of 2021 totaled $46.6 billion, or 23% of the total pre-tax value of write-downs in the first nine months of 2020.

Figure 3: S&P 500: Write-Downs in First Nine Months of 2020 vs. 2021

Sources: New Constructs, LLC, and company filings

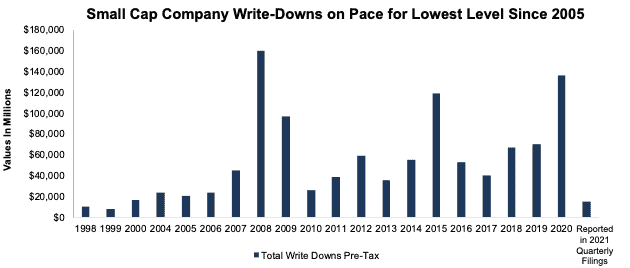

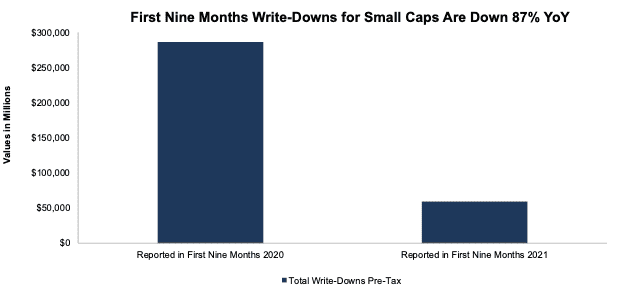

Small Cap Companies: First Nine Months of 2021: Write-Downs Are 87% Lower YoY

We found $14.8 billion in pre-tax write-downs, or 11% of the total in 2020, for Small Cap companies in the first nine months of 2021. Going back to the tech bubble, our analysis shows write-downs tend to spike when stock markets and economic growth lag.

The NC 1500 Small Cap index represents the aggregated results for the smallest 1500 companies by market cap in our NC 2000 All Cap index for each period. The list changes in each period based on the market caps of the companies in each period.

Figure 4: NC 1500 Small Cap: Total Write-Downs Pre-Tax: 1998 through First Nine Months of 2021

Sources: New Constructs, LLC, and company filings

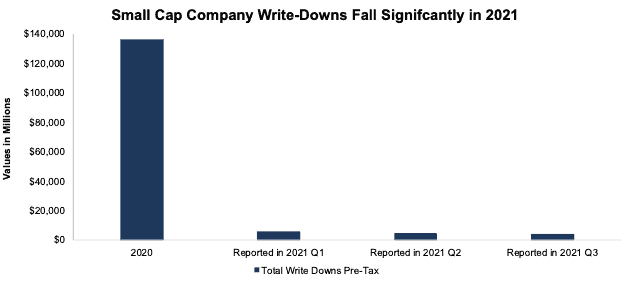

Small Cap Companies: First Nine Months of 2021: Massive Drop-off in Charges in 1Q21, 2Q21, and 3Q21

In 1Q21, Small Cap companies disclosed $6.1 billion in pre-tax write-downs. In 2Q21, we found another $4.8 billion in pre-tax write-downs. In 3Q21, Small Cap companies disclosed $3.9 billion in pre-tax write-downs, 77% less than 3Q20 and just 3% of the total for 2020.

Figure 5: NC 1500 Small Cap: Write-Downs in 2020 vs 1Q21, 2Q21, and 3Q21

Sources: New Constructs, LLC, and company filings

Small Cap Companies: Write-Downs in First Nine Months of 2021 vs. First Nine Months of 2020

Pre-tax write-downs in the first nine months of 2021 totaled $14.8 billion, or just 13% of the total pre-tax value of write-downs in the first nine months of 2020.

