We published an update on this IPO on June 12, 2023. A copy of the associated report is here.

Cava Group (CAVA: $1.5 billion expected valuation), the Mediterranean focused fast-casual restaurant filed its S-1 on May 19, 2023. The company has not provided share price information yet, but the business is expected to be valued at ~$1.5 billion, at which point the stock earns our Unattractive rating.

We do not think investors should buy Cava Group’s stock if the IPO valuation is anywhere close to the expected valuation. Despite rapidly expanding its store count, Cava Group is running out of good expansion opportunities. We find the timing of this IPO curious given the expected increase in the cost of the company’s operations. Additionally, without the cash infusion provided by an IPO, Cava Group would qualify for our Zombie Stock list, which features high-risk stocks with heavy cash burn and limited cash reserves.

Cava Group’s IPO reminds us of Sweetgreen (SG), a fellow fast-casual restaurant Zombie Stock that has been in the Danger Zone since its IPO in November 2021. Don’t get left holding the bag by bailing out the private equity owners of this overvalued and unprofitable fast-casual restaurant.

Our IPO research aims to provide investors with more reliable fundamental research.

Unprofitable Business From the Jump

Cava boasts impressive top-line growth, as is common with most IPOs. The company has grown revenue by 52% compounded annually from fiscal 2016 to fiscal 2022 and increased its store count from 22 in fiscal 2016 to 263 as of April 16, 2023.

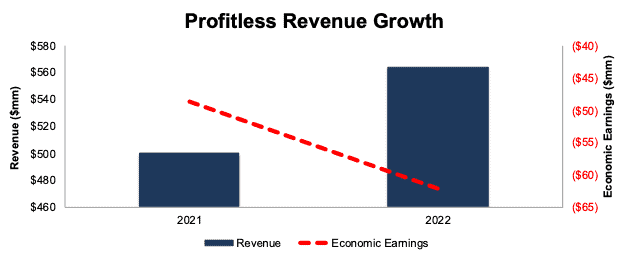

However, this growth has come with no profits. In the two years we have full financial data, Cava has not generated positive net operating profit after tax (NOPAT) or economic earnings, the true cash flows of the business. In fact, even as revenues grew 13% year-over-year (YoY) in fiscal 2022, economic earnings fell from -$49 million to -$62 million. See Figure 1.

Figure 1: Cava Group’s Revenue & Economic Earnings: 2021 – 2022

Sources: New Constructs, LLC and company filings

Last Chance to IPO Before the Business Gets Worse

Astute investors may question why a fast-casual restaurant would have an IPO in the current economic environment: the U.S faces a possible recession and the global economy looks shaky. The likely answer: the business will only get more unprofitable as time goes on, so now is better than later.

In 2018, Cava Group acquired previous Danger Zone pick and unprofitable Mediterranean restaurant Zoes Kitchen (ZOES). Since the acquisition through April 16, 2023, Cava has converted 145 Zoes Kitchen’s locations to Cava restaurants, which represent 55% of all Cava Group’s locations. These conversions represent a cheaper way to expand Cava’s footprint, with the S-1 noting “while conversions require initial capital investments, such costs are typically significantly lower for a conversion as compared to a new opening.” Unfortunately for Cava and its path to profitability, this cheap source of store expansion is coming to an end.

In its S-1, Cava Group notes that it plans to close or convert the remaining 34 Zoes Kitchen locations in 2023. After completion, investors should expect Cava’s expenses to increase substantially. Don’t just take our word for it either, Cava notes specifically in its S-1:

“We anticipate that our operating expenses will increase substantially in the foreseeable future“

and

“… following the completion of conversions of the remaining Zoes Kitchen locations… we expect that the capital expenditure requirements to open a new restaurant will be significantly higher than we have experienced in the past few years.”

Cava’s S-1 also notes that a “significant portion” of new restaurants will have drive-thru capabilities, which “require significant additional capital expenditures.” Because drive-thru restaurants are generally larger, they result in “higher real estate costs as well as incremental infrastructure and construction costs.”

Put these statements together and the situation is clear – Cava’s expenses are going to rise in the near future, and its current margins may be the closest it gets to breakeven for quite some time, which helps explains the odd timing of this IPO.

IPO Needed to Avoid Zombie Status

Not only is Cava running out of a cheaper source of store expansions, but it is also running out of capital to sustain its business.

