Our honest approach to research paid off again for clients through the first nine months of 2022.

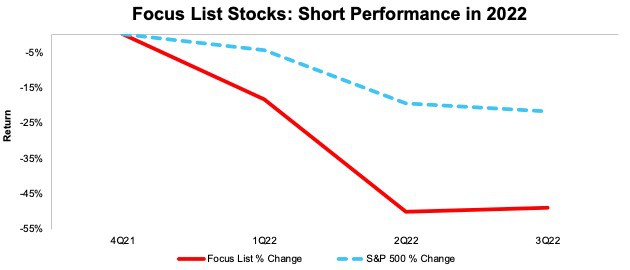

Our Focus List Stocks: Short Model Portfolio, the best-of-the-best of our Danger Zone picks, outperformed shorting the S&P 500[1] by 27% in through the first nine months of 2022, falling 49% compared to 22% for the S&P 500 over that time.

Figure 1: Focus List Stocks: Short Performance in First Nine Months 2022

Sources: New Constructs, LLC

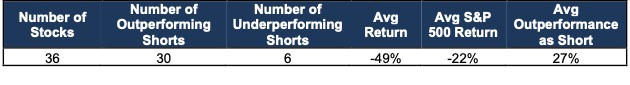

Figure 2 shows a more detailed breakdown of the Model Portfolio’s performance, which encompasses all the stocks that were in the Model Portfolio at any time in the first nine months of 2022.

Figure 2: 2022 Performance of Stocks in the Focus List Stocks: Short Model Portfolio Through 3Q22

Sources: New Constructs, LLC

Performance includes the performance of stocks currently in the Focus List Stocks: Short Model Portfolio, as well as those removed during the first nine months of 2022, of which there were none during that time.

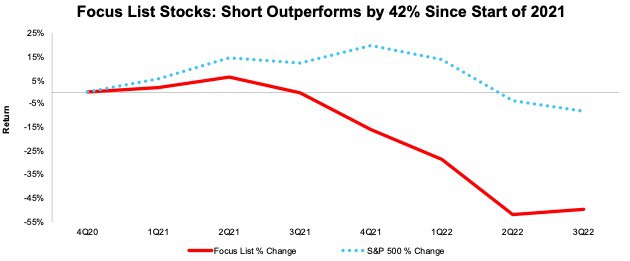

Underscoring just how important reliable fundamental research is in turbulent markets, this model portfolio has beaten the S&P 500 by an even wider margin, 42%, since the start of 2021.

Figure 3: Focus List Stocks: Short Performance Since Beginning of 2021

Sources: New Constructs, LLC

Pro-and-higher members get real-time updates and can track all our Model Portfolios on our site. The Focus List Stocks: Short Model Portfolio contains the “best of the best” of our Danger Zone picks, and leverages superior fundamental data, which provides a new source of alpha.

We’re here to help navigate these turbulent times. Our uniquely rigorous fundamental research consistently earns SumZero’s #1 All-Time ranking, along with #1 rankings in several other categories.

Investors deserve reliable fundamental research, more than ever, to protect their portfolios from overvalued stocks and falling knives.

This article originally published on October 6, 2022.

Disclosure: David Trainer, Kyle Guske II, and Matt Shuler receive no compensation to write about any specific stock, sector, style, or theme.

Follow us on Twitter, Facebook, LinkedIn, and StockTwits for real-time alerts on all our research.

[1] Stocks are in the Focus List Model Portfolios for different periods of time as we open and close positions during the year. When measuring outperformance of the Focus List Model Portfolios, we compare each stock’s return to the S&P 500’s return for the time each is in the Focus List Model Portfolios. This approach provides more of an apples-to-apples comparison of how each stock performed vs. the S&P 500.