Figure 6: NC 1500 Small Cap: Write-Downs in First Nine Months of 2020 vs First Nine Months of 2021

Sources: New Constructs, LLC, and company filings

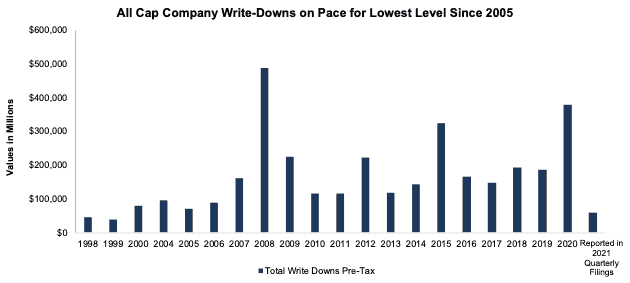

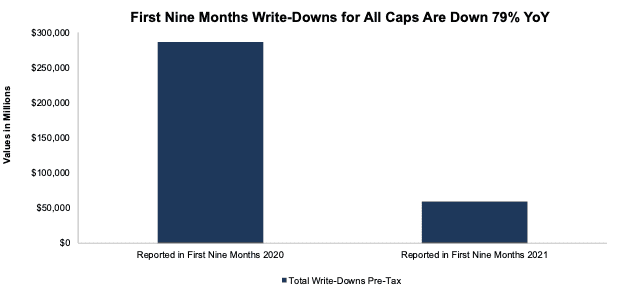

All Cap Companies: First Nine Months 2021: Write-Downs Are 79% Lower YoY

We found $59.2 billion in pre-tax write-downs, or 16% of the total in 2020, for our All Cap index in the first nine months of 2021.

The NC 2000 All Cap index represents the aggregated results for the largest 2000 companies by market cap in our coverage universe for each period. The list changes in each period based on the market caps of the companies in each period.

Figure 7: NC 2000 All Cap: Total Write-Downs Pre-Tax: 1998 through First Nine Months of 2021

Sources: New Constructs, LLC, and company filings

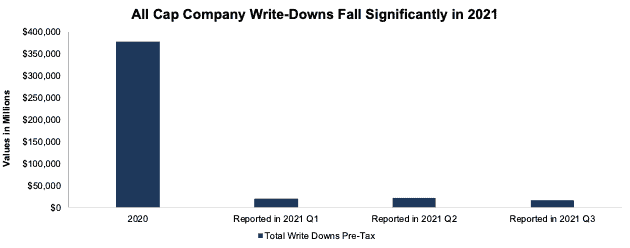

All Cap Companies: First Nine Months of 2021: Write-Downs by Quarter

In 1Q21, our All Cap index of companies disclosed $19.7 billion of pre-tax write-downs. In 2Q21, we found another $22.2 billion in pre-tax write-downs. In 3Q21, our All Cap index of companies disclosed $17.3 billion in pre-tax write-downs, 60% less than 3Q20 and just 5% of the total for 2020.

Figure 8: NC 2000 All Cap: Write-Downs in 2020 vs 1Q21, 2Q21, and 3Q21

Sources: New Constructs, LLC, and company filings

All Cap Companies: Write-Downs In First Nine Months 2021 vs. First Nine Months 2020

Pre-tax write-downs in the first nine months of 2021 totaled $59.2 billion or 21% of the total pre-tax value of write-downs in the first nine months of 2020 for our All Cap index.

Figure 9: NC 2000 All Cap: Write-Downs in First Nine Months of 2020 vs 2021

Sources: New Constructs, LLC, and company filings

This article originally published on December 14, 2021.

Disclosure: David Trainer, Kyle Guske II, and Matt Shuler receive no compensation to write about any specific stock, sector, style, or theme.

Follow us on Twitter, Facebook, LinkedIn, and StockTwits for real-time alerts on all our research.

[1] Three independent studies prove the superiority of our data, models, and ratings. Learn more here.

[2] This report focuses on “pre-tax” values though we also have the after-tax values for all views presented.

[3] Our S&P 500 research goes back to 2004. Our data on All Cap and Small Cap stocks go back to 1998.