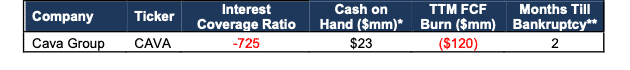

In 2022, Cava burned $120 million in free cash flow (FCF) and, as of April 16, 2023, had just $23 million in cash and cash equivalents on its balance sheet. Cava Group can only sustain its 2022 burn rate for 2 months from April 16, 2023. In other words, Cava needs a capital raise to remain a going concern, which further explains why its private owners are looking to raise money via an IPO.

Without the proceeds of the IPO, Cava Group would qualify as a Zombie Stock, or a company with high FCF burn, negative interest coverage, and a real chance of going to $0/share. Again, no wonder the current investors in Cava want to raise capital.

Figure 2: Cava Would Be a Zombie Stock Without IPO

Sources: New Constructs, LLC and company filings.

* As of 4/16/23

** To calculate “Months till Bankruptcy” we divided the 2022 FCF burn, excluding acquisitions, by 12 to get the monthly cash burn. We then divide reported cash and equivalents and long-term investments in the most recent S-1 by the monthly cash burn.

Local Sourcing Makes It More Difficult to Scale…

Cava operates Mediterranean focused restaurants that aim to appeal to consumers by providing “healthy, flavorful, and filling” food with most ingredients locally sourced.To provide this experience, Cava typically relies on a limited number of suppliers, and in some cases, single-source suppliers for several ingredients. The suppliers are small family-owned businesses or sole proprietors that will have more difficulty scaling production.

By not using national distributors, Cava adds complexity to its supply chain, which will make it more difficult and potentially more costly to scale. This inefficiency leads to higher operating costs. Cava’s restaurant operating costs were 83% of revenue in 2022. Chipotle’s restaurant operating costs[1], on the other hand, were just 77% of its food and beverage revenue in 2022.

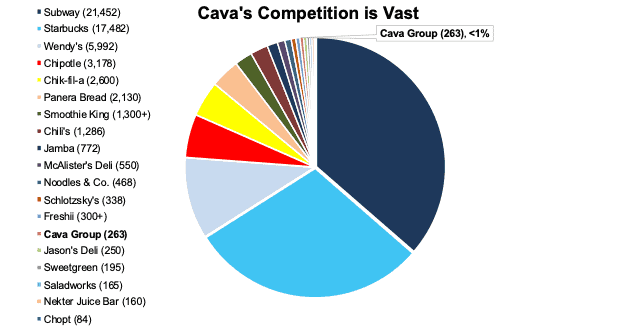

…So Does Intense Competition

Cava Group isn’t the first restaurant to offer consumers “healthy, flavorful, and filling” food. Subway’s “Eat Fresh” concept helped the company grow to more than 21,000 stores in the U.S. Chipotle has advertised the freshness of its offerings for years. The market for fresh, fast casual food is crowded, and, consequently, intensely competitive. See Figure 3. With just 263 store locations, Cava Group is a minor player and will have to spend mightily if it hopes to achieve the scale needed to generate the profits earned by many of its direct competitors.

In this context, potential IPO investors must ask themselves why they would buy stock in a cash-burning business that:

- will have to burn a great deal more cash to have a chance at scaling and

- must be more profitable than Brinker International (EAT) to justify the expected IPO price.

Figure 3: Cava Group’s Store Count Vs. Competitors[2]

Sources: New Constructs, LLC and company filings

Online and Delivery is Not a Differentiating Feature Either

Cava’s “Digital Revenue” made up 35% and 37% of revenue in 2022 and in the sixteen weeks ended April 16, 2023, respectively. Cava notes in its S-1 that the “expansion of digital and delivery business is important to the growth of our business.” However, delivery and digital orders are no longer a differentiating feature in 2023, but they do create additional branding and customer experience risk.

Nearly all of Cava’s delivery orders are fulfilled through third-party delivery partners, over which Cava has no control. The use of third-party services can facilitate sales, but it can also create unsatisfactory experiences for consumers and drive users away from Cava restaurants.

