This report is one of a series on the adjustments we make to GAAP data so we can measure shareholder value accurately. This report focuses on an adjustment we make to our calculation of economic book value and our discounted cash flow model.

We’ve already broken down the adjustments we make to NOPAT and invested capital. Many of the adjustments in this third and final section deal with how adjustments to those two metrics affect how we calculate the present value of future cash flows. Some adjustments represent senior claims to equity holders that reduce shareholder value while others are assets that we expect to be accretive to shareholder value.

Adjusting GAAP data to measure shareholder value should be part of every investor’s diligence process. Performing detailed analysis of footnotes and the MD&A is part of fulfilling fiduciary responsibilities.

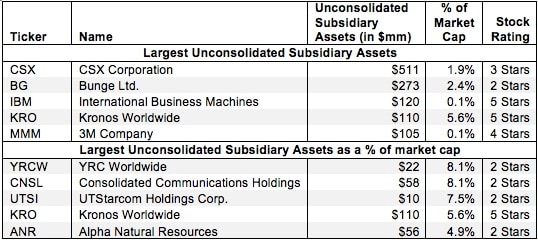

When a company has significant control in a subsidiary, the parent company’s equity stake in the subsidiary appears on the balance sheet, but the subsidiary’s financial statements are not consolidated into the parent company’s statements. If this subsidiary’s income is explicitly disclosed, we treated it as operating and add this income to the parent’s NOPAT and the subsidiary’s assets to the parent’s invested capital.

However, if this income is not explicitly disclosed on the income statement, we cannot determine the subsidiary’s impact on the parent company’s profits. In this case, we exclude the subsidiary’s income and assets from NOPAT and invested capital. We then treat the assets in the unconsolidated subsidiary like cash and add them to shareholder value as we do excess cash.

1 Response to "Unconsolidated Subsidiary Assets – Valuation Adjustment"

How can we intentionally exclude income earned from unconsolidated subsidiaries if it was never disclosed? By default it would be automatically excluded.

Also, I’m assuming that the cash flow amounts (but not the accrual income, as you have stated before) generated from unconsolidated subsidiary assets was disclosed. Is that correct?

Otherwise it makes no sense to add unconsolidated subsidiary assets to EBV because such an adjustment would artificially raise EBV if we don’t know if such subsidiaries are generating cash.