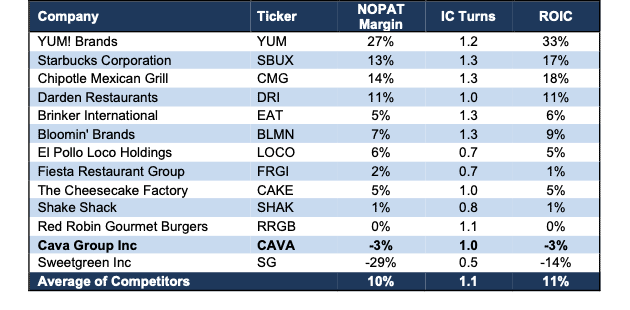

Only Sweetgreen Has Lower Profitability Than Cava

Given Cava’s more expensive supply chain and the intense competition that it faces, it comes as no surprise that the company’s fundamentals are much worse than peers. Peers include traditional, fast-food, and fast-casual restaurants.

Compared to its peer group[3], Cava’s NOPAT margin and return on invested capital (ROIC) of -3% are second to last. Only Sweetgreen, fellow Danger Zone pick and Zombie Stock, has a worse NOPAT margin and ROIC. See Figure 4.

Figure 4: Cava’s Profitability Vs. Competitors: TTM

Sources: New Constructs, LLC and company filings

Cava Group Is Priced to Grow as Fast as Chipotle

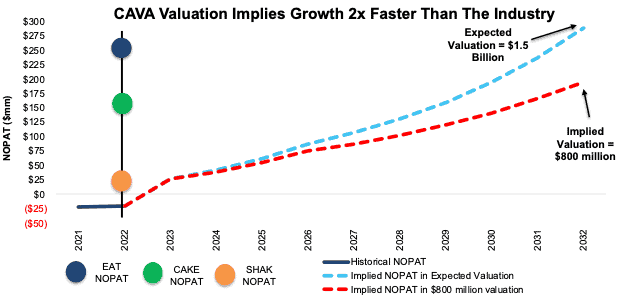

When we use our reverse discounted cash flow (DCF) model to analyze the future cash flow expectations baked into Cava Group’s current valuation, we can provide clear, mathematical evidence that the expected valuation of $1.5 billion appears too high and offers unattractive risk/reward.

To justify its expected IPO valuation, our model shows Cava Group would have to:

- improve its NOPAT margin to 4% in 2023 (vs. -3% in 2022), 5% in 2024, 6% in 2025, 7% in 2026, and then maintain 7% through 2032 and

- grow revenue by 22% (vs. +13% in 2022) compounded annually for the next ten years (nearly 2x the projected industry growth rate through 2027).

In this scenario, Cava Group would generate $4.1 billion in revenue in 2032, which is 7x its 2022 revenue. Cava Group’s 22% revenue CAGR in this scenario also matches the 22% revenue CAGR Chipotle achieved in its first 10 years after going public.

In this scenario, Cava Group would generate $288 million in NOPAT in 2032, which implies a total increase of $307 million, given its 2022 NOPAT is -$19 million. For reference, once going public, it took Chipotle seven years to increase NOPAT by $307 million. However, Chipotle went public into a much less competitive landscape with a more differentiated product at the time. And, most importantly, Chipotle was already profitable.

In other words, Cava Group must grow revenue as fast as Chipotle in its first decade as a public company, while also drastically improving margins, or the stock is worth much less than its expected valuation.

47% Downside Even if Growth Exceeds 1.5x Fast Casual Projections

A second DCF scenario highlights the downside risk should Cava’s revenue grow by “only” 1.5x projected industry growth.

If we assume Cava’s:

- NOPAT margin rises to 4% in 2023, 5% in 2024, 6% in 2025, 7% in 2026, and then remains 7% through 2032, and

- revenue grows by 17% (1.5x the projected industry growth CAGR from 2022-2027) compounded annually from 2023-2032, then

Cava would be worth just $800 million today, or 47% below Cava’s expected valuation. Should Cava struggle to improve margins at such a rapid pace or grow revenue more in line with the overall industry, the stock could be worth nothing or $0/share.

Figure 5 compares Cava’s implied future NOPAT in these three scenarios to its historical NOPAT. We also include the 2022 NOPAT for restaurant peers Brinker International (EAT), The Cheesecake Factory (CAKE), and Shake Shack (SHAK) for reference.

Figure 5: Cava’s Historical and Implied NOPAT: DCF Valuation Scenarios

Sources: New Constructs, LLC and company filings

Each of the above scenarios also assumes Cava Group grows revenue, NOPAT, and FCF without increasing working capital or fixed assets. This assumption is conservative and provides truly best-case scenarios. Given Cava’s aggressive store count growth goal of 4x by 2032, the company will likely burn millions of dollars of IPO capital to increase invested capital. For reference, Shake Shack and Chipotle grew invested capital 24% and 13% compounded annually, respectively, in their first 10 years as public companies. Should Cava Group’s invested capital grow anywhere near peers’, the stock has even more downside risk.

An Acquisition of Cava Group Is Unlikely

On its own, Cava Group is unlikely to generate the profits needed to justify an expected valuation of $1.5 billion. The best hope IPO investors in Cava Group might have is for an established company to acquire the firm. However, the fast-casual restaurant boom in recent years reminds us of the early days in the craft beer industry with many different concepts fighting for a slice of the market.

The big difference for the fast-casual industry is that it is much cheaper for large national companies to replicate a concept than acquire a firm. Larger firms have a long history of being able to quickly and easily introduce competing products. In other words, the acquisition premium, or hope for a white knight buyer, is low for Cava Group.

Red Flags for Investors

Beyond deteriorating fundamental sand an overvalued expected valuation, investors should be aware that Cava Group’s S-1 also has other red flags.

Need More Information to Determine Shareholder’s Power

Most IPOs in recent years have been structured in a way that new shareholders receive little ability to control the outcome of matters submitted to shareholders for approval. The use of dual class shares, which often provide super-voting capabilities to founders and existing investors, or large blocks of shares held by early investors, often ensure voting control remains in the hands of a few.

As of writing this report, it is too early to tell how much influence new shareholders will have within Cava Group, because the company’s S-1 lacks details around how many shares it will be selling and what that amount will mean in relation to existing shareholders. Once we have this information, we can truly analyze whether new investors get a say for their investment or are simply funding additional losses at an unprofitable business.

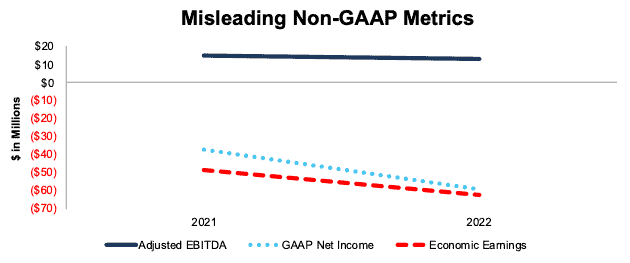

Ignore the Non-GAAP

Many unprofitable companies present non-GAAP metrics to appear more profitable than they really are, and Cava Group is no different. Cava provides investors with the popular Adjusted EBITDA metric, among many others, as a key performance indicator. Not surprisingly, Adjusted EBITDA gives a more profitable picture of the firm’s business than GAAP net income and our Economic Earnings.

For instance, Cava Group’s 2022 adjusted EBITDA removes $4 million in equity-based compensation costs and $20 million in depreciation and amortization. After removing all items, Cava Group reports adjusted EBITDA of $13 million in 2022. Meanwhile, GAAP net income is -$59 million in 2022 while economic earnings are even lower at -$62 million. See Figure 5.

Figure 5: Cava Group’s Adjusted EBITDA, GAAP Net Income, and Economic Earnings: 2021 to 2022

Sources: New Constructs, LLC and company filings

Emerging Growth Company Status Limits Transparency

By electing to operate as an “Emerging Growth Company”, Cava Group is exempt from certain requirements that are beneficial to shareholders.

More specifically, Cava Group is exempt from:

- providing an auditor’s attestation report on the company’s internal controls over financial reporting requirements of Section 404(b) of the Sarbanes-Oxley Act

- disclosing all the obligations regarding executive compensation

- immediately complying with new or revised accounting standards

Cava notes in its S-1 that it is currently in the process of reviewing, documenting and testing its internal controls over financial reporting. Investors need to know if a company’s financials can be trusted, and in this case, there are no assurances given that the reporting procedure are still being built and tested.

This article was originally published on May 25, 2023.

Disclosure: David Trainer, Kyle Guske II, and Italo Mendonça receive no compensation to write about any specific stock, style, or theme.

Questions on this report or others? Join our Society of Intelligent Investors and connect with us directly.

[1] Includes food, beverage, and packaging, labor, occupancy, and other operating costs to match Cava’s restaurant operating costs, which include food, beverage, and packaging, labor, occupancy, and other operating expenses.

[2] This list is a sample of Cava’s competitors and is not exhaustive, but serves to illustrate the crowded nature of Cava’s potential market.

[3] Peer group in this analysis includes the 32 other Restaurant and Bar companies under coverage.